Clinton Wins Election... Or So The Market Thinks

Solid gains all around would suggest marker participants have banked a Clinton win and are looking to pick up value. The question is whether narrow trading from July or August is really a barrier or just a symptom of a summer lull.

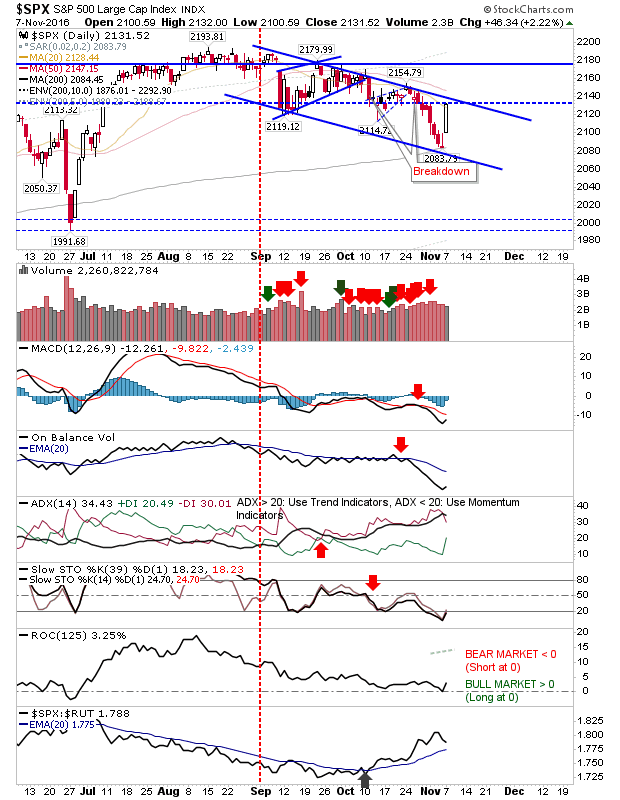

The S&P is back at the rising wedge, and resistance at 2,130. Also note the development of a new downward channel. Watch for a stall out on a tag of channel resistance.

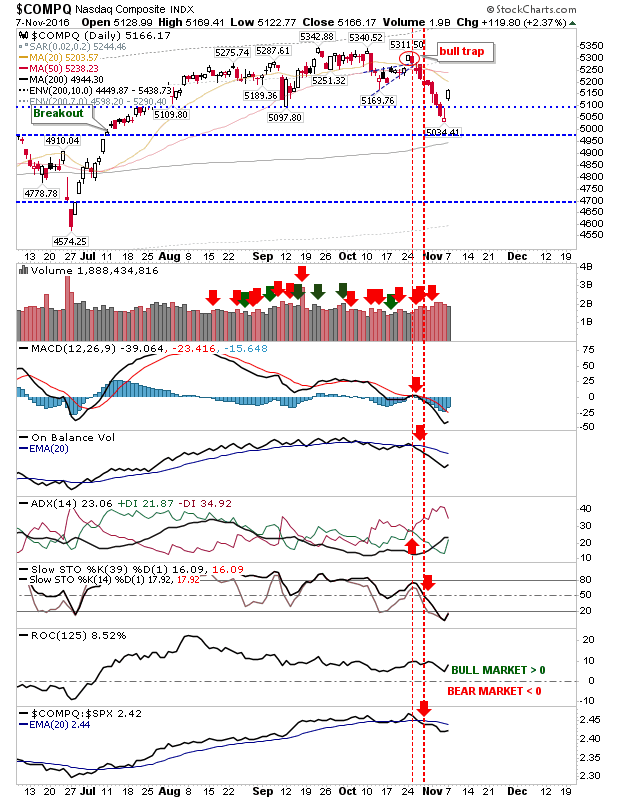

The Nasdaq hasn't established a downward channel like the S&P. However, there is a potential 'bear trap' on the return above 5,100.

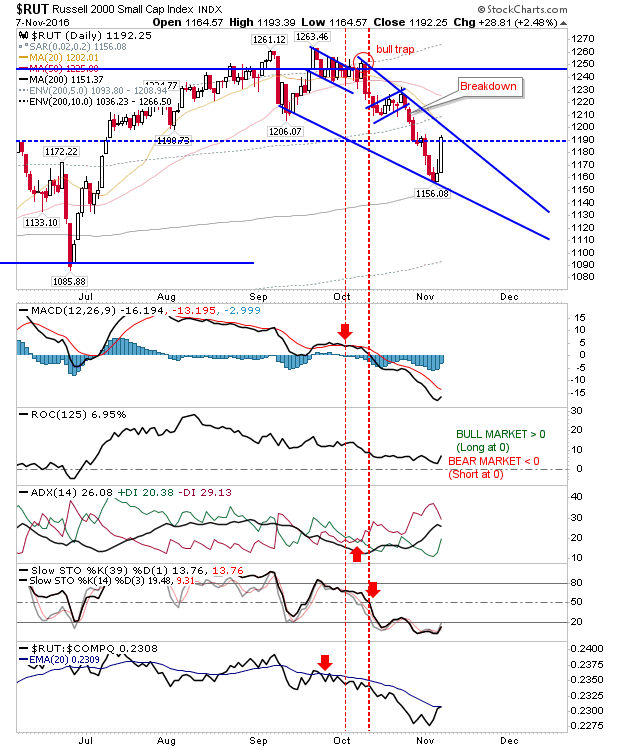

The Russell 2000 has endured the fastest rate of selling which lead to marked under performance. However, since the last week of October the market has enjoyed a marked improvement in relative performance despite the losses. It could be Small Caps time to shine again...

There may be some additional gains tomorrow, but watch for stall outs at wedge/channel resistance. Another day like today is possible, but with buyers showing their hand early, any muddled concession (or Trump victory) could trigger indecision and fresh (hard) selling.

Disclosure: None.