Bulls Fluff Their Lines Into The Labor Weekend

It was a classic technical bull trade but somehow bulls contrived to make a mess of it. It's not all lost, but the gap higher which quickly reversed and weakened throughout the day doesn't leave much room for maneuver.

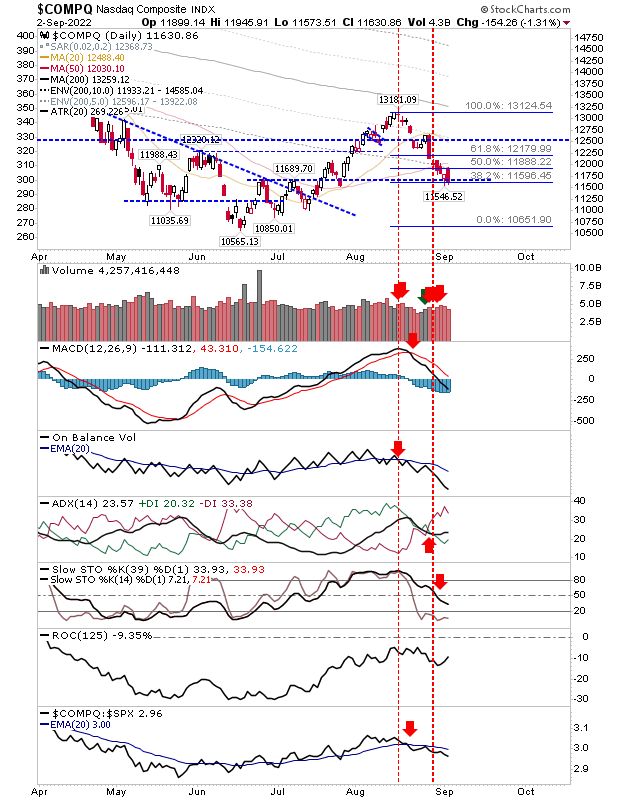

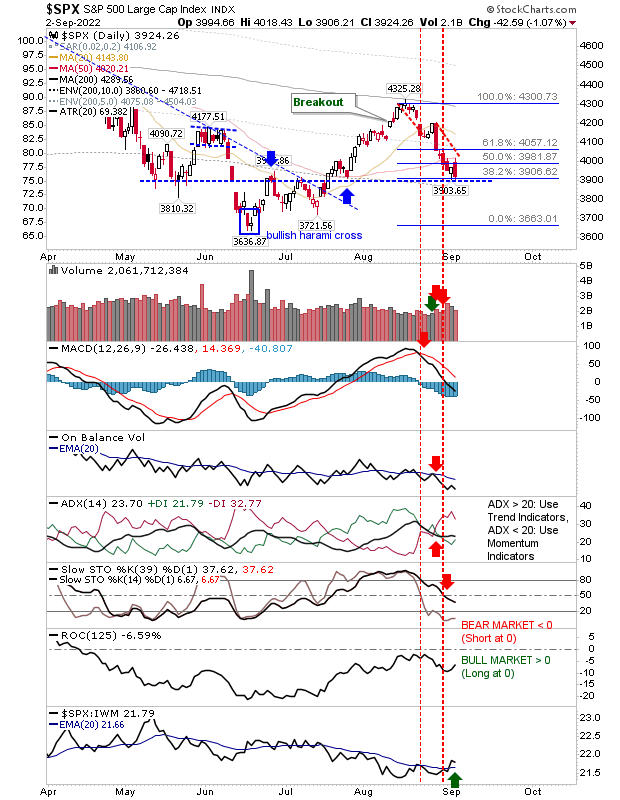

For the Nasdaq (QQQ) and S&P there were bearish engulfing patterns of Thursday's bullish hammers. Thursday's doji in the Russell 2000 was similarly engulfed by Friday's selling. The net result is to expect further losses when traders return to their desk on Tuesday.

Stochastics for the Nasdaq haven't yet reached an oversold level which is a little troublesome given the extent of losses leading into Friday's losses. The opportunity for the momentum rally at the stochastic mid-line is now off the table - so now we have to look at the possibility for a bottom when stochastics do finally reach an oversold state. .

The S&P (SPX) is also showing a net bearish technical picture as the Nasdaq, but like the Nasdaq, it finished the week on what should be decent price support - which is also its 61.8% retracement of the June-August rally.

The Russell 2000 is caught in the middle with its underperformance against the S&P, but outperformance versus the Nasdaq. It hasn't yet reached the support level defined by June's mini-consolidation during its bottom around $170 ($IWM), but given the action in the S&P and Nasdaq we would need to assume it will. Short term traders will be moving back from the S&P to the Russell 2000 (IWM) looking for a long trade, but it will be contingent on this aforementioned June support level holding.

For Tuesday, I would be waiting again for a bullish reversal candlestick - most likely a bullish doji or hammer - although a bullish piercing candlestick would suffice. Techicals for all indices are net bearish, and in such cases the expectation would be a move back to an oversold state - and this is still a couple of weeks away if you are looking at momentum. I don't think we will make it back to June lows, but we need to be rational and keep all plays on the table and trade accordingly.

More By This Author:

Silver Lining? Bullish Hammers At Fib Retracements For Lead Indices

Zig-Zag Correction To Test 50-day MAs For S&P And Co.

Early Risers

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more