Bullish Percents Continue To Point Lower

TLT is now trading above its 200-day with a very convincing tick higher. Nice if you own bonds, but not nice if you own stocks.

(Click on image to enlarge)

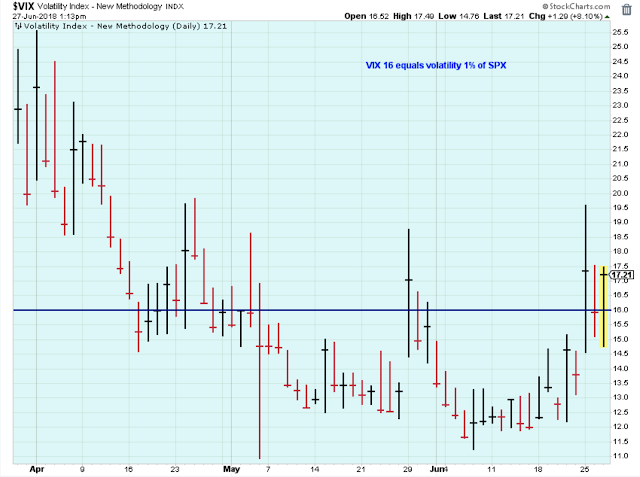

The VIX is also trading in the range that tends to push stocks lower.

(Click on image to enlarge)

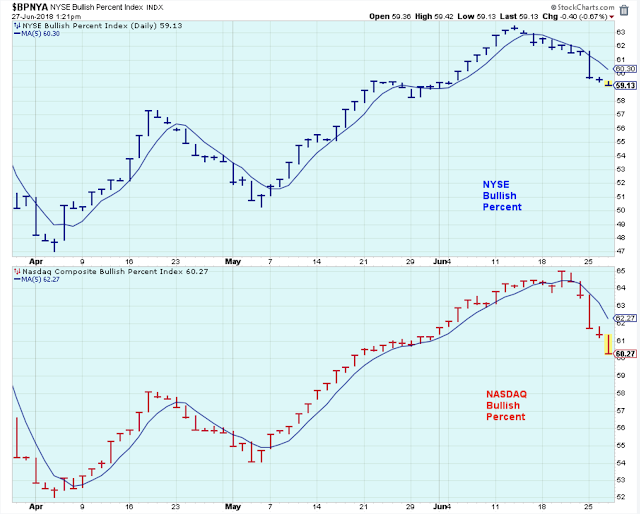

Bullish Percents continue to point lower.

(Click on image to enlarge)

The PMO Index is at the lows of its range (this is yesterday's chart).

When it gets to this level, it is time to start thinking about covering any shorts that were purchased to take advantage of the short-term trend. I'm not saying you should cover, but at a minimum it is time to be thinking about it.

(Click on image to enlarge)

The Medium-Term Trend

Everyone is watching to see that this trendline holds.

(Click on image to enlarge)

Will this critical index hold above its neckline?

(Click on image to enlarge)

Both indexes are moving sideways, but below their 200-day moving averages. Bearish.

(Click on image to enlarge)

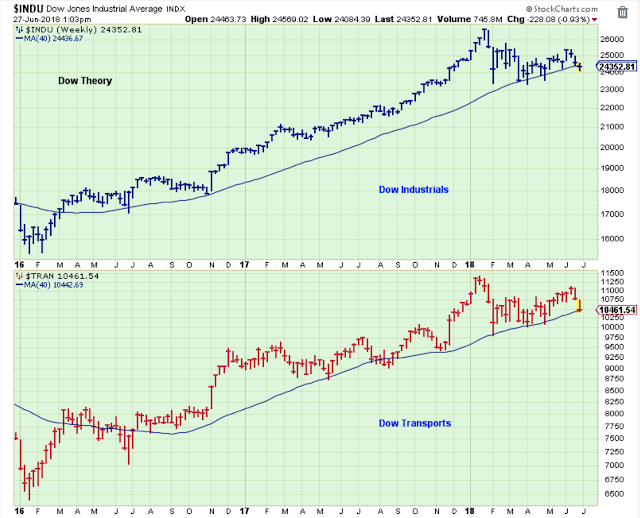

Dow Theory is holding onto a primary bull trend, but it is being challenged.

(Click on image to enlarge)

The medium-term trend looks like it may have hit a peak within a sideways range. I suspect the medium-term top is in, but if possible I would like to wait until the close Friday to make the call.

Outlook Summary:

The long-term outlook is increasingly cautious.

The medium-term trend is up as of May-10.Watching for signs of a peak.

The short-term trend is down as of Jun-19.

The medium-term trend for bond prices is up as of Jun-19 (yields lower, prices higher).

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more