Buy These Stocks Before Earnings After Strong January Retail Sales?

The market rebounded on Tuesday after three-straight sessions of declines that came on the back of January’s CPI release. Despite the fact that U.S. inflation climbed from 7% in December to 7.5% in January and remained at 40-year highs, fresh data out Wednesday showed resilient retail spending.

U.S. retail sales climbed at a seasonally adjusted 3.8% in January from the prior month. This represented the best monthly gain in retail spending since last March. The strong showing to start 2022 is a welcome sign and highlights the overall strength of the U.S. economy despite rising inflation.

Stocks were calm on Wednesday, with all three major U.S. indexes roughly flat on the day. Wall Street is also more convinced the Fed will raise rates by 0.50% instead of 0.25% at its next meeting on March 15-16.

The market has been preparing for higher rates for months now and the 10-year U.S. Treasury is already above 2% for the first time since 2019. Plus, S&P 500 earnings remain highly resilient to the current economic headwinds. All of this might mean investors want to consider adding a few retail stocks.

Home Depot (HD) – Q4 Financial Results Due Tuesday, February 22

Home Depot is one of the biggest home improvement retailers on the planet, with over 2,300 locations across the U.S. and a few other countries. The company grew its revenue at a really solid pace over the past decade, especially for a firm of its size and age, averaging over 5% sales expansion between 2011 and 2019. This included multiple years of roughly 7% top-line growth, as it attracts both professionals and do-it-yourselfers.

The coronavirus helped send its sales soaring in 2021 amid the housing boom and huge home improvement-focused spending. Home Depot’s revenue jumped 20% last year to $132 billion, with comps up 21%. HD is also coming off an impressive Q3 FY21 that showed its ability to grow its top and bottom lines during supply chain setbacks and rising labor costs.

HD handily beat our EPS estimate last quarter and its most recent EPS estimates for Q4 and FY22 are coming in above the current consensus. Zacks estimates call for Home Depot’s revenue to climb another 14% in FY21 to $150 billion, with FY22 projected to pop 2% (which would top FY19’s 1.8%). Meanwhile, its adjusted earnings are expected to jump 29% and 4%, respectively.

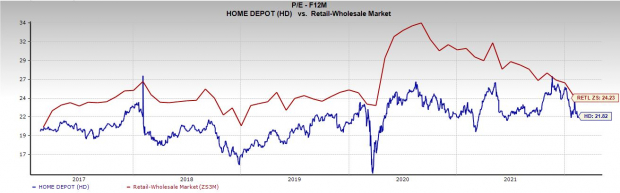

Image Source: Zacks Investment Research

Home Depot, which lands a Zacks Rank #3 (Hold) right now, has seen its shares surge 650% over the past 10 years to blow away the S&P 500’s 250% and its industry’s 480%. HD is up 25% in the last years vs. the benchmark’s 14% run. The stock has cooled off recently as part of the broader pullback, closing regular trading Wednesday 16% below its December records. And it’s trading nearly in line with its five-year median at 21.8X forward 12-month earnings and 20% below its highs.

Some investors might be worried they missed out on Home Depot. But the company and the stock were cruising well before the pandemic and it’s already taken a decent haircut in the last few months.

Wall Street remains high on the stock with 15 of the 21 brokerage recommendations Zacks has at either “Strong Buys” or “Buys.” On top of that, the housing market and home improvement spending are finally being driven by millennials and its Building Products – Retail space is in the top 12% of over 250 Zacks industries at the moment. Plus, Home Depot’s 1.89% dividend yield tops rival Lowe’s 1.4% and comes in not too far below the 10-year U.S. Treasury.

The TJX Companies, Inc. (TJX) – Q4 Financial Results Due Tuesday, February 23

TJX is an off-price apparel and home décor retailer that operates roughly 4,685 stores in nine countries, including the U.S., Canada, the UK, and Germany. The company operates under T.J. Maxx, Marshalls, and HomeGoods, as well as the much smaller Sierra and Homesense brands. The company has found success through both in-store retail and the expansion of its digital and e-commerce offerings.

TJX has carved out a strong niche within a rapidly evolving retail landscape that has seen Kohl's, Macy’s, and Nordstrom all struggle. TJX and its various brands compete for customers against the likes of titans such as Target in certain categories. The pandemic crushed TJX as many of its stores were forced to close, with revenue down 23% in 2020. Luckily, its stores are reopened and shoppers have, for the most part, rushed back to their favorite TJX locations and spent heavily online. The company’s revenue climbed 24% in Q3, while earnings popped 24%.

Image Source: Zacks Investment Research

Zacks estimates call for its current-year (FY22) revenue to soar 52% to $49 billion to blow away its pre-pandemic total of $41.71 billion. Its sales are then projected to climb over 7% higher next year. Plus, its adjusted earnings are projected to skyrocket from $0.31 a share last year to $2.93 a share, with next year set to jump another 15%.

TJX’s earnings revisions have stagnated recently and it lands a Zacks Rank #3 (Hold) at the moment. The company has also blown away our EPS estimates in four out of the last five quarters. On top of that, 14 of the 15 brokerage recommendations Zacks has are “Strong Buys.” TJX also grabs an “A” grade for Growth in our Style Scores system and its 1.55% dividend yield easily tops its industry’s 0.92% average and the S&P 500’s 1.28%.

TJX stock is up 75% in the last five years to lag its industry and it’s climbed 35% in the past three years. The stock closed regular hours Wednesday 12% below its early January records at $67.10 per share. Better still, TJX trades 27% below its current Zacks consensus price target of $85 a share. In terms of valuation, TJX is hovering near year-long lows at 20.3X forward 12-month earnings vs. its industry’s 23.2X, which puts it around where it was before the pandemic.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more