Canadian Dollar Churns Near Multi-Month Highs As U.S. Shutdown Suspends NFP Release

Photo by Michelle Spollen on Unsplash

The Canadian Dollar (CAD) traded in a narrow range against the US Dollar (USD) on Monday, holding near recent multi-month highs as markets grappled with the fallout from the ongoing US government shutdown. USD/CAD oscillated around the 1.3550 region, with traders hesitant to establish fresh directional positions ahead of a week now devoid of key US labor data.

The US Bureau of Labor Statistics (BLS) advised markets on Monday that Friday's scheduled publication of the latest Nonfarm Payrolls (NFP) jobs data package will be suspended until federal government operations resume. According to the BLS's official government website, "This website is currently not being updated due to the suspension of Federal government services. The last update to the site was Monday, February 2, 2026. Updates to the site will start again when the Federal government resumes operations."

Late 2025 saw the longest government-funding freeze on record, with a short-term stopgap funding solution only providing enough operating cash to keep federal services running through the end of January. Despite another half-measure to keep operational budgets in the black, the US Capitol continues to struggle to reach a budgetary consensus, keeping key federal offices underfunded. The partial shutdown has now extended into its third day, with House lawmakers expected to vote on a Senate-passed funding package as early as Tuesday.

The absence of official US economic data is forcing markets to rely on more volatile private-sector indicators, creating additional uncertainty for currency traders. With the Federal Reserve's (Fed) next policy decision not scheduled until March, the suspended labor data adds another layer of complexity to rate expectations. Markets are currently pricing in two Fed rate cuts for 2026, with the first move expected in June.

On the domestic front, the Bank of Canada (BoC) held its benchmark overnight rate at 2.25% at its January 28 meeting, citing modest near-term growth as population expansion slows and Canada adjusts to US protectionism. Canadian GDP flatlined in November, with manufacturing output contracting 1.3% month-on-month, underscoring that underlying momentum remains fragile. The BoC projects growth of 1.1% in 2026 and 1.5% in 2027.

The US Dollar Index (DXY) stabilized above the 97.00 handle on Monday following President Donald Trump's nomination of Kevin Warsh as the next Federal Reserve Chairman on Friday. Markets view Warsh as a credible, institutionalist pick who would maintain Fed independence, triggering a sharp risk-off move that sent gold and silver plunging while supporting the Greenback. West Texas Intermediate (WTI) Crude Oil prices pulled back sharply toward $62.00 per barrel after touching four-month highs near $66.00 last week, as easing US-Iran tensions deflated the geopolitical risk premium.

Daily digest market movers: US shutdown clouds data outlook for CAD traders

• CAD held steady near 1.3550 against USD on Monday, with markets awaiting clarity on both the US shutdown and upcoming data releases.

• BLS confirmed Friday's NFP report is suspended indefinitely; official US labor data unavailable until the federal government resumes operations.

• US partial shutdown extends into third day as House prepares to vote on Senate-passed funding package; Speaker Johnson targets Tuesday resolution.

• BoC held rates at 2.25% on January 28, projecting modest 1.1% GDP growth in 2026 amid ongoing trade policy uncertainty.

• DXY steadied above 97.00 after Trump's nomination of Kevin Warsh for Fed Chair triggered broad risk-off sentiment on Friday.

• WTI Crude Oil retreated sharply toward $62.00 from four-month highs as US-Iran tensions eased, removing support for the commodity-linked Loonie.

Canadian Dollar price forecast

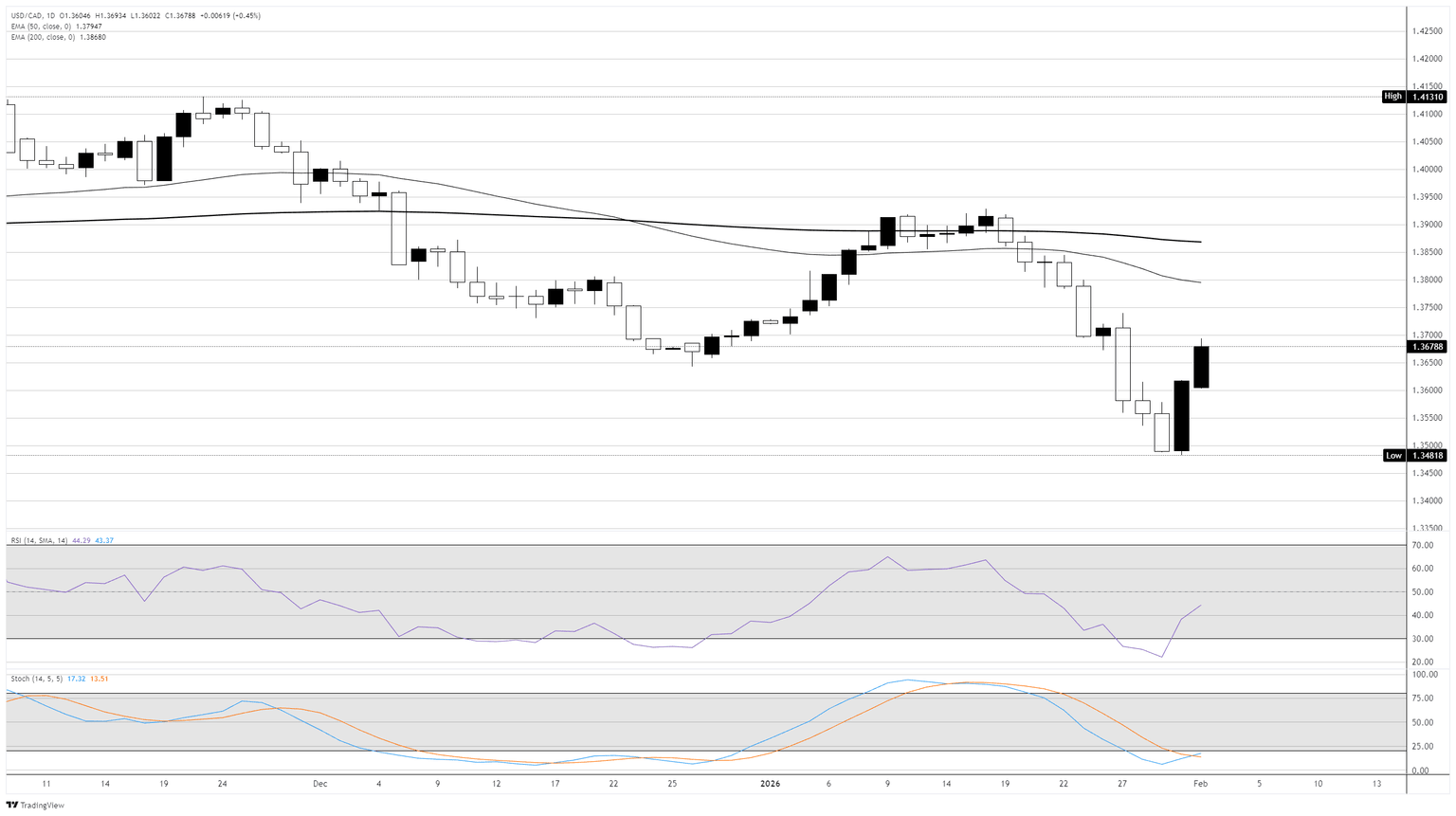

USD/CAD is consolidating near recent lows in the 1.3550 region after the pair's sharp decline from January highs near 1.3750. The break below the 78.6% Fibonacci retracement of the June advance has confirmed a meaningful shift in near-term momentum, with the 2023 trendline and the 2025 swing low near 1.3540 providing initial support. A sustained break below this threshold would expose the 100% extension at 1.3430 and the 2024 low-week close near 1.3360.

The 50-day Exponential Moving Average (EMA) continues to decline toward 1.3680, while the 200-day EMA sits near 1.3850. Price action remains well below both moving averages, maintaining the bearish structure that has dominated since the January reversal. The Relative Strength Index (RSI) is hovering in the low-40s, suggesting room for further downside before oversold conditions materialize.

Near-term resistance is seen at 1.3670, backed by the 2026 yearly open at 1.3725. Bulls would need a weekly close above this region to suggest a more significant low is in place. With official US data now suspended due to the government shutdown, volatility could remain subdued until markets receive fresh catalysts. The broader bias remains bearish while price holds below the 50-day EMA, though the absence of key economic releases may keep USD/CAD range-bound in the near term.

USD/CAD daily chart

(Click on image to enlarge)

More By This Author:

Dow Jones Industrial Average Struggles To Ward Off Software Downturn

Dow Jones Industrial Average Holds Steady Post-Fed Despite Some Yield Jitters

GBP/USD Soars Amid Greenback Collapse, Breaches Four-Year Highs