Coal For The Stock Market’s Santa Rally

Image Source: Pixabay

The stock market’s Santa Rally has delivered coal (so far)

This is one of the problems with buying wholeheartedly into seasonal factors, because it only works until it doesn’t and when it doesn’t, like it has done so far since the start of the Santa Rally on Christmas eve, it can wreck havoc on one’s portfolio.

Whether it is “Sell-in-May and Go Away” or the infamous “Buy the Dip”, I never commit myself with blind faith to any of these expressions.

Granted there is still three more days for Santa to right the ship, but will need to run about 68 points higher over the next three days in order to just breakeven. With the market being as oversold as it currently is, it honestly wouldn’t shock me to see the market rally higher here as a continuation from the bounce that started on December 20th.

(Click on image to enlarge)

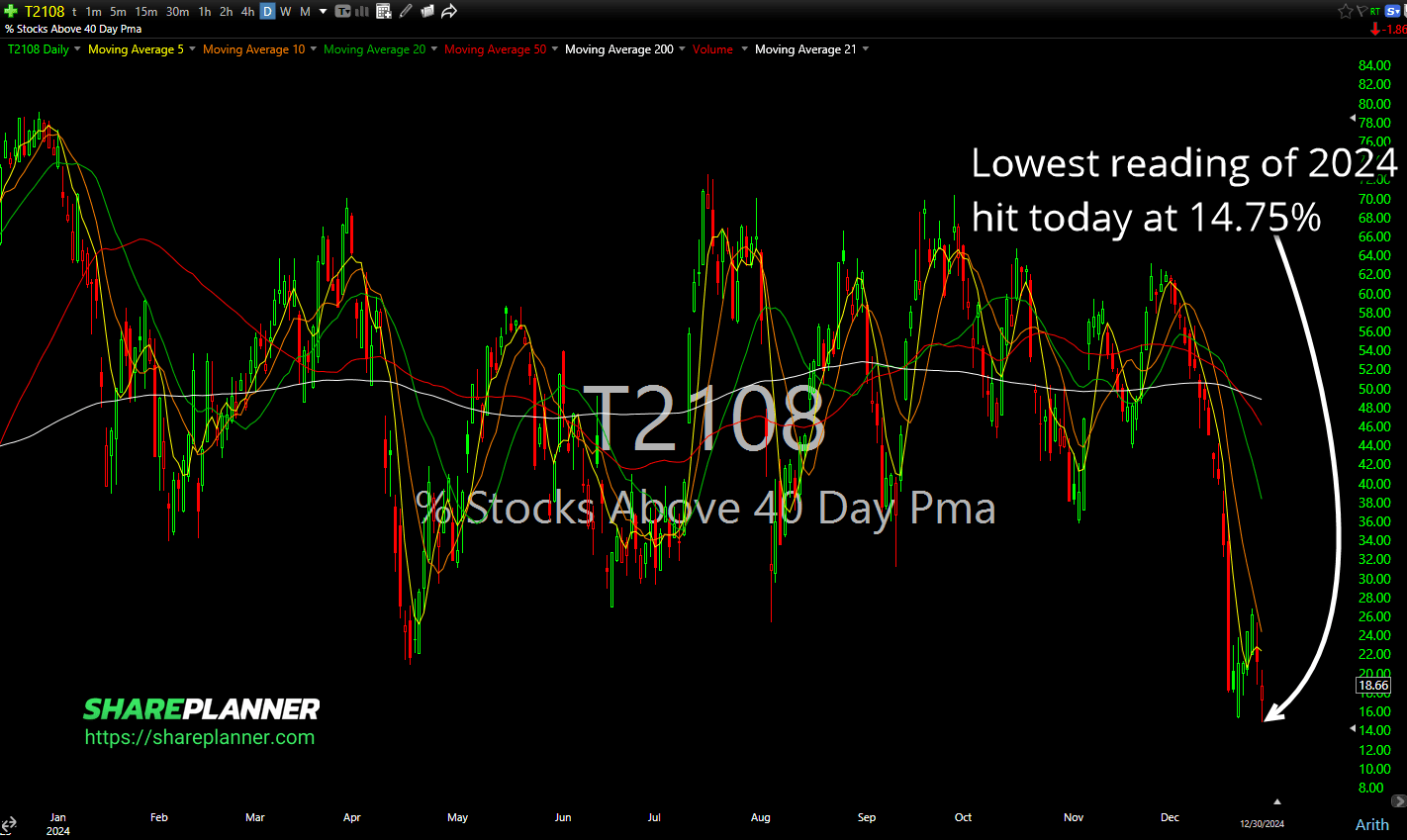

I mean, c’mon, getting short here at the end of year with the T2108 (the percentage of stocks trading above their 40-day moving average) hitting new lows on the year seems to be absolutely crazy and not one I am willing to take at this moment.

My plan for this Santa Rally

Instead, whether the rally takes place during the Santa Rally or not, in order for there to be any legit shorting opportunities going forward, we need to see a rally first in equities to get all the non-mega cap stocks off their lows and some breathing room for further downside.

Right now, I think the weakness being seen over the last two days is an attempt to suck in the over-eager bears into shorting the market now, so it can squeeze them later.

More By This Author:

How To Trade A Stock Split

Time For A Stock Market Bounce

Happiness Is A Discipline

Click here to download my Allocation Spreadsheet. Get all of my trades ...

more