BofA Warns Of 'Bear Stearns Moment' If Central Bank Put Fails

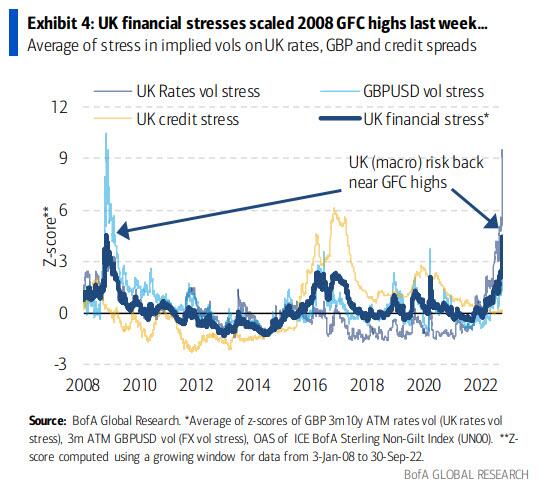

Last week's UK crisis was a reminder of how dependent markets are on central bank support, and the dilemma they face in maintaining market stability in the face of furious inflation.

As BofA writes in a note this morning, not since Greenspan invented the central bank put in the ’87 crash have they been this constrained and we see the biggest visible tail-risk as a test & fail of the Fed put.

Crucially the bank points out that the UK events also highlight that even when risk is well-telegraphed (global tightening), markets remain full of hidden risks.

Specifically, BofA draws five lessons from last week’s UK crisis, as it corroborated several concerns and made clear the risks emerging from today’s policy and market environment:

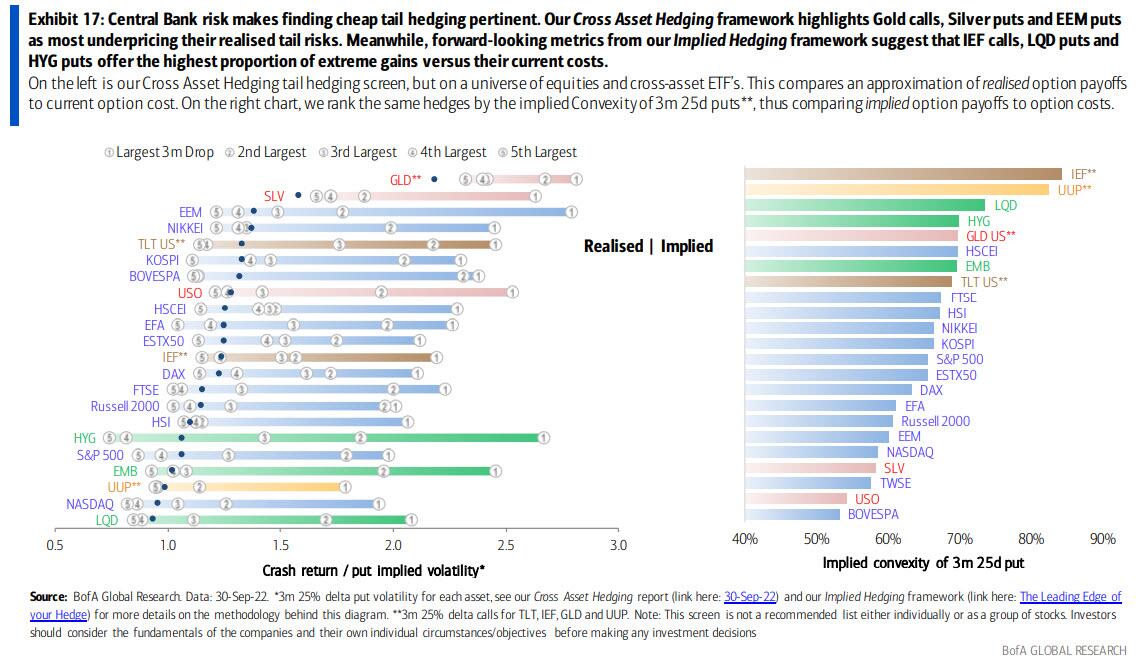

Reflecting on these lessons, BofA warns that historic moves in Gilts and Sterling akin to those seen last week have the ability to cause further contagion and add further pressure on central banks that are already constrained by persistent inflation. The path to contagion, though not the base case, can be rapid. Indeed, the recent re-pricing of derivatives convexity serves as a reminder that tail risks aren’t dead and the bank continues to recommend investors concerned about risk combine hedges for a grind lower with more convex protection.

The next test of the CB put (in the UK or elsewhere) may not be so easy to remedy without the ability to do “whatever it takes” for as long as it takes.

And if the BoE put were to still fail (they are not out of the woods yet), the risk is that it’s akin to the Bear Stearns moment of the 2008 crisis. The Fed facing a similar crisis would be the Lehman moment in our view.

Timing this risk is hard and oversold markets could create another June like bear rally. Between Bear and Lehman, the S&P rallied 10% before selling off.

But any risk-rally is also a good time to enter hedges, and we continue to suggest smart grind-lower coupled with cheap-to-carry convexity hedges.

Interestingly, BofA sees 'Gold Calls' as ranking cheapest versus their potential realized tail risks.

Additionally, BofA sees IEF calls, LQD puts, and HYG puts as screening best as hedges, offering the highest proportion of extreme gains vs current costs.

(Click on image to enlarge)

As BofA notes, it's far from all-clear with respect to UK risk, and if last week was any guide, we are watchful of further contagion to financial assets outside the UK.

So maybe those 'Gold calls' make sense here.

More By This Author:

Futures Storm Higher After Smaller Than Expected RBA Rate Hike Boosts Speculation Global Tightening Is Ending

We've "Crossed The Rubicon": Bear Traps Warns "Risk Of A Crash Is Rising"

The Growing Global Reliance On Antidepressants

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more