Consumer Credit Expansion Slowed Dramatically In October

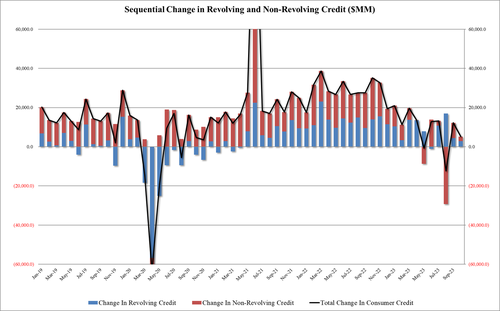

The latest data on consumer credit data for October confirmed the slowdown seen in September, as total debt increased by just $5.13 billion (below consensus estimates of $8.5 billion).

This is a clear regime shift lower from recent months when the monthly increase was in the $20/$30BN range.

Looking at the composition, both revolving and non-revolving credit were weak.

Starting with the former, in October, credit card debt rose by just $2.9 billion, which with the exception of June's freak negative revolving credit print, was the lowest monthly increase since April 2021 (amid the COVID lockdown crisis).

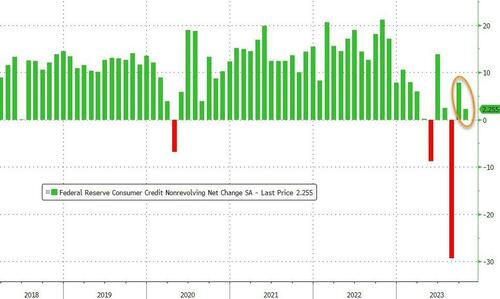

As for non-revolving credit, or student and auto loans, here too things have gotten bogged down, rising just $2.3 billion in October...

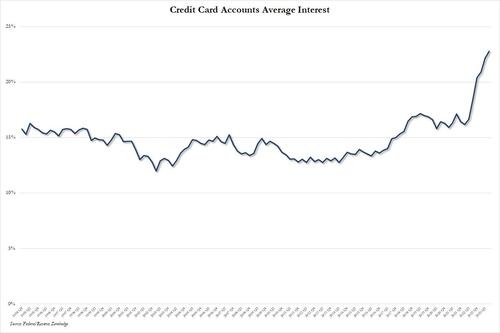

Of course, the slowdown in debt, and especially credit card debt, should not be a surprise since the average rate on credit cards across US financial institutions just hit a record high of 22.77%.

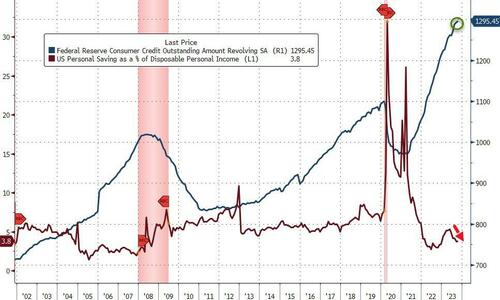

And with consumers increasingly reluctant to max out their credit cards due to record high rates, at a time when the personal savings rate in the US has collapsed back near multi-decade lows in recent months...

... it is now only a matter of time before US GDP prints deep negative now that that pillar supporting 70% of the US economy, consumer purchases, is about to crack.

More By This Author:

Fed's Bank Bailout Fund Explodes To Record High As Massive Money-Market Fund Inflows ContinueGameStop Shares Plunge 7% After Revealing Bizarre Plan To Allow CEO Ryan Cohen To Invest Company Cash In Equities

Jobless Claims Data Surges (And Falls) With Seasonal Hiring At Decade Lows

Disclosure: None