Capital Efficiency Or Inefficiency?

Treasuries with duration have been rolling over for a couple of weeks perhaps digesting the pending legislation currently being hammered out in congress and then over the last couple of days, the credit rating downgrade is also entered the mix. As rates have moved higher with the ten year close to 4.60% and the 30 year above 5%, stocks might also be rolling over again. Admittedly, it's just a couple of days so who knows yet if stocks are rolling over or not.

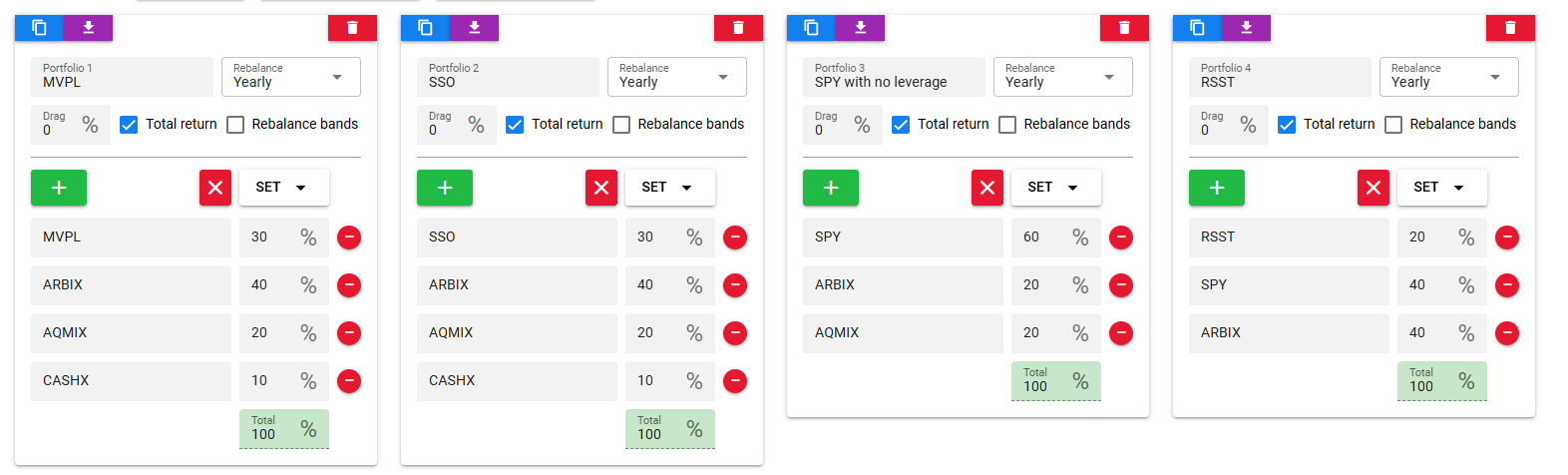

At a similar point after the tariffs were announced, I suggested taking the opportunity to stress test or revisit and revaluate any portfolio strategies or techniques that interest you. These events are great learning opportunities so I want to revisit capital efficiency the way we've looked at it before which is to leverage down as we've described it before.

The starting point for this post is the Miller Value Partners Leverage ETF (MVPL) which depending on a technical analysis process will either own plain vanilla S&P 500 via an ETF or have 2x exposure. Where equities trend up most of the time, MVPL should be expected to have 2x exposure most of the time. The variable would be how well its signals do going from 2x to 1x and then back again.

(Click on image to enlarge)

The weightings to equities and managed futures should all be the same while the unleveraged portfolio has just 20% in ARBIX which we're using as a fixed income substitute. The fifth one below is just VBAIX.

(Click on image to enlarge)

The period available to study was terrible for managed futures which might be why the results are meh. There's nothing catastrophic with any of the results. The RSST version is a little bit of an outlier to the downside but all of them lag VBAIX. For 2025, the MVPL version is the best performer and the RSST version is the worst.

If we take out the MVPL and RSST portfolios, we can go back quite a bit further and the results do a little better, thanks in large part to 2022.

(Click on image to enlarge)

Circling back to the result for this year, managed futures has struggled of course and while a 20% allocation is nice and tidy for a blog post, it would be better in real life to diversify your diversifiers. And while ARBIX is a fine substitute for fixed income with no duration, same thing, diversify your diversifiers. Twenty percent in just two alts that way is a bad idea.

More By This Author:

Inflation Fighting

Are Stocks The Only Game In Town?

What Retirement Planning Requires

Disclaimer: The information, statements, views, and opinions included in this publication are based on sources (both internal and external sources) considered to be reliable, but no ...

more