Bonds, Bullion, & Big-Tech Fear Bid, Stocks Skid Ahead Of NVDA's Big Day

Image Source: Pixabay

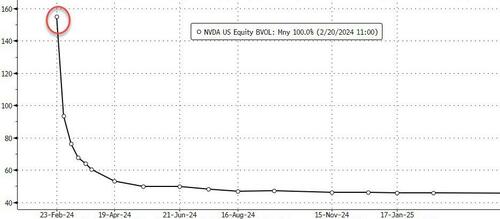

After yesterday's holiday - US markets stumbled to start the week (ahead of NVDA's big earnings announcement tomorrow after the close). NVDA vols are a little 'bid' let's say (with an implied move of +/-11% or a $200BN range of outcomes)...

Source: Bloomberg

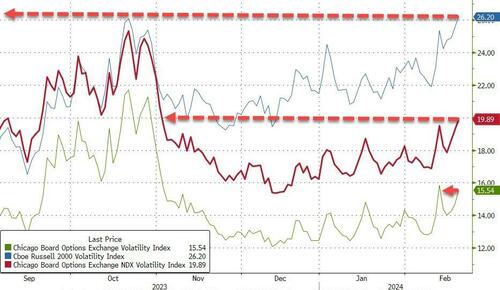

That helped drag Nasdaq's 'VIX' up to its highest since early November (but note that S&P 'VIX' remains below last week's highs and Small Caps 'VIX' is at its highest since May 2023)....

Source: Bloomberg

Oddly, the media were not quite as fast to squawk about the fact that NVDA's market cap fell back below that of AMZN and GOOGL's...

Source: Bloomberg

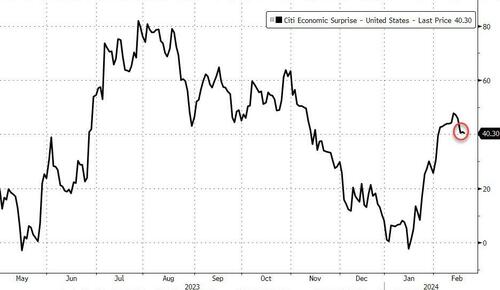

What little macro data there was today disappointed (Philly Fed Services deeper into contraction, and LEI's declining worse than expected for the longest streak since 'Lehman')...

Source: Bloomberg

That lifted expectations for 2024 rate-cuts very modestly...

Source: Bloomberg

Small Caps were the ugliest horse in today's glue factory and the Dow the prettiest - though they all closed red. With about 30 mins left in the cash session, everything shit the bed (for no obvious HL-driven reason), which dragged the S&P and Nasdaq down further (but that was quickly bid back up)...

MAG7 stocks broke down, out of their flag pattern from last week...

Source: Bloomberg

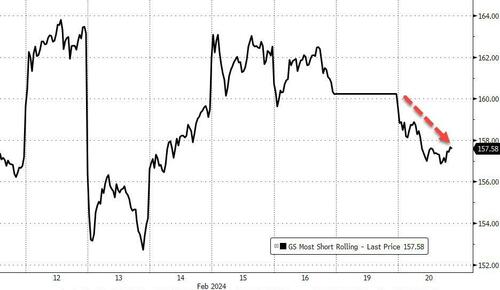

'Most Shorted' stocks also tumbled...

Source: Bloomberg

Treasuries were mixed (mostly bid) with the long-end underperforming, 2Y leading. Notably, bonds were bid all night and thru to the European close...

Source: Bloomberg

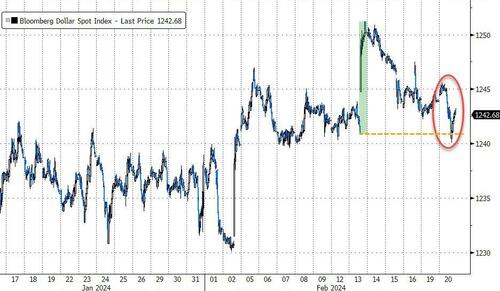

The dollar dumped today, erasing all the post-CPI gains...

Source: Bloomberg

Quite a ride for crypto today with BTC hitting $53,000; getting slammed back down to below $51,000; only to ramp back up above $52,000 and end the day green...

Source: Bloomberg

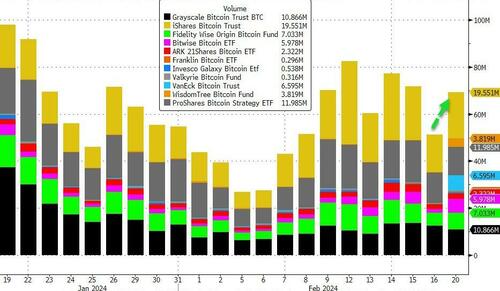

BTC ETF volumes were notably higher (with BTCW and HODL jumping bigly)...

Source: Bloomberg

Ethereum outperformed Bitcoin, topping $3,000 once again...

Source: Bloomberg

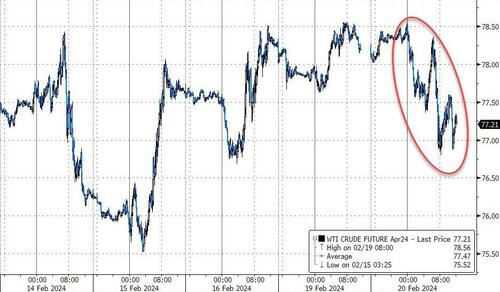

Oil prices declined today with the front-month WTI back with a $77 handle...

Source: Bloomberg

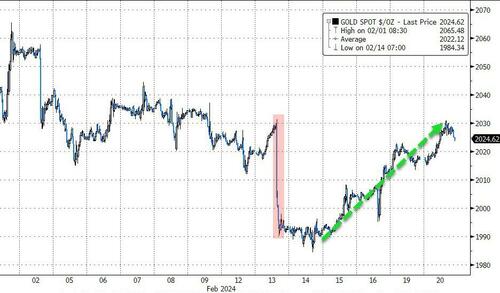

Gold extended its post-CPI-plunge rebound, erasing all the losses...

Source: Bloomberg

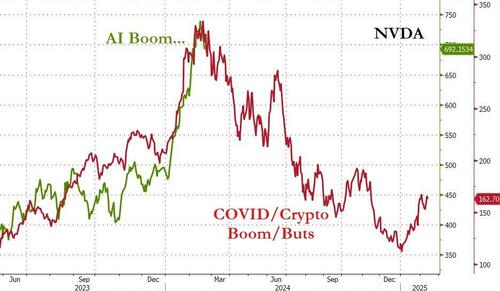

Finally, deja vu all over again, anyone?

Source: Bloomberg

Did NVDA just go thru the same pre-ordering, panic-bid-esque behavior we saw in 2021 as the COVID lockdowns (supply bottlenecks) and crypto/gaming demand accelerated?

More By This Author:

Ford Slashing Prices And Increasing Incentives On Electric Mach-E, F-150 LightningEthereum Outperforms As Bitcoin Soars; Goldman Notes ETFs Dominating Flows As Liquidity Improves

Home Depot Sales Slide For Fifth Quarter On Weak Housing Demand

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more