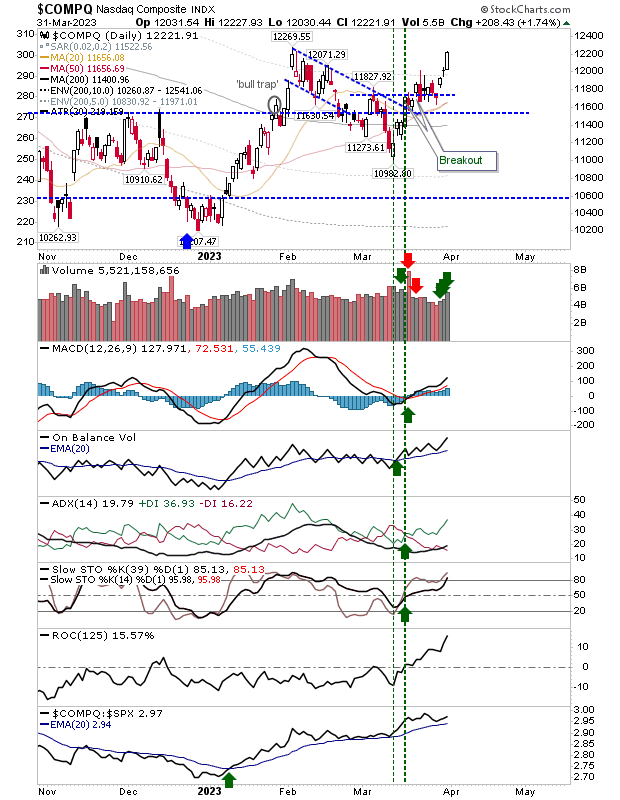

Buyers Deliver Confirmed Accumulation In Indices

Friday was a great day for longs with all indices recording gains on higher volume accumulation. The Nasdaq is outperforming both the S&P and Russell 2000 and with smell of recession in the air this index is performing remarkably well. Technicals are net bullish. I want to find something bad to say about the index, but at this point in time. there is little negative to say.

The S&P has surged in relative terms since the start of March. Friday's gain marked a new resistance breakout, taking out the early March high. As with the Nasdaq, technicals are net bullish. The index is trading above all key moving averages and has room for more. Next up is the February high.

The Russell 2000 has work to do as it works off its lows. The index is sharply underperforming peer indices as Friday's gain brings the index close to its 200-day MA. Technicals have started to improve, helped by the 'buy' signal in the MACD and On-Balance-Volume. While the Nasdaq is close to new all-time highs, there is the potential for it to help drag this key speculative index with it.

This week will be about consolidating Friday's mini-surge. It could all turn pear shaped on Monday, but given the clean breakout, expectations are for something more.

More By This Author:

Indecisive Gains, If There Is Such A Thing...Markets Giveth, Then Taketh Away

S&P Breakout Adds To The Earlier Breakout In Nasdaq

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more