Construction Spending At Record Highs

Image Source: Pexels

I’m a little more cautious than Davison is on the economy, especially given the Atlanta Fed downgrading Q2 GDP from 4.8% to 1.9%. Remember, these numbers for spending are backward-looking, so they won’t reflect what is happening now or next month.

That said, it is very hard to have a recession with these numbers growing like this.

I’m beginning to think that we might just stagnate for a bit with 1%—2% growth for a while until the election. It will “feel” like a recession to a lot of people but wont technically be one.

“Davidson” submits:

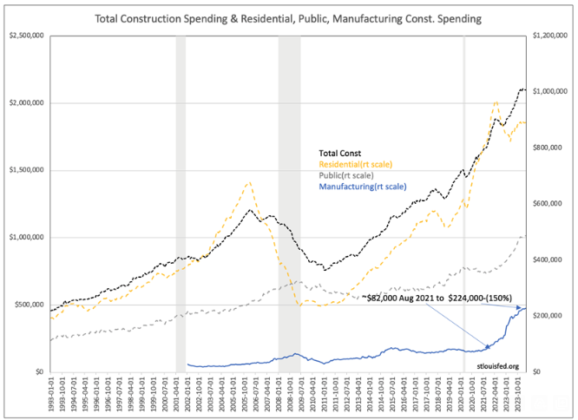

Total Construction Spending holding at record highs. This report revised higher recent month’s reports and is therefore better than previously reported. Manufacturing, also revised higher, represents the reshoring theme to improve the quality and availability of stable supply chains that were disrupted during the COVID lockdowns. Some industries remain impacted i.e., auto industry, and have yet to meet current demand. Others, like the semiconductor industry, have responded to clear threats posed by China on Taiwan semiconductor industry to build brown-field fabs in the US for the first time in decades. Also worth mentioning is that new factories in the US requires additional electrical power well beyond what renewables can supply. This demand has been ignored by the rush into EVs and AI(Artificial Intelligence). A recent analysis of that demand is available at https://realinvestmentadvice.com/ai-data-centers-and-evs-create-incredible-opportunities/.

Even if the current themes do not entirely develop as predicted, the current environment remains positive for infrastructure expansion the next several years. The overall demand for modernizing existing and building new has had such strength that one can see in the chart that the COVID lockdowns had only minor impact.

There are no indications of a construction slowdown in this data or in the many recent earnings reports of companies doing this work. Every one of the well-managed companies I monitor have raised guidance for 2024 and some even into 2025. This is positive for these equities that yet are priced at decent discounts to historical financials.

More By This Author:

Real Private GDP Continues To RiseReal Personal Income Rising, But Being Spent Less

Durable Goods Orders Holding - Wednesday, May 29

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more