Clock Ticking On Brexit Deal, Still No Agreement On Stimulus Package

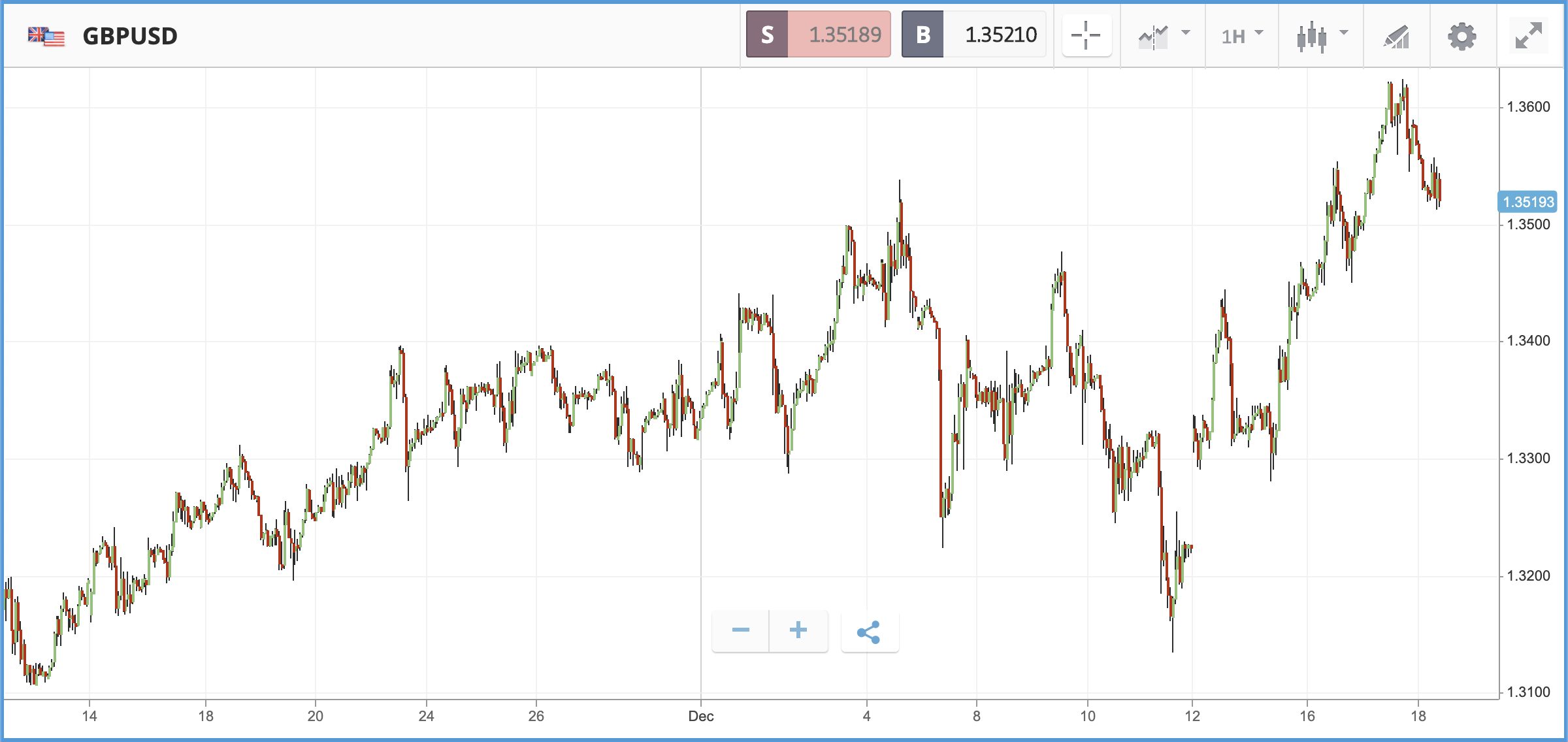

European markets are mixed this morning as the EU’s chief negotiator Michel Barnier warns there are mere hours left to secure a trade deal between the UK and the bloc. Sterling has dipped by 0.5% against the dollar, which in turn has helped the FTSE 100 gain by a similar amount due to its overseas earning contingent. Both sides have always talked about compromise but also failed to cede ground on certain issues, making it look more likely the UK could leave without a deal at the end of the year.

US stocks were up on Thursday despite another week of increases for initial jobless claim figures, as lawmakers pushed to get a pandemic relief bill over the line before Christmas. There are still disputes to be resolved, with The Washington Post reporting that talks appear likely to drag into the weekend. The role of the Federal Reserve is currently a sticking point, as is exactly where relief funds will be distributed. Jobless claim figures show the ever-increasing need for another stimulus package, with the latest week of data showing 885,000 people filed for first-time unemployment benefits.

In corporate news, FedEx (FDX) made waves on Thursday as it beat earnings and revenue estimates in its quarterly release. However, the firm declined to provide an earnings forecast for 2021, sending its shares down more than 3% in after-hours trading. In its latest quarter, FedEx sales topped $20bn for the first time, with profits more than double the same quarter last year, as it has benefited from a surge in online purchases.

Elsewhere, the revival in commodity markets continues apace, with copper, the world’s most important industrial metal, posting a huge rally from its March lows, climbing more than 70% to a seven-year high above $7,900 a tonne.

The metal has been in huge demand as it is vital to help build out green energy networks and electric vehicles. Other commodities are also higher following a tumultuous year, with gold holding firm at $1,884 and Brent crude oil back above $50, trading at $51 overnight.

Accenture leads S&P 500 higher, Coca-Cola cuts jobs

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite were all in the green on Thursday, up by 0.6%, 0.5%, and 0.8% respectively. Sector-wise, nine of the S&P 500’s 11 sectors were up, with the real estate, materials, and healthcare sectors all gaining by more than 1%. Technology consulting giant Accenture was one of the best-performing stocks in the S&P 500, adding 6.9% on the back of a strong quarterly earnings report.

Elsewhere, Coca-Cola (KO) announced that it is cutting 2,200 jobs globally, including 1,200 in the US. Per The WSJ, the reductions amount for around 12% of the company’s US workforce and come after the company offered voluntary packages to thousands of staff in the US and Canada in August. Coca-Cola has taken a hit from the closure of restaurants, bars, cinemas, and more, with its stock down 3.8% year-to-date.

S&P 500: +0.6% Thursday, +15.2% YTD

Dow Jones Industrial Average: +0.5% Thursday, +6.2% YTD

Nasdaq Composite: +0.8% Thursday, +42.3% YTD

Stocks mixed after BofE rate hold, furlough scheme extension

On Thursday, UK Chancellor Rishi Sunak extended the UK’s furlough scheme by another month, until the end of April 2021. The Bank of England also decided to hold interest rates steady, although the Monetary Policy Committee noted the Covid-19 vaccine rollout reduces the downside risk to the economy. However, caution prevailed, with the MPC adding that UK GDP growth in Q4 is likely to be weaker than expected back in November. The FTSE 100 closed the day out 0.3% lower, while the FTSE 250 gained 1%. In the FTSE 100, Vodafone, United Utilities, and Ocado were the biggest losers, falling 4.1%, 2.8%, and 2.7% respectively. In the FTSE 250, private air travel firm Signature Aviation jumped by 40% after reports that private equity giant Blackstone is in talks to buy the firm. Gambling firm Rank Group was also up double digits, adding 10.4%.

FTSE 100: -0.3% Thursday, -13.1% YTD

FTSE 250: +1% Thursday, -7.3% YTD

What to watch

Nike (NKE): One of the earnings highlights of the week, sports apparel giant Nike will deliver its latest quarterly report on Friday after the market close in the US. The firm has added 39% to its share price in 2020, on the back of a strong online presence and Chinese market demand. Wall Street analysts overwhelmingly favor a buy rating on the stock, after the company delivered a major earnings beat in its last set of results. The firm generated $10.6bn in revenue, more than $1bn higher than expectations, and double the expected profit. That was a dramatic bounceback from a loss in the quarter ended May 31, when store closures due to the pandemic took a toll.

Darden Restaurants (DRI): Restaurant group Darden owns brands such as Olive Garden and Longhorn Steakhouse, with close to 2,000 restaurants across the US. Despite the toll that the pandemic has taken on the restaurant industry, with mass closures and capacity restrictions, Darden’s share price is up by 8.8% this year following a 29.5% rally over the past three months. The company beat earnings expectations in its last quarterly results and reinstated its dividend. A key point of focus on its Friday earnings call will be what toll the huge surge of Covid-19 cases across the US is taking on the firm.

Crypto Corner: Institutions pile in to bitcoin as the price continues to climb

Bitcoin has delivered a return of 224% year-to-date, making it the best performing asset of 2020, with the price up nearly 500% if taken from the lows seen in March.

Bitcoin crossed $20,000 on Wednesday for the first time, the latest milestone in a rally that has also made it the best-performing investment of 2020, according to Forbes. However, it has not stopped there, hitting a new record peak of $23,764, up more than 500% from its low of $3,797.

Huge institutional buying has fueled the latest surge above $20,000. In the last three months, the Grayscale Bitcoin Trust, a popular ETF backed with Bitcoin held in Coinbase vaults, said the pace at which institutional investors have been investing into GBTC has tripled. Grayscale has a six-month lock-up period on investments, making it far more popular with institutions and family-wealth firms and therefore a better gauge on institutional investment demand.

All data, figures & charts are valid as of 18/12/2020.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any ...

more