CB LEI: Currently In A Recession?

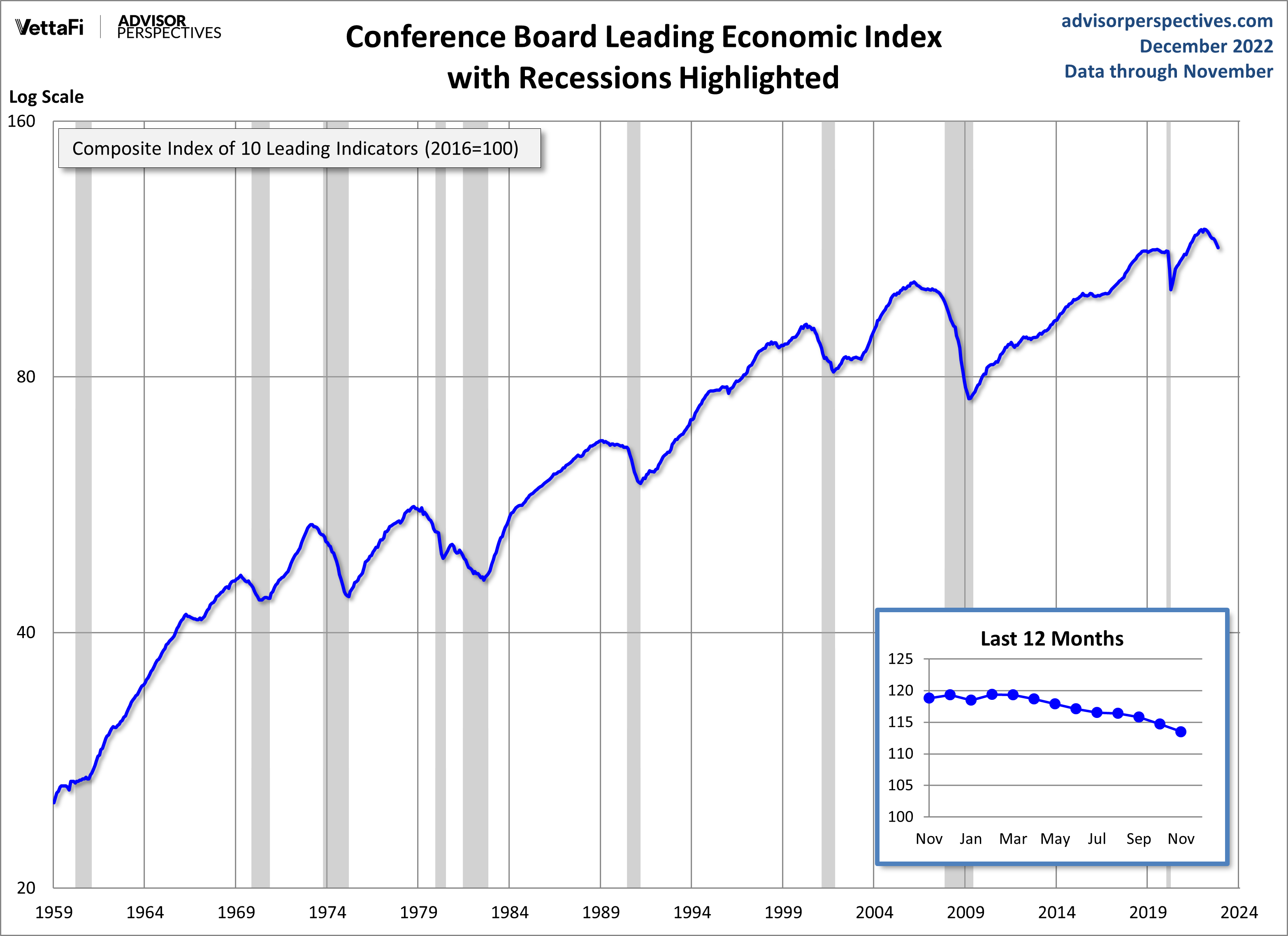

The latest Conference Board Leading Economic Index (LEI) for November was down 1% from the October final figure of 113.5.

The Conference Board Leading Economic Index® (LEI)for theU.S. decreased by 1.0 percent in November 2022 to 113.5 (2016=100), following a decline of 0.9 percent in October. The LEI is now down 3.7 percent over the six-month period between May and November 2022—a much steeper rate of decline than its 0.8 percent contraction over the previous six-month period, between November 2021 and May 2022.

“The US LEI fell sharply in November, continuing the slide it’s been on for most of 2022 after peaking in February,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “Only stock prices contributed positively to the US LEI in November. Labor market, manufacturing, and housing indicators all weakened—reflecting serious headwinds to economic growth. Interest rate spread and manufacturing new orders components were essentially unchanged in November, confirming a lack of economic growth momentum in the near term.” More

Here is a log-scale chart of the LEI series with documented recessions as identified by the NBER. The use of a log scale gives us a better sense of the relative sizes of peaks and troughs than a more conventional linear scale.

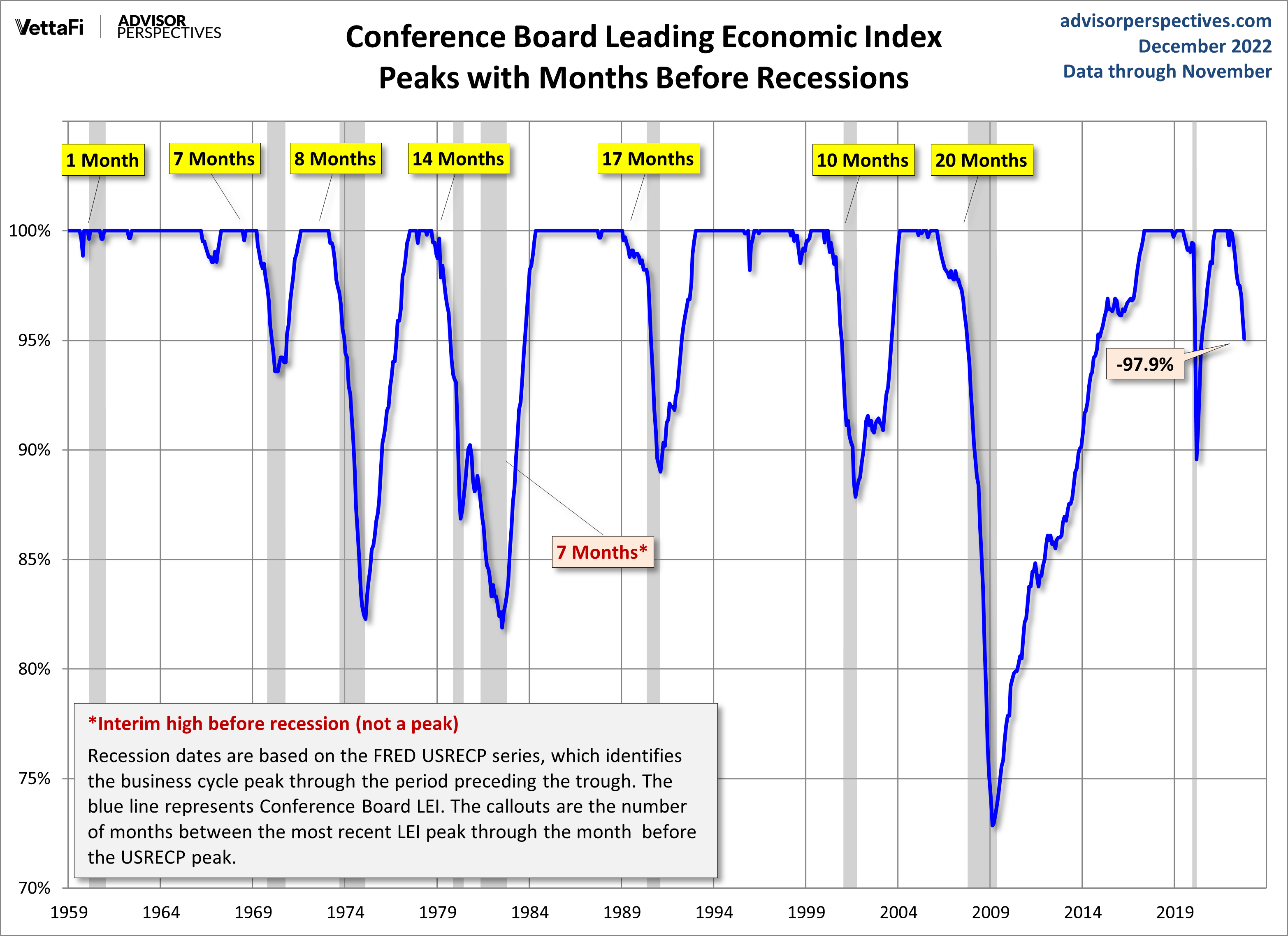

For a better understanding of the relationship between the LEI and recessions, the next chart shows the percentage-off the previous peak for the index and the number of months between the previous peak and official recessions.

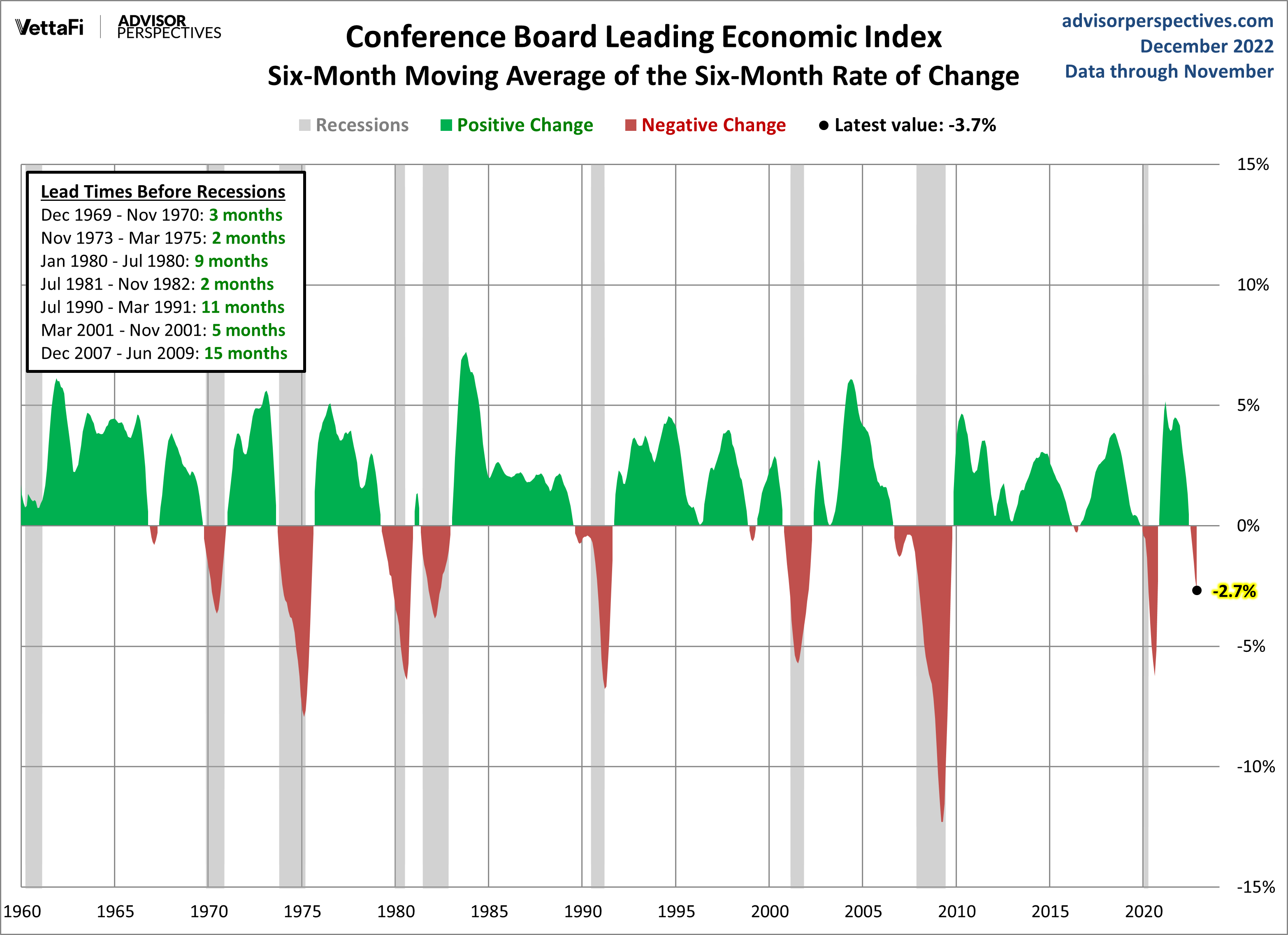

LEI and Its Six-Month Smoothed Rate of Change

Based on suggestions from Neile Wolfe of Wells Fargo Advisors and Dwaine Van Vuuren of RecessionAlert, we can tighten the recession lead times for this indicator by plotting a smoothed six-month rate of change to further enhance our use of the Conference Board's LEI as a gauge of recession risk.

As we can see, the LEI has historically dropped below its six-month moving average anywhere between 2 to 15 months before a recession. Here is a twelve-month smoothed out version, which further eliminates the whipsaws:

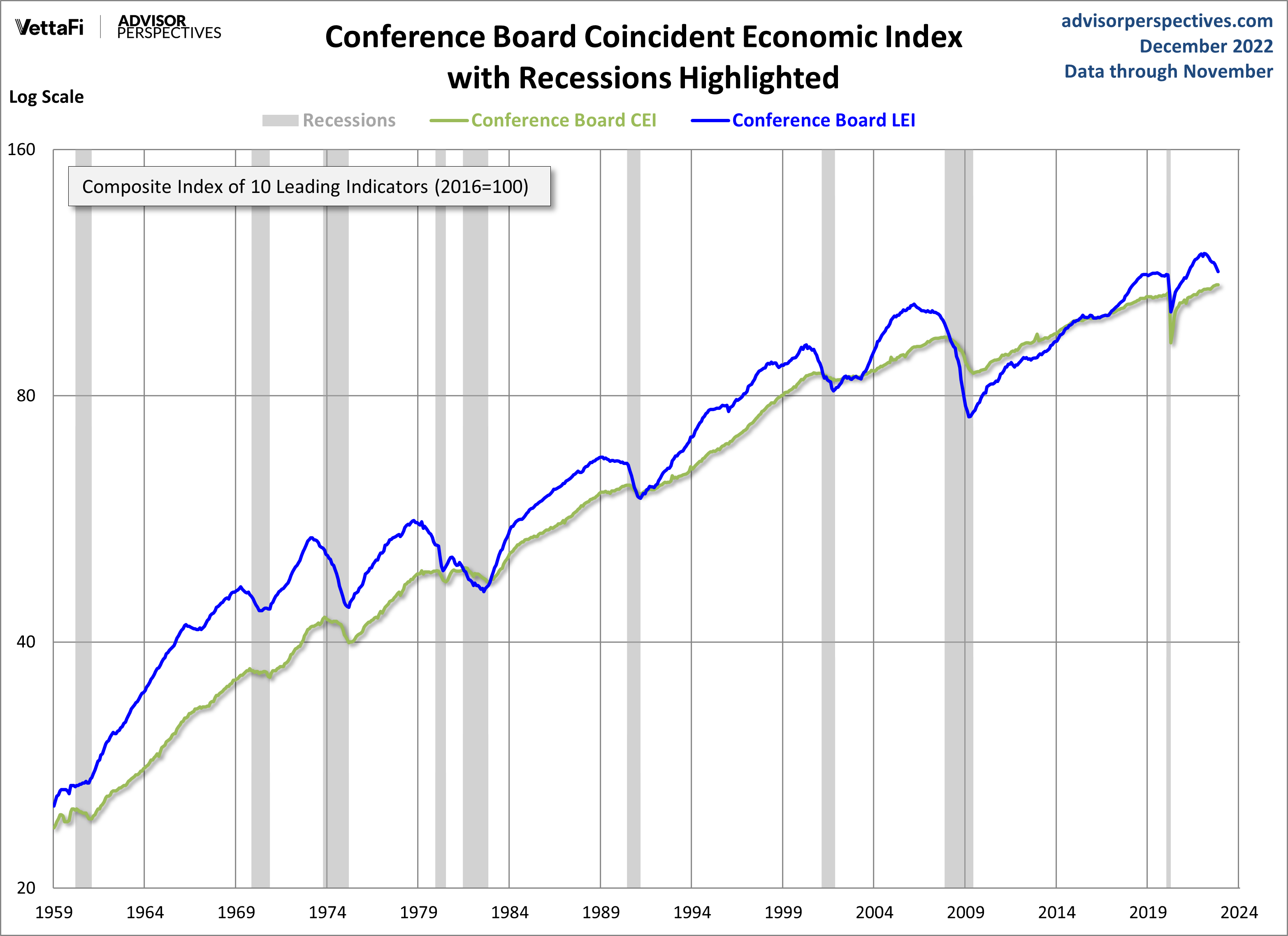

The Conference Board also includes its Coincident Economic Index (CEI) in each release. It measures current economic activity and is made up of four components: nonagricultural payroll, personal income less transfer payments, manufacturing and trade sales, and industrial production. Based on observations, when the LEI begins to decline, the CEI is still rising. Here's a chart including both the CEI and LEI.

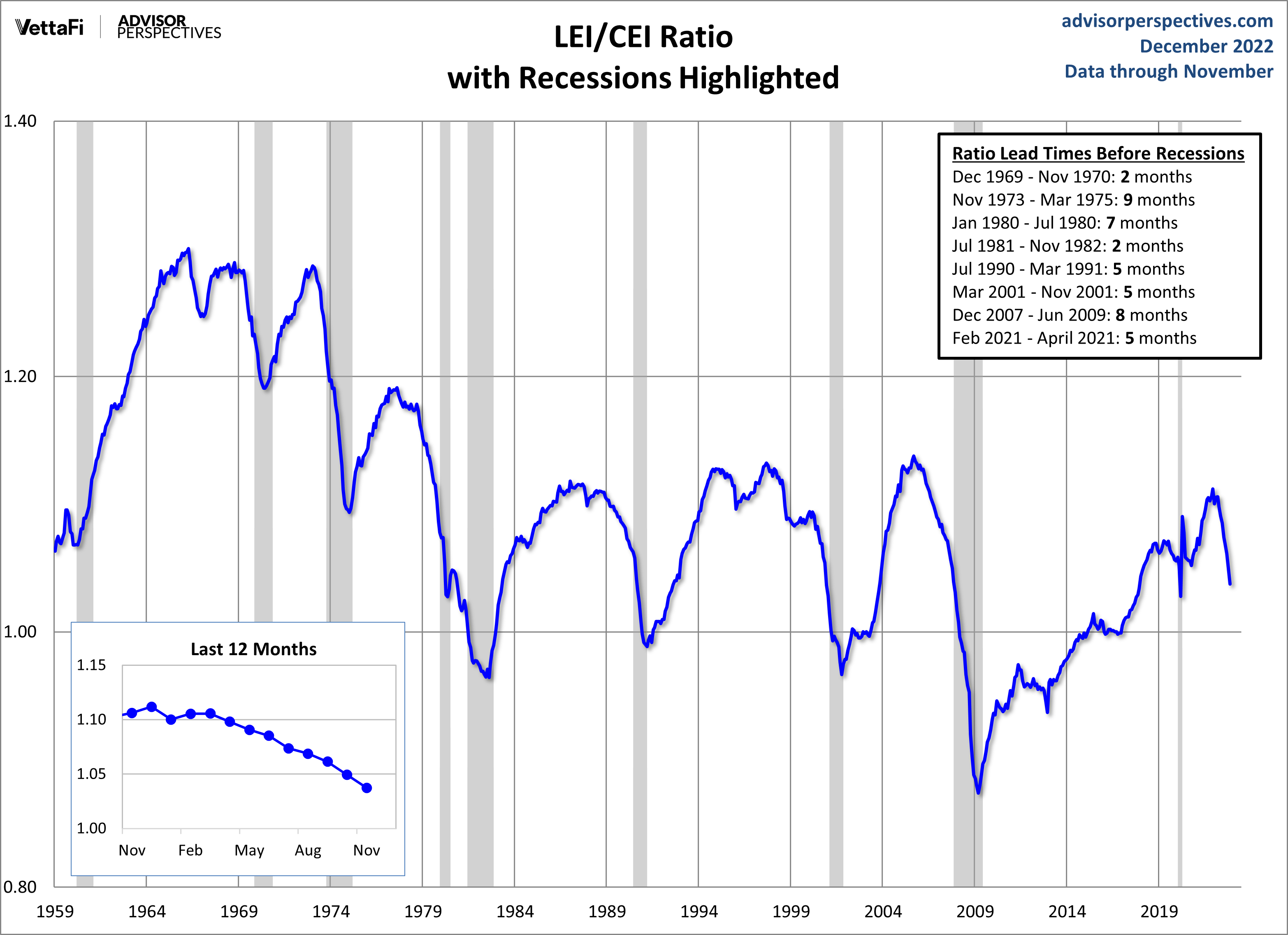

Here is a chart of the LEI/CEI ratio, which perhaps has been a leading indicator of recessions. We count the lead time as the number of months that the ratio has been declining prior to a recession. There have been times where the ratio has been in decline for several months without a recession.

More By This Author:

FHFA House Price Index Flat In OctoberThe Big Four: Real Personal Income In November

Kansas City Fed Mfg Survey: Activity Declines At Faster Rate