Calithera Biosciences: An Under The Radar Opportunity

Calithera (CALA) is approaching significant value inflection milestones with both its CANTATA and KEAPSAKE studies. CALA is a company we know very well as we have been covering it extensively for some time. The company expects top-line data from its CANTATA study of its lead drug Telaglenastat to read out between now and the beginning of 2021.

CANTATA is examining Telaglenastat (fka.CB-839) in combination with Exelixis’ (EXEL) Cabozantinib (CABO) vs. placebo with Cabo in both second and third line clear cell Renal Cell Carcinoma (ccRCC). The study enrolled two sub cohorts of patients, either refracted to immunotherapy (PD-1 + CTLA-4) or another tyrosine kinase inhibitor (TKI) besides Cabo. CALA's latest guidance is for top-line (PFS) analysis to be ready by the end of this year or early Q1 2021.

Image Source: Unsplash

The CANTATA study successfully enrolled 444 patients, far exceeding the original 298 target (which was later increased to 416). The company has clearly guided that it expects this trial to be registrational, which means if the trial is successful and because the drug is on The Food and Drug Administration's (FDA) Fast Track protocol, Calithera would (assuming good data) then submit a New Drug Application (NDA). The FDA then would inform the company within 60 days if it intends to grant a priority review. If priority review is granted, the FDA makes its decision to approve or not within 6 months - Telaglenastat could potentially be on the market before the end of 2021.

The CANTATA trial design reflects a broader shift that’s been taking place in the RCC landscape, moving from sequential single agent therapy to combinatorial approaches. Patients in the past that failed one or two TKI therapies would move onto an mTOR inhibitor such as Everolimus as a salvage approach. However, Bristol-Myers Squibb (BMY) changed this with its all immuno-oncological combination of Nivolumab and Ipilimumab (Anti PD-1 +CTLA-4) approval in front-line RCC.

Since then, other combinations have been approved such as Pfizer’s (PFE) Axitinib and Merck’s (MRK) Pembrolizumab. In addition, an NDA was recently filed for Cabo and Nivolumab in the front-line setting following promising data.

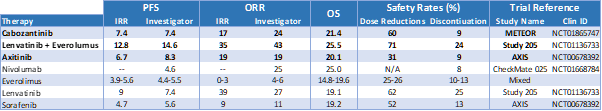

For second-line RCC, the only combination with FDA approval is Eisai’s (OTCPK: ESALF) TKI based Lenvatinib and Everolimus in RCC following TKI failure. From an efficacy standpoint, this combination significantly outperforms the single agent therapies, both according to its pivotal study and in other references summarized below:

Graphic source: Dan Cohen

Altogether, the studies above set the bar for CALA's CANTATA trial. The goal for CALA here is for the combination study to show significant superiority to Cabo alone. According to EXEL's METEOR trial results, the bar to exceed is 7.4 months progression-free survival (PFS). However, it would be even more bullish for CANTATA to meet or exceed the bar efficacy set by the Lenvatinib combination by showing superior tolerability.

Toxicity is a significant concern for oncologists to consider before treating patients with the Lenvatinib combination in second line RCC refracted. These toxicities were particularly evident within the gastrointestinal tract, making the combination ill-suited for the elderly and frail.

According to Dr. Chung-Han Lee at the Memorial Sloan Kettering Cancer Center, most people are using Lenvatinib/Everolimus in the third-line setting. It should also be noted that none of the above referenced studies enrolled patients who were refracted to Bristol’s immunotherapy combination. This offers CALA an alternative path to market approval if the combination demonstrates superiority.

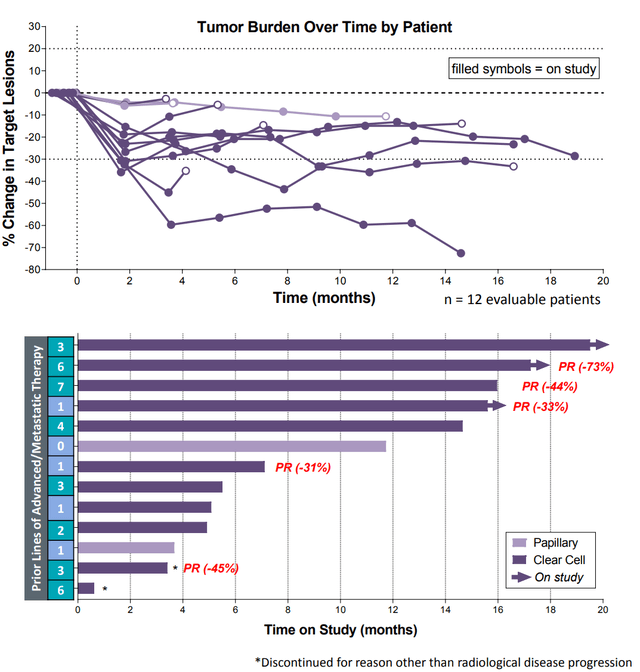

In CALA’s phase 1b study that CANTATA is built on (n10, RCC), the company demonstrated that the combination of Telaglenastat and Cabo led to an ORR of 50% and a disease control rate of 100%.

Chart and graphic source: Calithera.com

With a sAE rate of 4/13 (31%) vs. 68% in the METEOR study, it appears that Telaglenastat does not increase toxicity in any meaningful way in the combination treatment. So, if the improvement in ORR (50% v. 17% ORR in ccRCC) with the combination translates to PFS benefit, it would be likely that Telaglenastat would establish a new standard of care in second line RCC.

However, the CANTATA study doesn’t just have implications for the RCC treatment landscape, it also provides an important read-through for the future of the glutaminase inhibition platform. Notably, the clear cell subtype of RCC is driven by dysfunction in the hypoxia (HIF-1α and 2α) pathway. It's evident to us that the company’s core hypothesis is centered on the notion that glutaminase is the key pathway shared by antioxidant-resistant tumors.

This hypothesis is reflected in the company’s randomized KEAPSAKE study, which is examining Telaglenastat in combination with pembrolizumab and platinum-based therapy, in Nrf2/KEAP1 pathway mutated Non-Small Cell Lung Cancer. Like HIF-1, Nrf2 is a transcription factor that regulates multiple metabolic genes in response to reactive oxygen species (ROS) accumulation. Under normal (normoxic) conditions, both HIF-1 and Nrf2 are signaled for proteasomal degradation by the Von Hippel-Lindau (VHL) and KEAP1 proteins, respectively.

Tumors adapt to become hypoxic, which gives it 3 key survival advantages: hijacking the antioxidant response pathway for chemo resistance, dysregulating immune cells for immunotherapy resistance, and increasing genetic instability as a result.

In order to survive in such hostile conditions, tumors form a significant dependency on glutamine metabolism instead of glucose, as a result of the Warburg effect. Under low oxygen conditions, glutamine is the substrate for fatty acid metabolism which is essential for tumor survival. This also functions as the substrate for glutathione synthesis, an antioxidant that prevents damage to the cell from high levels of ROS.

The significant genetic damage which occurs requires frequent repair in which glutamine is the most viable carbon source in the absence of oxygen. In terms of immune response, glutamine is an essential substrate for T-cell survival and memory formation - this is key to the mechanism behind anti PD-1’s most touted benefit of significant durability for responders.

Furthermore, the absence of glutamine appears to prevent myeloid differentiation, which leads to the accumulation of myeloid derived suppressor cells (MDSCs) in the tumor environment.

An investigator sponsor study run by The MD Anderson Cancer Center, explored glutaminase inhibition using CALA's Telaglenastat in combination with standard of care azacytidine in high risk Myelodysplastic Syndrome (MDS) patients - MDS is a disease of malignant hematopoietic stem cells which have failed to undergo differentiation.

The study is showing an impressive 65.2% CR rate with 5 of the 23 patients moving on to transplantation, and at median follow-up of 10.3 months, Overall Survivability (OS) has not yet reached. Notably, investigators uncovered evidence of myeloid differentiation in these responders validating this mechanistic rationale. Further data will be published at the American Society for Hematology (ASH) conference in December this year.

Additionally, a very strong response rate was especially observed in TP53mut MDS patients with a 62.5% CR and median OS of 8 months. This is notable, as p53 drives resistance to oxidative stress and is often co-mutated with KEAP1. Some evidence suggests that TP53mut interacts with Nrf2, further modulating its activity.

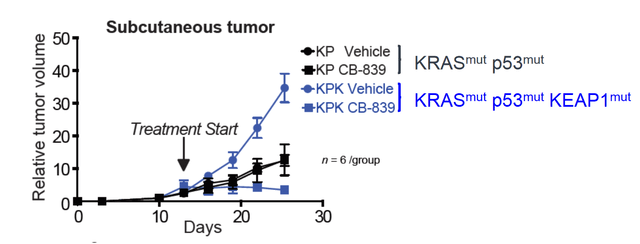

This study published here demonstrated that Telaglenastat is active in these ROS driven tumors. As more aggressive mutations accumulate, Telaglenastat's activity seems to increase further. In models which had KRAS p53 and KEAP1 all mutated, Telaglenastat as a single agent saw tumor reductions in a cohort of 6 mice. Without KEAP1mut the activity of Telaglenastat was less meaningful, showing just how important glutamine metabolism is to tumor survival as it becomes increasingly aggressive with hypoxia.

Graphic source: Calithera.com

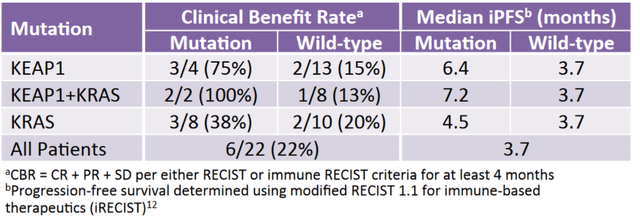

Exploring these hypotheses, the company bio-markered patients who were actively progressing on anti PD-1 therapy by adding glutaminase inhibition. Afterwards, the investigators observed that the majority of lung cancer patients remained stable longer than would be expected given the rapid growth which preceded enrollment. Interestingly enough, stabilization occurred more frequently in Nrf2/KEAP1 altered patients.

Graphic source: Calithera.com

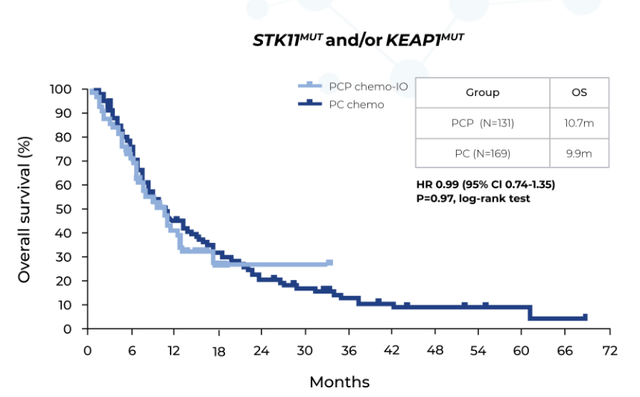

It can be hypothesized that for Nrf2/KEAP1 altered tumors, lack of glutamine in the tumor microenvironment (TME) was a primary reason for treatment failure. Building on this hypothesis, it was observed that for STK11/LKB1 mutated Non-Small Cell Lung Cancer (NSCLC) patients, the addition of pembrolizumab (Anti PD-1) to platinum-based chemotherapy showed no meaningful benefit.

Also, the finding of 10.7 months for median OS in front-line NSCLC significantly lags the 20.4 months observed for this therapy in NSCLC broadly. One of the most common co-mutations with Nrf2/KEAP1 is STK11/LKB1, which is one stratification CALA is using for the KEAPSAKE study.

Graphic source: Skoulidis et al. 2019 ASCO Annual Meeting. Abstract #102

We believe that when glutaminase inhibition is moved up the line to the treatment-naïve setting, it will not just temporarily stabilize patients but enable deeper and more durable responses. The goal here is to move the responders in Nrf2 altered patients closer to those who do not have such alterations, filling the gap between the curves where there is significant room - this would be consistent with the company’s preclinical model.

Importantly, these genetic signatures which the company believes will confer response to glutaminase inhibition are also included on Next Generation Sequencing (NGS) panels. Overall, this makes it far less costly and prohibitive to enroll KEAPSAKE and eventually market Telaglenastat in this setting.

Success here would be meaningful for the company’s future given that KEAP1 is the 3rd most common mutation in lung adenocarcinoma. This segment represents approximately 20-25% of patients which accounts for roughly $10B to $12B in revenues of the entire $50B+ lung cancer market.

CALA needs to beat the anti PD-1/chemo PFS bar of 4.5 months with its KEAPSAKE trial. The company has already shown on a small N6 number that Telaglenastat delivers 6.4 months of PFS. We think when adding chemo to the mix, we can see upwards of 10 months PFS data based on our hypothesis above. Basically, patients with the Nrf2/Keap1 mutant don't really have a standard of care or much hope of seeing meaningful improvement with the current anti PD1/chemo treatment regimen - CALA hopes to change that.

We see the bar here to AA for CALA as low to get over. If the company can clear this bar, it would be the sole server of a $10B to $12B market.

So, why hasn’t the stock price of CALA reflected the opportunity we are seeing here? For starters, the biotech market trades and speculates in what it's comfortable with; companies with strong early single-agent activity and clearly validated targets. Many market participants in this sector also speculate on acquisitions based on other companies that have a similar mechanism of action/target that have recently been acquired.

The best current example we can give for this is Trillium Therapeutics (TRIL). Going back 4 years ago or so, the CD47 target was hotly speculated as being the next big thing in biotech. Because of its CD47 targeted platform, TRIL went on a huge run into the mid- $20s. After traders and investors cooled down on CD47 because they weren’t getting the early results they wanted to see (also because TRIL’s prior management team did a poor job), the stock languished badly, trading as low as the $0.20 range about a year ago. However, CD47 became hot again when Forty Seven, Inc. (FTSV) had a hot data hit centered on The CD47 target.

Not long afterwards, FTSV was acquired by Gilead (GILD) for $4.9B, representing a stock price of $95.50 a share. To put this in perspective, FTSV’s stock price traded as low as $5.53 in October of 2019. Needless to say, this was a huge win for shareholders in FTSV who purchased this stock near its bottom in 2019.

We aren’t saying TRIL won’t eventually see a similar outcome, we merely mention this as an example of how developmental biotech can get hotly speculated when there is a frame of reference (prior target validation/ similar mechanistic action) on which to speculate on.

The majority of developmental biotech retail investors are actually traders who take advantage of run-up trades before a developmental biotech company has a major binary/catalyst. In the trading world, this has been coined “The catalyst run-up trade.” Most of these traders rarely buy and hold these companies, with top traders turning nice profits following this strategy.

We are making an investment thesis case for CALA here, not a trading thesis. We see CALA as a company with a novel mechanism of action with an expedited lower-bar pathway to wide-open high-value unmet need markets, provided the company proves successful with its data sets.

CALA statistics; (source: Yahoo Finance)

Income Statement

| Revenue (ttm) | N/A |

| Revenue Per Share (ttm) | N/A |

| Quarterly Revenue Growth (yoy) | N/A |

| Gross Profit (ttm) | -76.29M |

| EBITDA | -90.78M |

| Net Income Avi to Common (ttm) | -89.3M |

| Diluted EPS (ttm) | -1.3750 |

| Quarterly Earnings Growth (yoy) | N/A |

Balance Sheet

| Total Cash (mrq) | 137.75M |

| Total Cash Per Share (mrq) | 1.95 |

| Total Debt (mrq) | 7.15M |

| Total Debt/Equity (mrq) | 5.84 |

| Current Ratio (mrq) | 7.07 |

| Book Value Per Share (mrq) | 1.74 |

Cash Flow Statement

| Operating Cash Flow (ttm) | -79.71M |

| Levered Free Cash Flow (ttm) | -47.18M |

CALA has been burning quite bit of cash as of late primarily because the company has completed one registrational trial, and is currently enrolling another registrational trial (KEAPSAKE). The company is at a pivotal point; if its CANTATA trial has at least a decent read-out, this will provide CALA with additional revenue, leverage, and market exposure. However, if the company misses completely on the CANTATA trial it will be hamstrung to raise cash and likely forced to pivot towards repurposing itself as an MDS company, in which to date has shown very promising maturing data via the investigator sponsored trial (MDAnderson).

However, since CALA is a developmental biotech that has yet to receive an approval from the FDA, our investment thesis here carries significant risk. As much as we believe this company will be successful based on very deep due diligence, there is no guarantee that it will be successful. CALA’s trials can fail, and those who invest now could have their capital sit for years before the company could possibly reinvent itself with an MDS focus, if at all.

We think in time that CALA has a legitimate shot at becoming a full-fledged large cap biopharma company, and the main reason we think that is because of its KEAPSAKE trial. With data success in an accelerated approval designed registrational trial, the company would be the sole player in a very high margin $10B to $12B a year market within 3 years.

Assuming that CALA does receive eventual approval in this segment and using a 10x price to sales mid-ratio, this would fully valuate the company at $100B. However, we think the company would be acquired long before it would realize such a valuation, so we see $20B as the going acquisition target within the next 3 years - well over $200 a share based on the current outstanding share count of around 80M shares.

On the flip side, however, assuming the company fails on all its current trials, we would then see a valuation of about $150M - under $2 a share or potentially lower with expected dilution to keep afloat.

Too many retail investors do not understand the high risk in developmental biotech companies. Many of these investors think it's as simple as buying shares of these companies and getting rich, it’s not. However, our intention is to hold through data and take that risk. If you do the same, please be sure that you fully understand the risks here.

Disclosure: We are long CALA.

For more biotech commentary, investment thesis, trading ideas, join us daily during market hours on our live chat and audio at more

$CALA sounds like a good buy.

Yes, it is!

Good.

Very interesting. Worth digging a bit deeper into CALA. For sure bio-tech stocks are high risk and because of the long testing and approval processes are usually "long" investments. Thanks for the tip.