Clean Power Plan Will Double Coal Retirements Unequally

In this article, I will clarify the intent and introduce another layer of analysis.

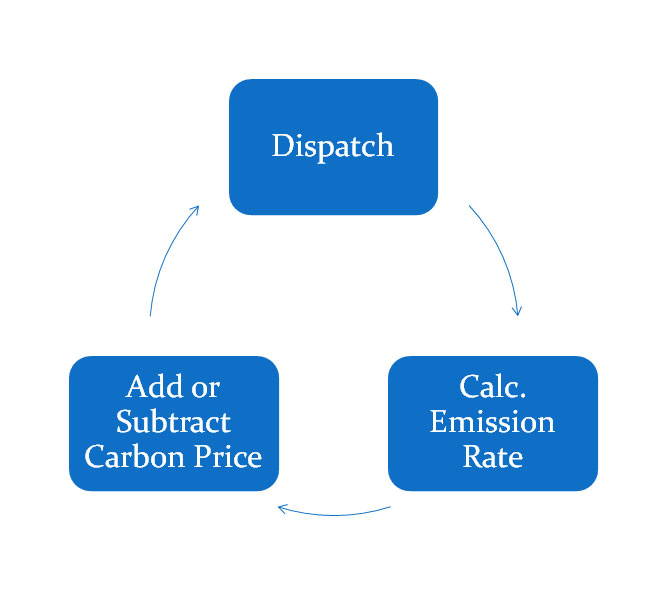

The analysis was not funded by any entity. The development of the analysis came from pure intellectual curiosity and the enthusiasm of solving a puzzle. All Energy Consulting has not received any payment or business as a result of the analysis done on EPA Clean Power Plan. The article is not intended to argue the merits of global warming.The article is also not intended to absolutely quantify the cost of the plan. The main intention of the report was to demonstrate that the cost of the plan will vary significantly among the states. In order to do this, as noted in the article, we used the implicit EPA calculations for Blocks 3 & 4. In addition, we used our highly sophisticated and very well calibrated power modeling platform – Power Market Analysis (PMA). PMA is used to quantify risk in the futures power markets for hedge funds to end-users. PMA was used to calculate an impact of Block 2. Block 2 per EPA involves the re-dispatching of the system with gas generation over taking coal generation. PMA uses the software AuroraXMP by EPIS which allows us to input our knowledge in a relative easy manner and produce numerous runs in a short time span. We had to produce hourly dispatching results for the entire N. America with at least 15 plus simulations to produce the analysis. For the analysis, we re-dispatched the system using state by state carbon prices in order to achieve the CO2 emission rates targeted by EPA for Block 2 – see process flow figure below.

There are limitations with this analysis for use outside the intended use of demonstrating large economic disparity among states as result of the Clean Power Plan. Given our goal of showing large differences in state economic impacts, we did not do a full cost analysis of the plan. EPA simple analysis did not do this either. They just assumed the substitution of generation from coal to gas would be sufficient given the perceived underutilized capacity factors of gas plants. However, a full cost analysis of the plan would involve an iterative approach to retire units no longer economically sustainable. As the CO2 costs rise, many of the existing units no longer produce enough power to be economically supported given their fixed cost of operation. This leads to retirements in the system. There will be stranded cost issues with early retirements of plants. Our initial analysis did not go that far. The cost derived from CO2 prices to drive those retirements represents a conservative cost that will occur in order to substitute with new technology. In many cases, the cost will even be higher than the CO2 impacts of driving units – mainly coal – out of the system given replacement power needs an economic hurdle to get a project developed. We can certainly do this analysis at All Energy Consulting, but we were limited by time and the need to pay the bills. Given this analysis was done free of charge, and our intellectual goal was to demonstrate large state disparity, we were able to achieve this without a retirement sequence analysis.

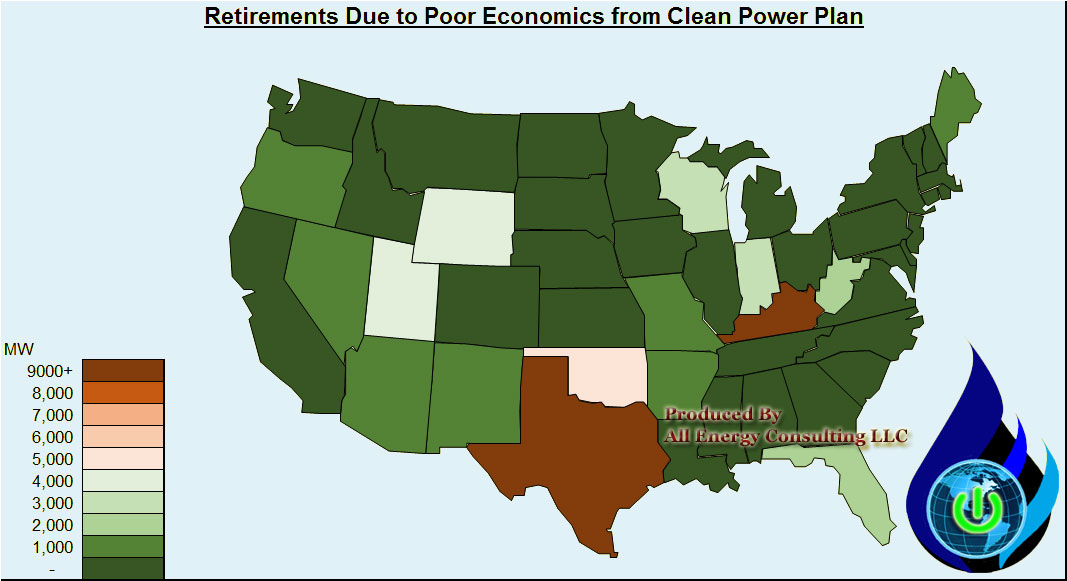

We were given more time recently and did do the next sequence of the analysis –once again for pure intellectual curiosity – no payment. Taking the output from our 100% Block 3 & 4 case from the article, we did a unit by unit analysis and identified the units that are no longer economically viable vs. the no CO2 case. This amounted to nearly 60 GW of generating units with almost 90% being coal – see map below. This is on top of the already planned retirements. In our base simulation, we have nearly 60 GW of coal plants retired from 2010 to 2016. Gas units are under economic pressure if the plant is located in a state with high carbon prices relative to the surrounding states. There will be gas plant casualties as a result of plant location as electricity flows do not know state boundaries.

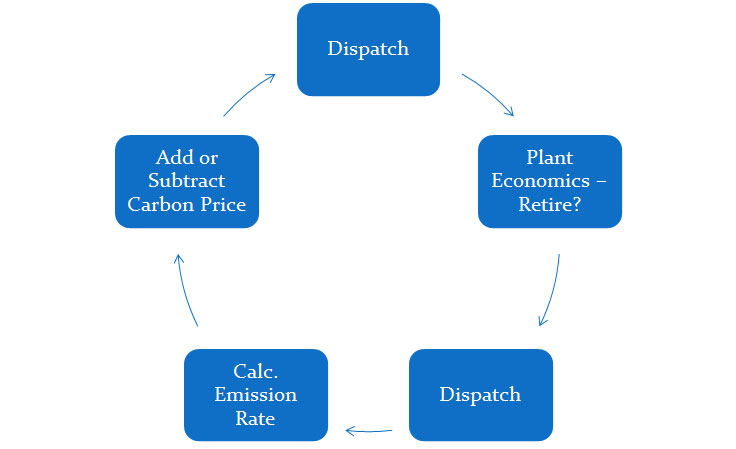

We then retired those units and re-dispatched the system and went through the process as noted above to converge upon a CO2 rate that would meet EPA rate limits. This took almost 20 simulations given the need to also re-compute the retirement economics as we lowered carbon prices.

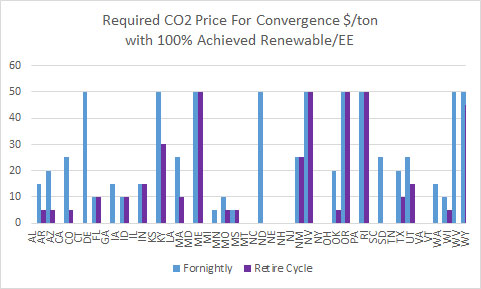

As expected CO2 prices do fall down relative to the previous results as coal units disappear from the system.

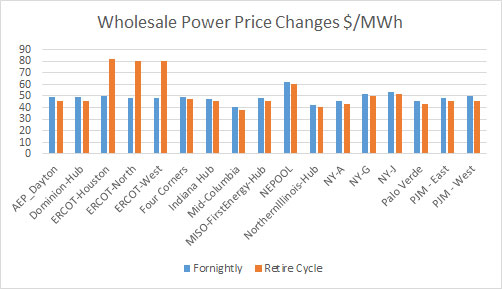

Reliability concerns are likely, but can be managed with transmission investments. These costs are not trivial and will show up in retail rates not wholesale prices. Retirements will be balanced by the large expansion of solar, wind, and energy efficiency programs and likely new gas generation from neighboring states. Wholesale power prices in this case are lower than in the previous case given the lower CO2 prices, but for Texas as 24% of the retirements came from there – see below.

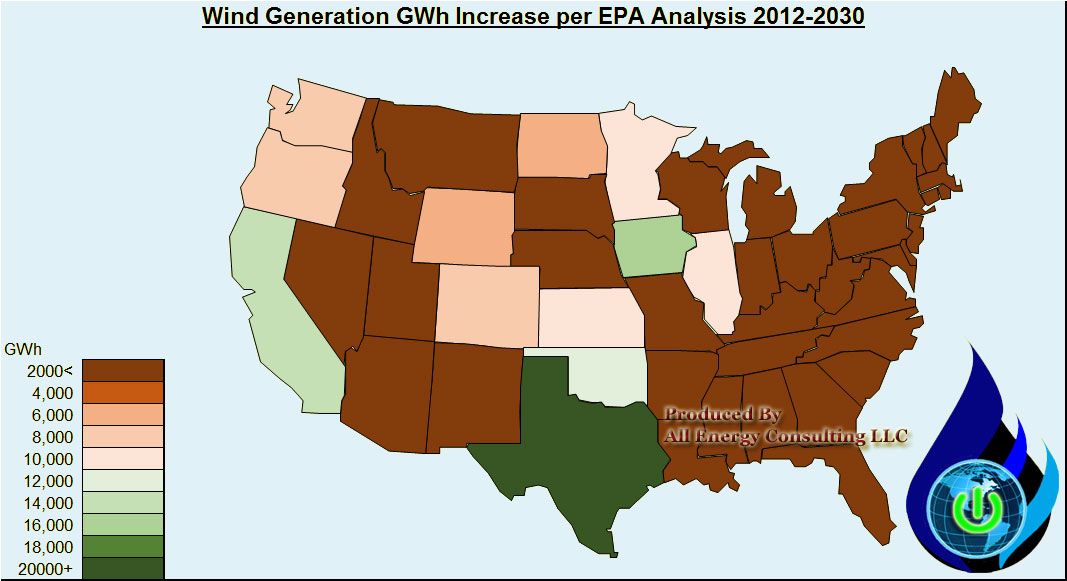

Texas is expected to get a large dose of wind generation so the wholesale prices are likely to come down and potentially driving even more retirements – see below.

Obviously a crucial element was the outlook of the spread between gas and coal prices. Staying with the Fortnightly analysis we used the forward curve projections of 2016 in June 2014. Henry hub averaged $4.26 with CAPP coal prices at $65/ton. Both those benchmarks are much lower now – 25% lower for Henry and 20% for CAPP. Lower spreads likely means more coal retirements.

The next step of the analysis is to create a build profile to meet the requirements in Block 3 & 4 and re-disptach it within the system. This will have significant cost plus significant dispatch implications. One of the areas, we are reviewing is the large solar penetration in the west which will likely drive peak power prices negative in the shoulder months. All Energy Consulting can do this analysis, but we are looking for interested parties to fund this stage of the analysis. The result will be a comprehensive cost of the plan. In addition, we will be able to address some of the impacts of such large renewable penetration. Those interested in funding the analysis will get customized views of the results.

Contact us to get a range of coal and gas consumption in the power sector plus power prices. more