Brean Capital Weighs In On Keryx Biopharmaceuticals Inc. And Rockwell Medical Inc. In Light Of Dialysis Drugs

On June 22, Brean Capital analyst Jonathan Aschoff weighed in on Keryx Biopharmaceuticals Inc. (NASDAQ: KERX) and Rockwell Medical Inc. (NASDAQ: RMTI) to provide commentary on both companies’ dialysis drugs.

Keryx Biopharmaceuticals focuses its attention on providing care for patients with renal disease and kidney disease. Its lead product, Auryxia, was approved by the Food and Drug Administration (FDA) on September 5, 2014. It will be marketed in the United States and be made available to dialysis patients this year.

Jonathan Aschoff gave Keryx Biopharmaceuticals a Buy rating with a $26 price target in anticipation that physicians will write more prescriptions for Auryxia in the near future. The sales for Auryxia have been stagnating, floating between 200-250 prescriptions a week. Aschoff explains that physicains “generally wait for there to be a critical mass of patients covered before aggressively writing prescriptions for a particular drug”. He continues, “only a couple more large payers are needed to drive the magnitude of prescription volume required to bring more investors back to the story.”

On the other hand, Aschoff is not as confident in Rockwell Medical Inc., which also has a dialysis drug called Triferic. The company focuses on developing drugs to treat kidney diseases. Triferic is meant to replace iron that is lost in patients who undergo dialysis treatment. The drug was approved by the FDA in January of this year and is expected to launch in July.

Aschoff gave Rockwell Medical Inc. a Sell rating with a price target of $4 citing that “shares [are] being [prematurely] pumped” ahead of the launch of Triferic.” The analyst sees “no significant medical benefit to the patient, and no financial benefit to the center, from using Triferic.”

Overall, Aschoff believes “Rockwell also cannot use the insufficient critical mass of payer argument that Keryx justifiably can, given that dialysis centers cannot seek specific reimbursement for Triferic under bundled reimbursements.”

Click on picture to enlarge

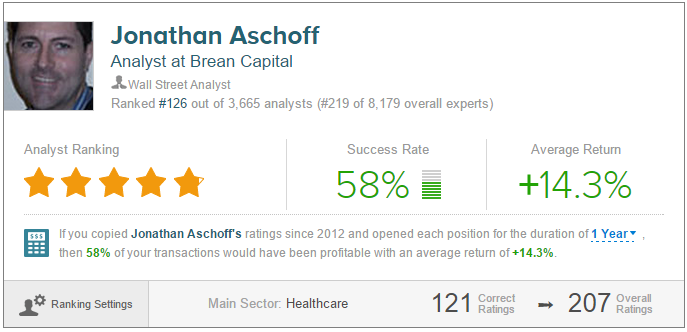

On average, Jonathan Aschoff has a 58% success rate recommending stocks with a+14.3% average return per recommendation.

Disclosure: To see more visit more