Capturing Gains Within The Context Of Normal Market Volatility

Staying Invested Is Not Easy

A recent analysis of a rare bullish signal may have given the impression-trend following is relatively easy to implement in the real world. Volatility tells us nothing is easy in the markets.

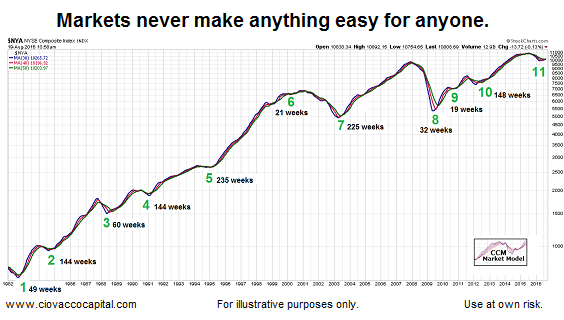

Volatility Is A Fact Of Life In The Markets

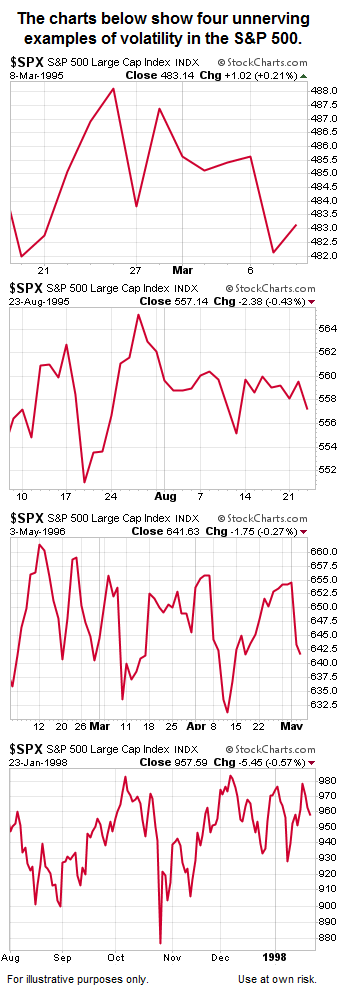

Would it be easy to stay with the trend during the bouts of volatility below?

Examples Above Occurred Within A Bullish Trend

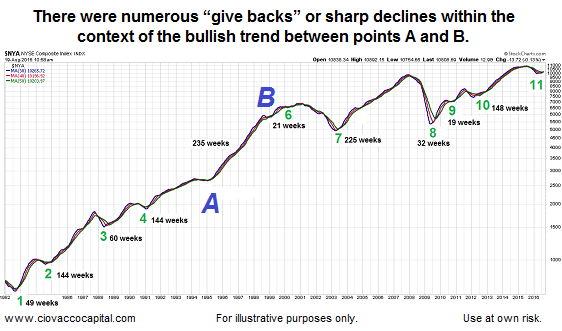

All four examples of S&P 500 volatility above took place between points A and B below, demonstrating that capturing long-term gains requires emotional stability and a high degree of discipline. Point A is in 1995 and Point B is in 1999.

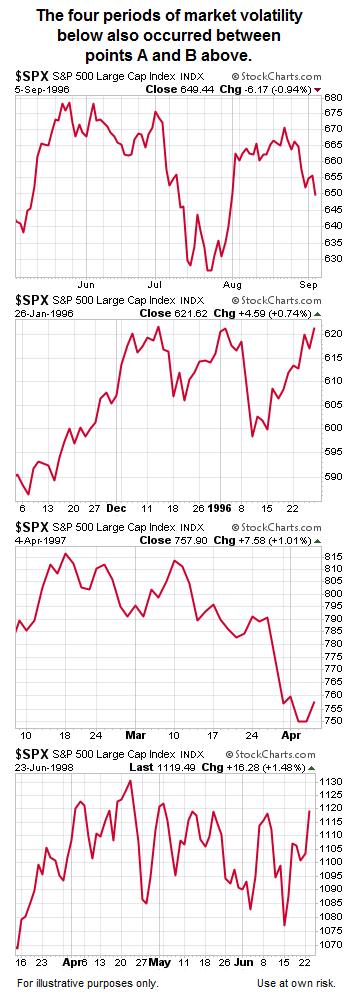

Four More “Give Back” Examples

Notice the dates on the four charts below; they all fall between 1995 and 1999.

2016: Why Are Stocks Holding Up After Talk Of Rate Hikes?

While it is too early to declare the stock market is going to be able to shake off renewed talk of rate hikes, the early returns fall into the “better than expected” category. The Wall Street Journal headline below aligns with our analysis of Jackson Hole, which can be found at the 25:48 mark of this video.

Why Can’t We Just Buy And Hold?

There is nothing wrong with long-term buy and hold. However, due to the inevitable large drawdowns that a buy-and-hold investor must endure, buy and hold is not easy to implement and it can be emotionally draining.

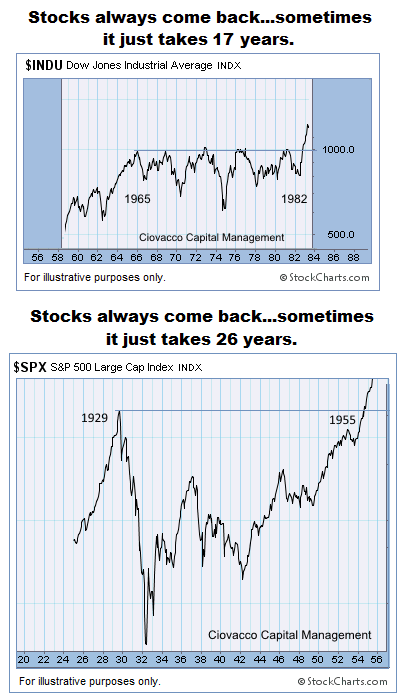

Stocks Always Come Back

The two charts below show in the long run buy and hold has proved to be an effective strategy; the question is what happens if the 17-year or 26-year periods below occur during your retirement? Many investors cannot afford to wait 17 to 26 years for buy and hold to make it back to break even.

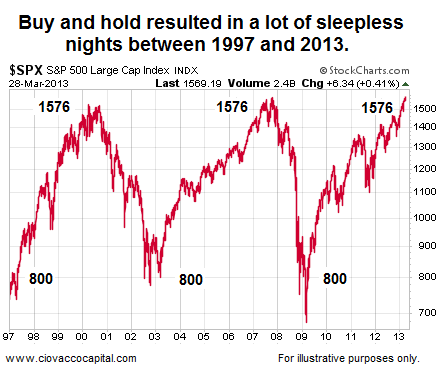

Some may counter with “those are extremely rare periods”. That may be the case, however, the S&P 500 hit 1,576 in March 2000….the S&P was at 1,576 in 2007….and again in 2013. The same can be said for the three “the market has gone nowhere” visits to 800 in 1997, 2002, and 2009 (see 1576s and 800s in the chart below).

Toning Down The Talk Of Rate Hikes

All things being equal, risk markets tend to frown upon rate hikes. After a rate-hike-induced reversal during the August 26, 2016, trading session, two statements were made that were a bit more market-friendly. FromThe Wall Street Journal:

“Two Fed officials have played down the likelihood of two rate increases this year beginning as soon as next month, after the U.S. central bank’s second-in-command floated the idea on the sidelines of the Kansas City Fed’s research conference. Vice Chairman Stanley Fischer told CNBC on Friday that Fed Chairwoman Janet Yellen’s Jackson Hole speech, in which she said the case for a rate increase has strengthened, was consistent with the central bank potentially raising rates at its meeting next month and again before the end of the year, if data shows the economy performing well.”

Both Approaches Can Work; Neither Are Easy To Implement

Buy and hold worked very well historically, assuming investors stayed invested during the gigantic drawdowns and periods of “going nowhere” for well over ten years. Managing risk with trends has worked well historically, but like buy and hold, it is very difficult to implement properly during countertrend moves.

The key to both approaches is having realistic expectations with regard to drawdowns, volatility, and discipline. Both methods can work; neither are easy to implement in the real world and in the context of human emotions. The moral of the story is:

It is nearly impossible to invest successfully without allowing our account balances to swing from time to time due to normal and expected market volatility.

Under our approach, the market model helps us discern between volatility to ignore and volatility to respect.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more

Thanks for sharing