Buckle Up, This Bull Market Might Be Ending

The markets are setting up for a big test. If they fail, we’re in for some REAL fireworks in stocks. I’ve been bullish on stocks for most of the last few weeks, but yesterday’s price action, combined with how the weekly candles are setting up, is changing everything.

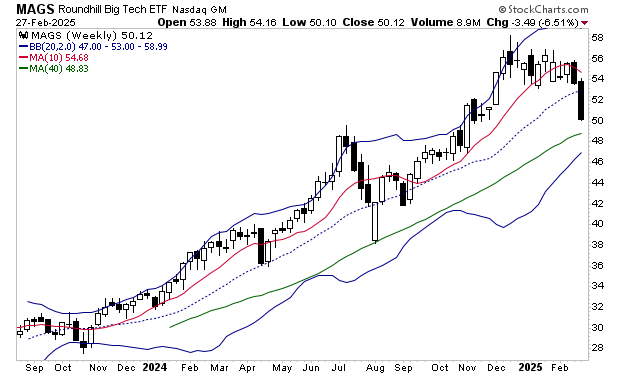

The MAG-7 stocks (MAGS) have declined to test their 40-week (same as the 200-day) simple moving average. This has held during every pullback in the last two years. If it doesn’t hold here, then we’re in for a rough patch that will last several weeks and possibly months.

The S&P 500 (SPX) is now in the process of erasing ALL of its post-election gains. The “Trump bump” is gone, and stocks have failed to make any money for four months.

The economically sensitive Russell 2000 (IWM) has already taken out its 40-WSMA. This might be the UGLIEST chart for the stock market bulls. Unless this reverses right here and now, this chart is suggesting that the bull run begun in late 2023 is OVER.

Finally, the totality of stocks over the totality of bonds ratio (ITOT:IGOV) has broken below its 50-DSMA and is heading towards its 200-DSMA. This tells us it’s time to shift capital to income plays/ bonds and out of stocks as we’re entering a significant “risk off” period.

More By This Author:

Worried About Stocks? You Need To See This ChartWhere’s The Trump Stock Market Miracle?

Will DOGE Have An Impact On Your Portfolio?