Bond Yields And Bitcoin Bounce But Trade-Talk Trumped Terrible-Data For Stocks

Remember Sunday... when a single Chinese 'soft' data survey beat prompted panic-buying around the world? Well, by the end of the week, Global macro data had extended its decline (but that never stopped stocks)...

(Click on image to enlarge)

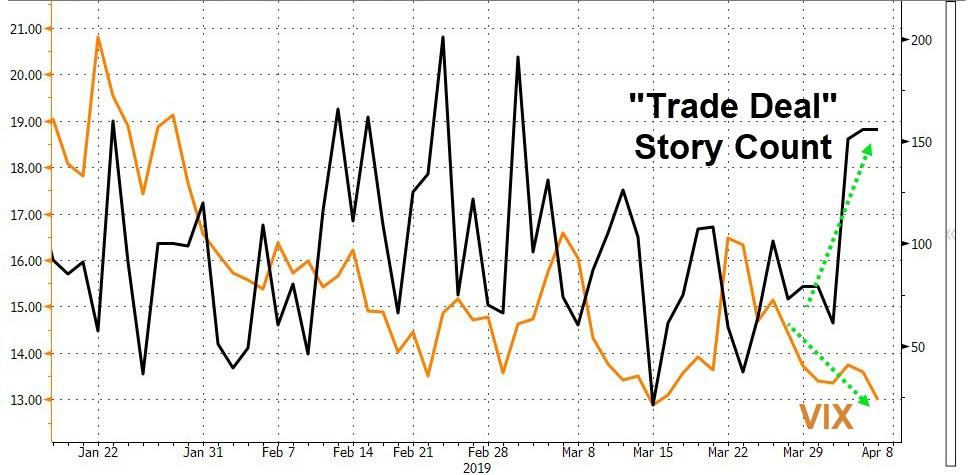

Because only one thing matters... "a trade deal"

(Click on image to enlarge)

Never mind though, the market is not the economy and so "It's not the economy, everything is awesome, stupid!"

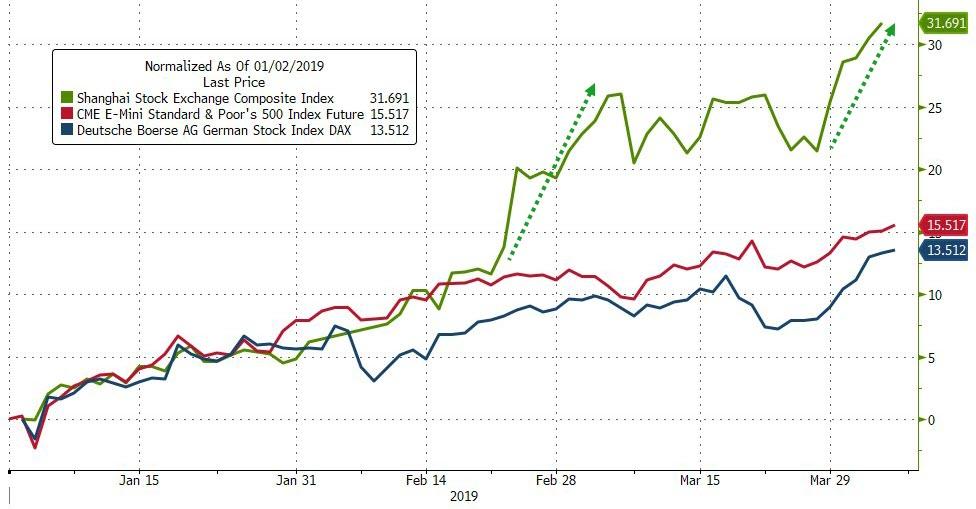

China was closed last night but the last five days have been insane in Chinese stocks leaving ChiNext up over 9%... (SHCOMP's 2nd best week since March 2016 to its highest since March 2018)

(Click on image to enlarge)

Germany's DAX led European markets higher, despite a collapse in its factory orders...

(Click on image to enlarge)

China is leading the world with another leg higher, crushing Europe and US...

(Click on image to enlarge)

US markets all gained solidly, helped by the Monday gap open after China... Trannies were best on the week...

(Click on image to enlarge)

Odd day for The Dow rallied after the close on Xi comments, ripped on the jobs data, dumped at cash open, dumped after Europe close, then pumped and dumped into the close...

(Click on image to enlarge)

This was the biggest short-squeeze week in 2 months...

(Click on image to enlarge)

And buyback-related stocks soared... (biggest 2-week jump since the start of 2019)

(Click on image to enlarge)

Huge week for semi stocks, surging to a new record high...best week for semis in 5 months

(Click on image to enlarge)

Credit and equity protection costs plummeted this week...

(Click on image to enlarge)

But VIX and stocks remain decoupled...

(Click on image to enlarge)

But the jaws between bonds and stocks remain the widest...

(Click on image to enlarge)

Despite some gains today, bonds were ugly this week with yields up 8-10bps across the curve...

(Click on image to enlarge)

But 10Y remained below 2.50% (and 30Y below 3.00%)...

(Click on image to enlarge)

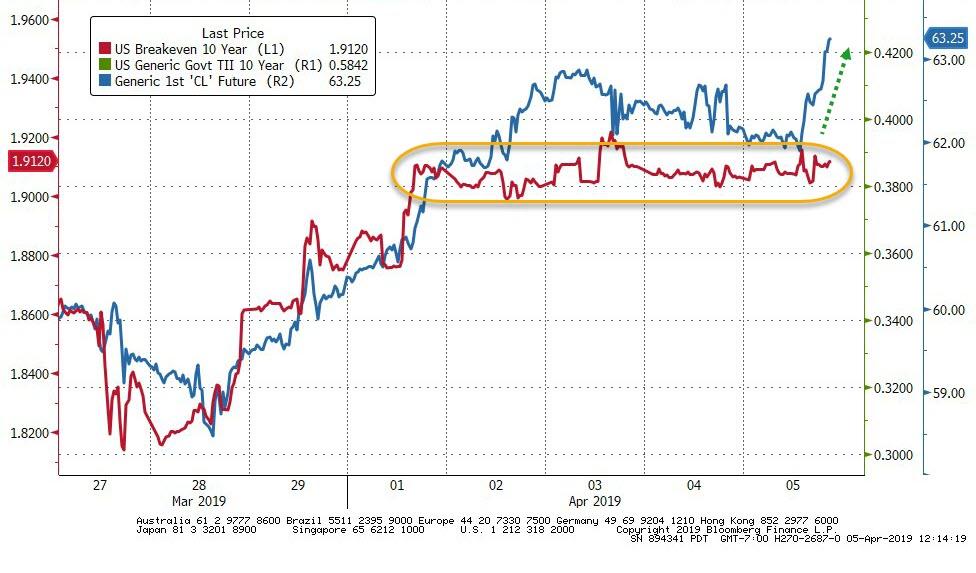

Inflation Breakevens were up on the week but flatlined the last few days even as Oil exploded...

(Click on image to enlarge)

The Dollar ended the week unchanged (despite all the excitement over a trade deal) despite some volatility intraweek...

(Click on image to enlarge)

NOTE the resistance at 1200 for Bloomberg Dollar Index.

Cable mirrored the dollar as Brexit headlines dominated once again to leave the pound unchanged...

(Click on image to enlarge)

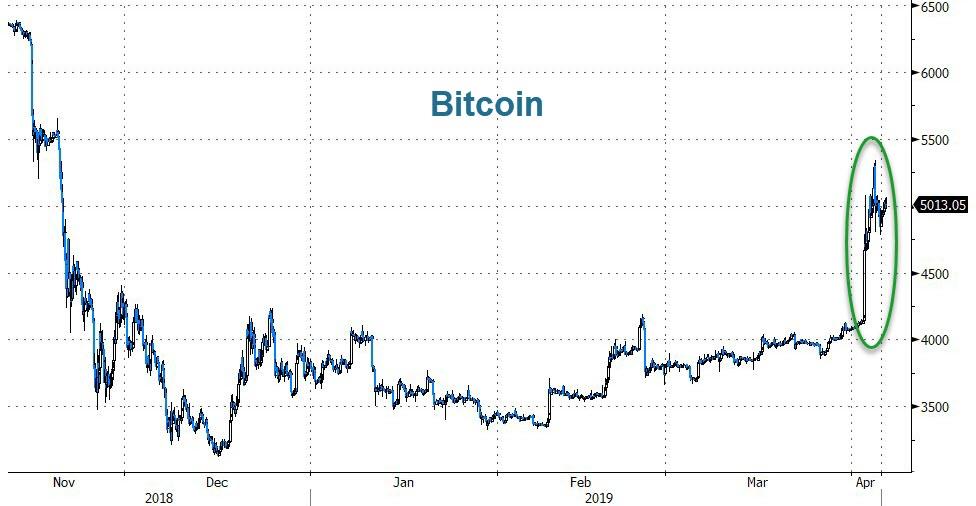

Cryptos had their best week of the year with Bloomberg's Galaxy Crypto Index up 21.5%... led by Bitcoin Cash and Litecoin...

(Click on image to enlarge)

With Bitcoin holding above $5000...

(Click on image to enlarge)

PMs ended the week unch - in line with the dollar - but crude and copper diverged dramatically...

(Click on image to enlarge)

In precious metal land, palladium's pukefest continues as platinum has become the new favorite (on the week, gold and silver were unch)...

(Click on image to enlarge)

As an aside, Copper/Gold and the UST 10Y yield have recoupled (just like Jeff Gundlach said)...

(Click on image to enlarge)

WTI surged today, breaking above $63 to a new cycle high (BRENT topped $70)...

(Click on image to enlarge)

And Lean Hogs soared as Asian piggy flu struck...

(Click on image to enlarge)

Finally, it's different this time... for now...

(Click on image to enlarge)

And while 'risk-on' is in full swing, positioning in 'risk-off' assets is not playing along with the theme at all!!

(Click on image to enlarge)

And remember, Q1 was hedge funds' worst start to a year since 2012 (presumably since they follow some rational investment thesis that simply does not compute with the new normal equity market)...

Rule 1 in modern finance: If you can't generate alpha, you buy monitors pic.twitter.com/geyUOn6fWG

— zerohedge (@zerohedge) April 5, 2019