Bonds Bounced As Stocks, Commodities And REITs Fell Last Week

Fixed income showed some of its traditional diversification edges last week as selling took a toll elsewhere for the major asset classes, based on a set of ETFs through Friday’s close (May 13). It’s too early to confirm that bonds have started an extended rebound after a rough year, but last week’s bounce opens the door for debate.

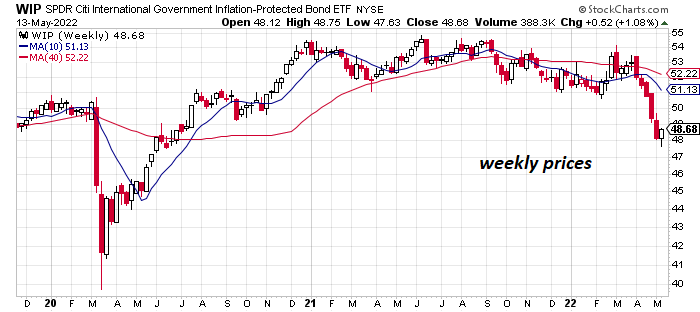

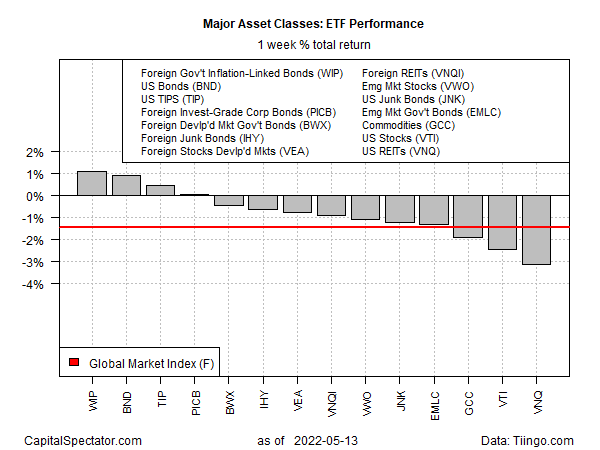

SPDR FTSE International Government Inflation-Protected Bond ETF (WIP) posted the biggest gain last week for the major asset classes. The fund’s 1.1% rise marks the first weekly advance since late March.

US bonds were a close second in last week’s horse race for the major asset classes. Vanguard Total Bond Market Index Fund (BND) rose 0.9%. Weekly gains for BND have been rare this year; the latest pop is only the fourth increase so far in 2022.

Some analysts say that the failure of bonds to act as a safe-haven asset this year has limits. “The bit that’s been missing is that risk-off means bonds rally,” notes Nick Hayes at AXA Investment Managers. “That doesn’t always work but we can’t go on for too long where bonds don’t behave as a safe haven.”

The 10-year Treasury yield’s fall last week after briefly rising above 3% may be significant, some market observers explain. Barron’s notes that “yields at current levels are now high enough to attract buyers of 10-year debt. At 2.93%, the yield is above the 2.59% average annual inflation that the market seems to expect over the next decade. That means investors can now reap a real, inflation-adjusted return by owning the bond. More buyers would keep the price higher and the yield lower.”

While several slices of global bonds posted gains last week, the seller’s dominated elsewhere. Stocks, commodities, property, and high-yield fixed-income securities fell. The biggest weekly slide: US real estate investment trusts via VNQ, which tumbled more than 3%.

The Global Market Index (GMI.F) fell for a sixth straight week, losing 1.4%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

For the one-year return window, commodities are still leading by a wide margin. WisdomTree Commodities (GCC) is up over 25% for the past 12 months, far ahead of the rest of the field.

GCC’s one-year gain is a world away from the biggest one-year loser: foreign corporate bonds via PICB, which has shed over 20% for the past 12 months.

GMI.F is off 9.2% for the past year.

About half of the major asset classes are now posting deeper drawdowns than GMI.F. The steepest peak-to-trough decline at last week’s close: government bonds issued in emerging markets via EMLC, which is nearly 30% below its previous peak.

GMI.F’s current drawdown: -15.7%.

Disclosures: None.