Canadian Dollar Continues To Slide Ahead Of Fed Rate Call

Photo by Michelle Spollen on Unsplash

The Canadian Dollar (CAD) extended into a fourth straight day of losses against the US Dollar (USD) on Tuesday, continuing a Greenback-positive theme in the run-up to the latest interest rate call from the Federal Reserve (Fed). Another hold on interest rates is a foregone conclusion to markets, and investors will be keeping a close eye on the Fed’s rate announcement on Wednesday for signals that the Federal Reserve Open Market Committee (FOMC) is ready to start cutting rates at its next meeting on September 17.

Wednesday will also bring the latest rate decision from the Bank of Canada (BoC). Both the Fed and the BoC are expected to stand pat on interest rates for the time being, but the BoC is poised to be eclipsed entirely by the Fed’s market presence. With safe-haven flows on the upswing and the CAD already stuttering after a rapid series of seven consecutive rate cuts from the BoC earlier this year, the charts could be primed for a fresh round of Loonie losses in the days to come.

Daily digest market movers: Canadian Dollar buckles as traders pivot into US Dollar

- The Canadian Dollar shed around one-quarter of one percent against the US Dollar on Tuesday, bolstering the USD/CAD pair back above 1.3750 and putting the Loonie-Dollar pairing on a collision course with 1.3800.

- Four straight sessions of declines for the Loonie, or rather gains for the Greenback, has pushed the CAD down over 1.5% top-to-bottom over the past week.

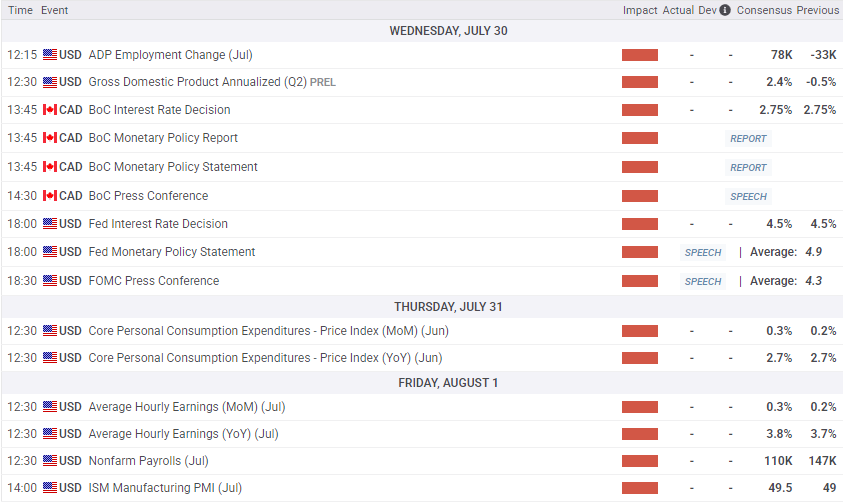

- On top of dual central bank interest rate decisions, a slew of high-impact US economic releases is also weighing on this week’s data docket.

- US Gross Domestic Product (GDP), Personal Consumption Expenditure Price Index (PCE) inflation, US earnings, and another round of US Nonfarm Payrolls (NFP) are all on the offering this week, stuffing the data chute.

- Friday, August 1 is also the most-recent self-imposed “tariff deadline” set by US President Donald Trump. The beginnings of some trade deals may be beginning to surface, but concrete details remain woefully light for a country just four days away from a global trade deal deadline.

(Click on image to enlarge)

Canadian Dollar price forecast

Another day of one-sided losses pushing the Canadian Dollar into the basement has given the USD/CAD pair the boost it needs to chalk in a fourth straight green candle as markets broadly favor the safe-haven US Dollar ahead of key events.

USD/CAD continues to grind higher following a messy triple-bottom chart pattern, climbing from 1.3600 toward the 1.3800 handle. Bullish momentum may be poised to slow, with intraday price action grappling with chart territory north of the 50-day Exponential Moving Average (EMA) near 1.3730.

USD/CAD daily chart

(Click on image to enlarge)

More By This Author:

GBP/USD Extends Into A Third Day Of Losses Amid Wider Greenback RecoveryCanadian Dollar Slumps For A Third Straight Day As U.S. Dollar Climbs

Dow Jones Industrial Average Goes Both Ways Ahead Of Hectic Week