Buy This Small Cap Rocket About To Lift Off

After emerging from the brutal financial crisis of 2008, the banking and financial services industries are finally generating some solid growth. As Americans start to get comfortable with the stock market again, investment flows are starting to return to U.S. equities from the retail investor community. Many of these investors are turning to the services provided by independent brokerage and advisory firms in an effort to optimize their portfolios and meet their investment goals. In addition, the equity underwriting space is seeing some of the best activity in years.

Ladenburg Thalmann Financial Services, Inc. (NYSE: LTS) is a diversified company whose platform includes broker-dealers, asset management, investment banking, life insurance products, and equity research. The firm posted record high revenue and net income in 2014, and there is good reason to believe that this trend will continue into the future.

Ladenburg now offers a network of 4,000 financial advisors and has $125 billion in client assets under management (AUM) thanks to organic growth and some key recent acquisitions. I am intrigued by the firm’s robust range of services, upward trending growth, and notable insider buying. The company has a market capitalization of just over $600 million and surprisingly has little analyst coverage at the moment despite the company having been a member of the New York Stock Exchange for 135 years.

Offering a Diversified Range of Financial Services:

The two primary arms of Ladenburg Thalmann are its independent brokerage and advisory services (IBD) sector, and investment banking and capital markets division. The firm’s IBD business maintains five broker- dealer and registered investment advisor firms as standalone operations. LTS preserves the independence of those businesses in an effort to maintain their history and culture while enabling them to leverage the technological and back office support of the overarching company.

Ladenburg’s advisors have access to all the resources of the company, from its capital market products and investment banking services to its proprietary institutional equity research. So far the strategy seems to be working, as recurring revenues in its IBD operations improved to a solid 71% in 2014.

The investment banking and capital markets business focuses on providing corporate finance and advisory services to public and private companies with market capitalizations below $500 million. Financing options include underwritten public offerings, registered direct offerings, and private investment in public equity (PIPEs). In 2014 the firm participated in 106 underwritten offerings that raised a total of approximately $19 billion.

Its bankers deal primarily with REITs, business development companies (BDCs), and master limited partnerships (MLPs), having participated in 206 offerings of these nature since 2012. Ladenburg also has dedicated investment bankers focused on healthcare and biotech companies. Given that noted multi-billionaire biotech entrepreneur and investor Phillip Frost owns a good chunk of the company, I expect Ladenburg to continue to grow in this fast growing space.

2014 Financial Results Impress:

Ladenburg Thalmann improved revenues by 16% in 2014 to just over $920 million, a record high for the company. EBITDA grew by 7% to about $61 million, and net income came in at approximately $33 million compared to a loss of just under one million dollars in 2013. In 2012 the company recorded a net loss of about $16 million, so the upward trajectory for revenues and overall net income over the past years is definitely a positive sign. Advisory fee revenues increased by 25% year-over-year, and investment banking revenues improved by 12%.

The fact that both of the company’s primary operations have experienced solid growth over the past year is promising and indicative of a strong underlying business platform. Currently, analysts are expecting revenues slightly above one billion dollars in 2015. Ladenburg Thalmann cites the retirement of nearly 80 million baby boomers and their need to adjust retirement assets accordingly as a potential macroeconomic trend driving IBD revenues. I think the scale (presence in all 50 states) and independent nature of the company’s IBD lines of business give it a flexible advantage in the market.

To Acquire or be Acquired:

Management has strategically expanded the company’s nationwide presence and services with a number of key acquisitions. Ladenburg has purchased Securities Service Network, KMS Financial Services, and Highland Capital Brokerage, as well as some assets of Sunset Financial Services over the past few years, in an effort to solidify a foothold in IBD and its more stable cash flows. Based on the successful growth mentioned earlier, this strategy has served the company well.

The firm views revenues tied to investment banking, capital markets, institutional sales, and trading as more volatile and subject to business cycles. Ladenburg believes the independent brokerage business can generate significant operating cash flow when its other business units might suffer from downturns and to benefit from its diversification efforts. These recent acquisitions align well with this strategy and have already have had a meaningful impact on revenue. The Highland Capital acquisition also enabled entry into the wholesale life insurance business, yet another avenue to diversify operations.

Given its wide range of products and services, as well as its upward trending revenues, I could see Ladenburg Thalmann sparking the interest of a much larger financial services company like Raymond James (NYSE: RJF) which it most closely resembles. Ladenburg is still a relatively small player in terms of market value compared to some of the heavier hitters. The company is financially healthy and has reduced long-term debt from almost $200 million in 2012 down to around $56 million at the end of 2014.

Insider Buying & Valuation:

I always like investing along with insiders. Over the past year, almost two million shares of Ladenburg Thalmann have been purchased by insiders. Many of these parties maintain significant investments in the firm. Among them is the aforementioned and renowned billionaire investor Dr. Phillip Frost, who holds over 12 million shares, and CEO Richard Lampen, who holds just over one million shares.

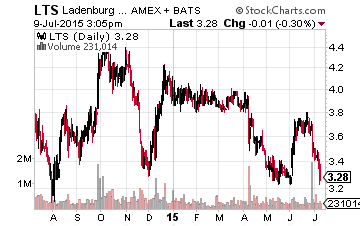

Ladenburg Thalmann is trading at approximately $3.30 a share. The company flirted with the one dollar per share mark in 2012 before finding traction at the end of 2013 and into the beginning of 2014. I think this upward trend will continue in the coming years outside a significant domestic recession.

Probably the best way to value Ladenburg is to compare some key metrics against competitors in the space like Raymond James which is larger but has similar business lines. Raymond James is currently trading north of 1.5 times forward revenues. Currently, Ladenburg is trading at approximately 60% of this year’s expected sales. In addition, Ladenburg’s revenue should increase at three times the rate of Raymond James this year. During its last completed quarter, the company grew revenues by slightly over 25% year-over-year. Over time, I expect this large valuation discount to narrow significantly.

Summary:

I like management’s strategy of diversifying the firm’s revenue base and scaling up IBD operations. I am fine owning Ladenburg as a stand-alone entity as I think revenues will continue to grow at a good pace and it will successfully expand its investment banking business and has scale in asset management.

The company has made big strides reducing leverage and increasing EBITDA. Adjusted EBITDA should come in between $70 million to $80 million in 2015 in 2015.

Ladenburg has a current stock buyback authorization of just over 10 million shares in effect, which would retire over five percent of its outstanding float at current price levels.

I also would not be surprised to see Ladenburg become an acquisition target itself. In February, Stifel Nicolaus acquired Stern Agee. The price paid by Stifel was slightly better than two times Stern Agee’s annual revenues.

Applying the same metric to Ladenburg would value the company at roughly $10.00 a share. I think this is a very optimistic scenario. However, I can easily see the shares hitting $5.00 to $6.00 in the next 12 to 18 months should the company continue to expand both AUM and its investment banking business.

Disclosure: Long LTS