Can Keurig Surprise This Quarter Amid Disappointing Product Launches?

(Photo Credit: John Lee)

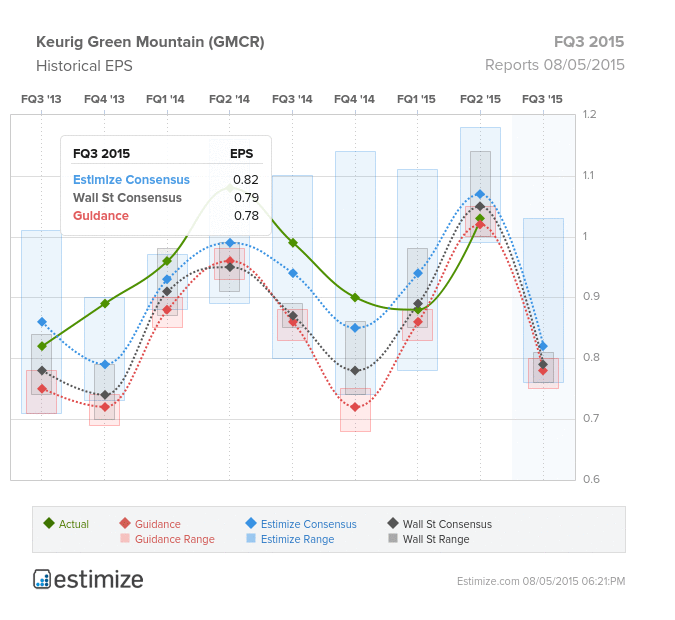

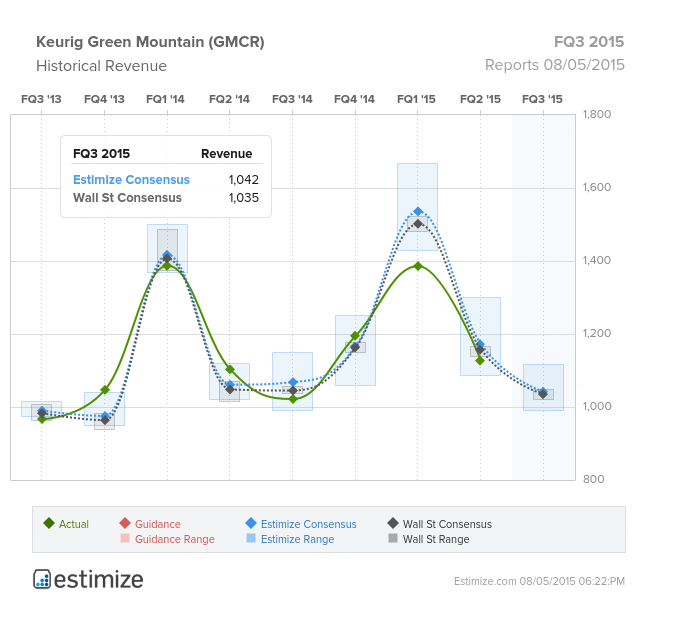

Keurig Green Mountain (GMCR) will report its FQ3 ’15 figures after the closing bell this afternoon. Estimize is predicting an EPS of $.82, the Wall Street consensus is set at $.79, and guidance is at $.78. Keurig has seen negative YoY growth for the last two quarters, and for the last eight quarters, Keurig has outperformed company guidance. In terms of revenues, Estimize is predicting a figure of $1.044B and Wall Street comes in slightly below this figure at $1.035B. For the last 3 out of 4 quarters, company actuals have been below both the Estimize and Wall Street consensus. Keurig has fallen more than 42% since the start of 2015, with the P/E ratio sitting at 20.99. This high ratio indicates that investors expect higher future earnings growth than companies in the same industry with lower ratios.

One notable problem that Keurig faced this quarter was the transition from Keurig’s old brewer to the new version Keurig 2.0. After the product launch, the company faced delays putting the new product on retail shelves. The high price of the new product as well as the lack of details provided to customers about it resulted in customer resistance to switching over. Moreover, the unlicensed pods that consumers had previously used were not compatible with this new brewer. Keurig dealt with this resistance by preparing a more effective package using better company communication. Keurig is also bringing the ‘My K-Cup’ back into the market, allowing users to brew any coffee of their choice. However, these improvements will take several quarters to positively affect the company financials. This third fiscal quarter, company sales will be negatively affected, and as a result, Keurig Green Mountain expects a flat to low-single digits growth in the net sales.

Another product, Keurig Kold, is one of the most awaited products in the market, and could really be the turnaround that Keurig needs. However, the delayed product launch is dwindling customer excitement as well as disappointing investors. When launched, it is predicted that the company could sell around 4 million Kold brewers in 2016, and 37.5 Kold K-Cup packs per brewer in 2016.

So will Keurig’s financials be able to persevere afternan unsuccessful Keurig 2.0 launch as well as a disappointing delay in Keurig Kold’s launch? Over the last three months, GMCR’s stock plummeted over 35%. Will this number continue to decrease when company earnings are released, or are investors over-exaggerating the company’s hurdles?

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.

Oh they surprised alright. Down 53% after hours.