Brazil’s Dryness Hurts 2nd Crop Corn Likely Tightening US Old-Crop Stocks

Market Analysis

What a dramatic change of events in the past year! From the depths of 2020’s initial world-wide economic COVID-19 shutdown, reduced ag supplies & building post vaccination demand has boosted US grain & oilseed prices to decade high values. 2020’s late season US dryness and China’s return to the world ag markets to boast their feed supplies after African Swine Fever ravaged their meat supplies two years ago also added strength to this year’s turnaround. South American crop concerns have provided the latest support to the corn market.

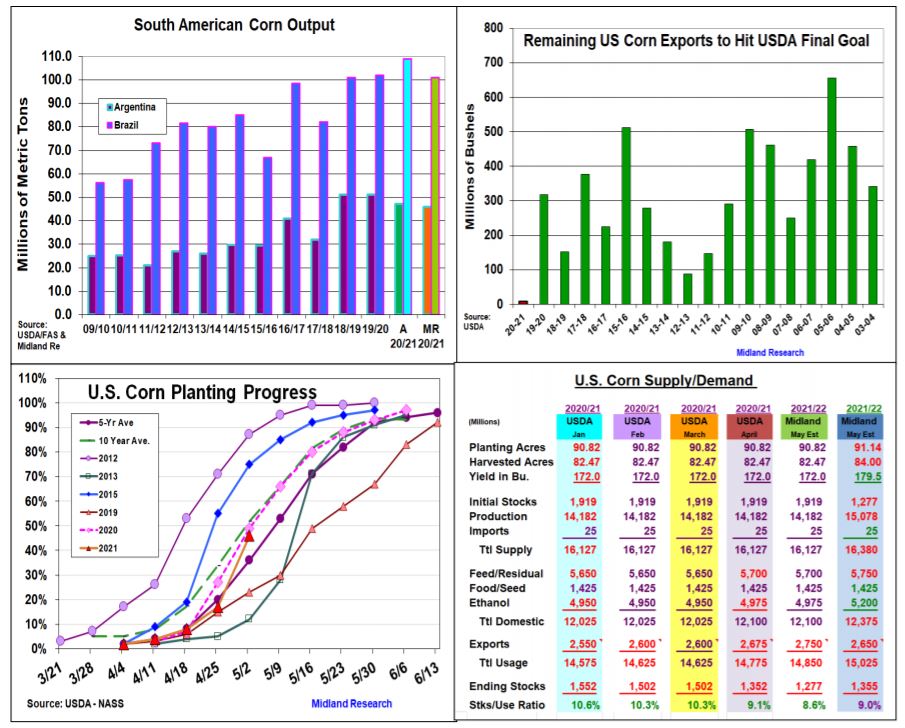

La Nina dryness significantly delayed Brazil’s 2020 soybean (SOYB) plantings. This postponed their 2nd crop safrina corn seedings past its optimal February period. Given this year’s early arrival of the dry season in April, Brazil’s overall corn output is under threat despite a sizable jump in plantings this year. With S. Am analysts cutting their corn (CORN) output, the USDA could cut Brazil’s crop by 8 mmt to 101 mmt. Further shrinkage could occur if the current dryness continues during seed filling into mid to late May.

After April’s post-quarterly stocks adjustments in US feed & ethanol 2020/21 corn demand outlooks, we don’t expect any changes in these USDA forecasts this month. However, corn’s current export sales are just 9 million bu. below the USDA’s 2.675 billion forecast with 4 months left in the crop year. With smaller supplies coming from S American, the Chinese aren’t likely to defer their US purchases. The USDA should up this year’s export outlook by 75-100 million bu dropping the US ending stocks to 1.277 billion.

This week’s US plantings rose by 29% to 46%; 10% higher than corn’s early May 5-yr average. However, dryness in the WCB keeps us cautious about above trend yields.

Traditionally, the USDA’s May new-crop 2021/22 corn balance sheet utilizes their Ag Outlook demand and yield ideas along with their March plantings. However, old-crop’s smaller carryover and a slightly smaller plantings could slice some feed and export demand from their Feb levels leaving a small initial 1.355 billion bu. 21/22 stocks level.

What’s Ahead

The size of Brazil’s 2nd crop safrina corn crop is the driving force in the world’s corn market. The impact of weather on this normally exportable output will determine this feed grain’s world price going forward.

Given prices are approaching their all-time, marketing ½ of your remaining 5-10% in old-crop supplies seems appropriate. Hold 2021/22 sales at 20-25%.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more