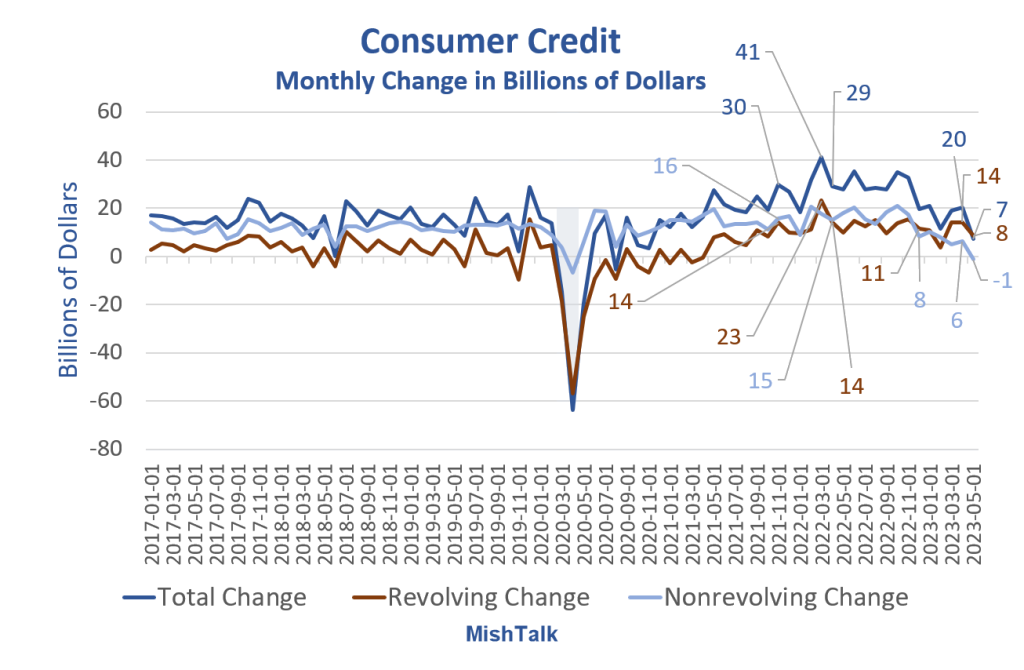

Consumer Credit Is Much Weaker Than Expected, Non-Revolving Turns Negative

Consumer credit data from the Fed, chart by Mish

The Bloomberg Econoday consensus was for credit to rise by $20.0 billion.

Instead, the rise was $7.3 billion. In addition, the Fed revised May credit from $23.0 billion to $20.3 billion.

The consumer is clearly weakening as the lead chart shows.

Consumer credit came in much lower than anticipated at $7.2 bil vs $20.3 in April (revised lower). A drop in non-revolving credit (auto loans) was one of the key factors. Overall reading was lowest since late 2020. pic.twitter.com/tjE11K1Zaa

— Kathy Jones (@KathyJones) July 10, 2023

Consumer Credit in Billions of Dollars

Consumer credit data from the Fed, government credit is student loans, chart by Mish

Those are nominal numbers. In nominal terms revolving credit, mainly credit cards, hit a new record high. Inflation adjusted numbers are much weaker.

Revolving Consumer Credit

Revolving consumer credit data from the Fed, Real (inflation adjusted) calculation and chart by Mish.

Resolving Consumer Credit Detail in Billions of Dollars

Adjusted for inflation, revolving credit is still less than the pre-pandemic high.

Real Consumer Credit

Real consumer credit is weakening, especially non-revolving. That reflects a slowdown in autos, housing, and student debt.

Heading Into Earnings Season, Let’s Discuss Actual Corporate Profits

In case you missed it, please see Heading Into Earnings Season, Let’s Discuss Actual Corporate Profits.

More By This Author:

Heading Into Earnings Season, Let’s Discuss Actual Corporate ProfitsThe Green Deal In The EU Goes Unfunded, Expect A Total Collapse

More Gold Backed BRIC Currency Silliness On Dethroning The Dollar

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more