Consider Swiping In For The Square IPO

Square, Incorporated (NYSE: SQ) expects to raise $324 million in its upcoming IPO. Based in San Francisco, California, Square develops and provides point-of-sale software worldwide.

Square will offer 27 million shares at an expected price of $11 to $13. If the underwriters price the IPO at the midpoint of that range, Square will have a market capitalization of $3.9 billion.

Square filed for the IPO on October 14, 2015.

Lead Underwriters: Goldman Sachs, J.P. Morgan Securities, and Morgan Stanley

Underwriters: Barclays Capital, Deutsche Bank Securities, Jeffries LLC, LOYAL3 Securities, RBC Capital Markets, SMBC Nikko Securities, and Stifel Nicolaus

Business Summary: Developer and Maker of Point-of-sale Software for Use with Smartphones and Tablets

(click to enlarge)

(Source)

Square, Inc. develops and offers point-of-sale software utilized worldwide primarily through smartphones and tablets. The company also offers Square Register, which is a point-of-sale system that provides digital receipts, analytics, feedback, sales reports and manages inventory. Square promotes its products as one cohesive service to run an entire business by turning mobile devices into registers, providing analytics through any computer, as well as offering small business financing and marketing tools.

Square derives the majority of its revenue from sales in the United States, although it has a growing customer base in Canada and Japan. Its sellers range from individual venders to multinational organizations, and its products can easily scale as a business grows.

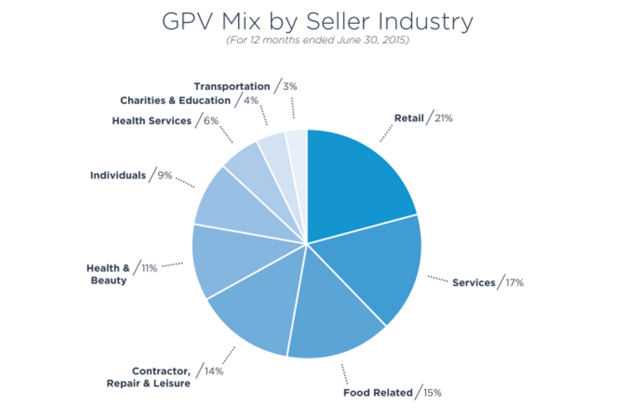

In the 12 months ended September 30, 2015, Square processed $32.4 billion in gross payment volume (GPV) through 638 million card payments made from approximately 180 million payment cards. Square generates revenue as a percentage of the GPV, and the company noted that in the same period, over two million sellers accepted five or more payments through Square, which represented approximately 97 percent of its GPV.

The company also offers Square Capital, which is a financial service that extends cash advances to sellers. Currently, Square Capital has advanced over $300 million through 50,000 advances, and the company expects this business to grow significantly. Square Customer Engagement offers sellers tools to utilize feedback sent through digital receipts.

Square devices accept the latest technology in payment methods, including EMV and NFC, which enables payment through Apple Pay and Android.

The company had $850 million in revenue last year. Revenue for the first half of this year was $560.6 million, an increase of 51 percent over the same period last year. However, the company had a net loss of $154.1 million in 2014, and a loss of $77.6 million for the first half of 2015 and has warned that it may continue to generate losses in the near future.

Executive Management Highlights

Jack Dorsey co-founded Square in February 2009, and he serves as President, CEO and Chairman. He is also a co-founder of Twitter (NYSE:TWTR) and has served as its CEO since September 2015. He has been a director of Twitter since 2007 and an independent director of The Walt Disney Company since 2013. Mr. Dorsey attended New York University and Missouri University of Science and Technology.

CFO Sarah Friar has served Square in her position since 2012. Her previous experience comes from senior positions at Salesforce.com, Goldman Sachs, and McKinsey & Company. Ms. Friar holds an MBA from Stanford University Graduate School of Business in 2000 and a MEng, in Metallurgy, Economics, and Management from the University of Oxford.

Potential Competition: PayPal, Flint and Spark Pay

Although Square was an innovator in mobile payment processors, several companies offer viable alternatives to Square's equipment, apps and reports. These include Flint, Spark Pay, PayPal (NASDAQ:PYPL), Here, Level Up, IZettle, Softcard and Inner Fence.

Financials: Impressive Revenues, Steady Losses

Square provided the following figures from its financial documents for the six months ended June 30:

|

2015 |

2014 |

|

|

Transaction Revenue |

$470,974,000 |

$309,908,000 |

|

Net Income (Loss) |

($77,598,000) |

($79,335,000) |

As of June 15, 2015:

|

Assets |

$597,946,000 |

|

Total Liabilities |

$361,484,000 |

|

Stockholders' Equity |

$236,462,000 |

Conclusion: Consider Swiping In

We've previously covered Square as the deal has developed on our IPO Insights platform here and here.

Since then, last week's large deal (another financial) LoanDepot (NYSE:LDI) postponed, largely due to market conditions. The tragic events in Paris this past weekend could exacerbate market volatility.

We've also noted previous concerns, ranging from consistent losses to its CEO multitasking; however, we still suggest investors consider a modest allocation in Square.

Expansion into Japan is promising, along with enormous adoption among both small and larger enterprises.

Disclosure: None.