Canadian Dollar Snaps Winning Streak As U.S. Dollar Pares Losses

Photo by Michelle Spollen on Unsplash

The Canadian Dollar (CAD) faltered on Thursday, snapping a four-day winning streak and giving back ground to the US Dollar (USD). The USD/CAD pair has been bolstered back above 1.3600, and Loonie flows are reversing direction on multiple fronts, thanks to better-than-expected economic data out of the United States (US).

Canadian Retail Sales figures came in near expectations, but expectations have been geared sharply lower. Canadian consumer spending habits continue to show cracks as a slow-moving trade war with the US exacerbates recession indicators.

(Click on image to enlarge)

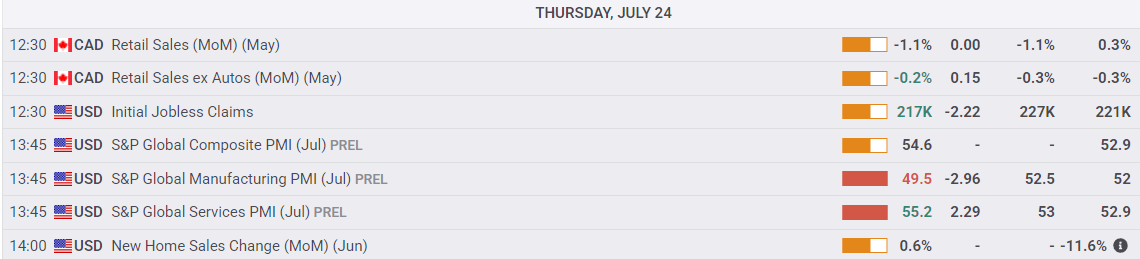

Daily digest market movers: Sharp Canadian Retail Sales contraction and falling Fed rate cut hopes drag on Loonie

- Canadian Retail Sales contracted by 1.1% in June, the largest MoM decline in 12 months.

- The Trump administration is poised to allow key US energy companies to resume Crude Oil extraction in Venezuela, hitting West Texas Intermediate (WTI) barrel prices and further pressing down on the Loonie.

- Venezuela has been locked out of the US market since sanctions were put in place in 2019, and the potential addition to already-existing supply overhang is chipping away at energy market confidence.

- US Services PMI data rebounded sharply in July, overshadowing a general decline in Manufacturing PMI figures.

- US weekly Initial Jobless Claims also fell slightly to 217K, highlighting general labor market strength that is keeping further Federal Reserve (Fed) rate cut hopes at bay.

Canadian Dollar price forecast

Thursday’s general reversal in both US Dollar and Canadian Dollar flows has bumped the USD/CAD pair back above 1.3600, drawing a sharp turnaround from the key technical level. Immediate price action is poised to get caught in a chart trap between a messy support zone below 1.3600 and the 50-day Exponential Moving Average (EMA) near 1.3730, and technical oscillators are recoiling from mildly oversold conditions, implying USD/CAD is set to chalk in another leg of a consolidation range that is developing on daily candlesticks.

USD/CAD daily chart

(Click on image to enlarge)

More By This Author:

Dow Jones Industrial Average Inches Back Into Peaks On Trade Deal HopesU.S.-Japan Trade Agreement Poses Accidental Threat To U.S. Auto Sector

Dow Jones Industrial Average Rallies On Potential Trade Deals