Brief Update On The Recent Market Decline

Image Source: Pexels

“Well, the market did continue to charge forward and the cost to us was underperformance. Even though our returns were solidly positive, they did not match the performance of the S&P 500. Does that mean our cautious approach was unwise? We don’t think so. If you buy fire insurance and your house does not burn down the premium on the policy may seem like a waste – until there is a fire. At today’s level of stock prices, our analysis implies the need to be cautious, to focus on value stocks whose price exceeds our DCF valuations, and to continue to hedge. Although we strive for return, protecting the wealth of our clients remains a prime objective. And what we see as the frothy level of stock prices is a significant concern in that regard.”

April 2nd, 2024

Investor Memo Q1 2024: The Market Throws Caution to the Wind

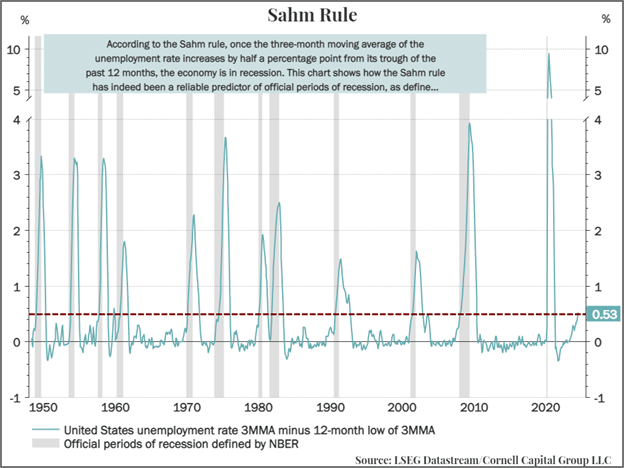

“While valuation is our main concern, it is not our only fear. Numerous indicators, including the three that we presented, suggest that a recession could be on the horizon for the United States. If it does arrive, it is difficult to imagine stock prices remaining at their largely unprecedented valuations relative to CAPE.

The bottom line is that we believe the wise course is to take on less market exposure during the second half of the year, despite the continued run-up in the second quarter. If the market continues to advance as it did in that quarter, a more conservative strategy will underperform the S&P 500. Nonetheless we think that the risk/return trade-off favors that approach.”

July 9th, 2024

Investor Memo Q2 2024: How Long Can This Go On?

An obvious question is whether the experience of the past three trading days has altered the conclusions we reached in our most recent quarterly memos. On Wednesday, July 31, the S&P500 closed at 5522. On August 5, it closed at 5186, down 6.1% from the close on Wednesday. This drop does not alter our conclusions. Although U.S. stocks are cheaper than they were last week, they are still far from cheap. Furthermore, one key recession indicator we noted in the quarterly memo, the Sahm Rule shown below, has now changed from a threat to an unambiguous indicator of recession.

(Click on image to enlarge)

Finally, we want to emphasize the importance of the equity risk premium (ERP), which is the added return that investors require for holding stocks rather than government bonds. This can be thought of as a gauge of investor sentiment (along with indicators like the VIX). In good times when stocks are steadily rising, ERPs are low. However, during uncertain and volatile times when investors are fearful, they will require greater compensation to invest in risky assets and thus higher risk premiums. During the steady market advance, the ERP was falling. In fact, the decline in the ERP was undoubtedly one of the reasons that prices rose because investors were discounting future earnings at lower rates. What is not often appreciated is the extent to which changes in the ERP can move stock prices. As we noted in our paper on structural change and valuation, a one percentage point increase in the ERP leads to approximately a 20% decline in the S&P 500. With uncertainty rising, a one percentage point increase is a real possibility – in which case the fall in stock prices would be far from over.

To conclude, for the reasons reiterated here and for the details discussed in our quarterly memos and paper on structural change and valuation, we see no reason to change our conclusions. We remain convinced that the best approach is be cautious, to focus on stocks whose price exceeds our DCF valuations, and to continue to hedge market risk.

More By This Author:

Tesla’s Valuation Fountain Of YouthInvestor Memo Q2 2024: How Long Can This Go On?

Reflections On Investing : Risk And Return Revisited

Disclaimer: Cornell Capital Group LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or ...

more