Big Risks Facing The BDC Industry

Financial sector stocks have significantly outperformed since the US election last month. The narrative has been that the president-elect’s pro-growth agenda, and anticipated rollback of regulations, will benefit banking stocks in particular. However, business development companies (BDCs) are also part of the financial sector, and market conditions may be increasingly stacking against them, yet their prices have also outperformed since the election, and this is in addition to their already very strong performance earlier this year leading into the election. This article reviews some of the big risks facing the BDC industry, and provides some ideas on how income-focused investors might safely invest in BDCs.

The Big Risks:

Less Regulation:

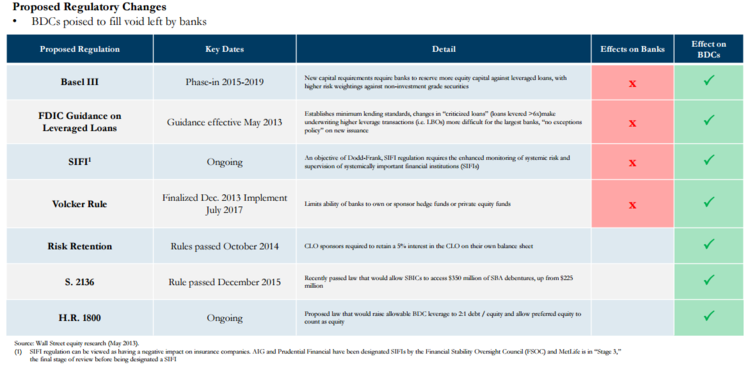

The first big risk is that government may rollback regulations in the banking industry, which could actually create more competition and less opportunities for BDCs. The narrative (and reality) for BDCs over the last 5 years has been that they’ve benefitted from de-risking in the banking industry. Specifically, big banks have been required (by regulations) to de-risk their balance sheets and purge high risk investments. In essence, this has meant less higher risk middle market lending for banks, and that has created the opportunity for business development companies as shown in the following graphic (note: the table is from 2013 when the Obama Administration was in full force, and long before Donald Trump was ever expected to win the Presidency).

The key point is that regulations have been hurting banks and helping BDCs, but that could all be about to change under the new administration.

Higher Interest Rates:

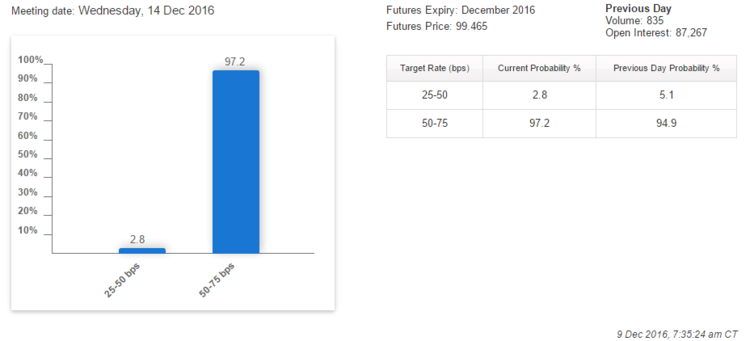

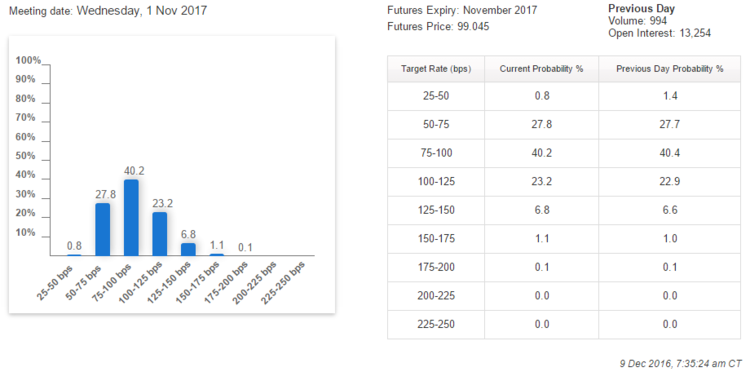

The next big risk facing BDC’s is higher interest rates. Most BDCs have structured their investments so they will actually benefit from a rise in rates in much the same way big banks benefit when net interest margins increase. However, the risk is that higher interest rates may actually lead to higher defaults. If you are a middle market business with a floating rate loan from a BDC and that rate floats too high then you may fold (default) under the pressure. After all, low rates were intended to boost the economy and higher rates may work to slow the economy. And when the economy slows, BDCs are left holding some of the riskiest loans. For reference, these next two CME charts shows the market’s expectation of rising interest rates.

The Credit Cycle / Loan Vintage Years:

BDCs have benefited from the credit cycle over the last 6 or 7 years coming out of the financial crisis, but that may be changing. For example, many BDCs actually benefited from distressed market conditions whereby they not only benefited from banks de-risking, but also benefited from the high rates they were able to charge to distressed businesses because they had no other options. Market conditions have improved, and the same great distress opportunities are not still there. In fact, as the following chart shows, some BDCs are actually getting quite frothy as measured by price-to-book values, many of which exceed “one” signifying, indicating a premium price.

Performance Mean Reversion:

BDCs have outperformed the rest of the market significantly so far this year as measured by the total return (price plus dividends) of the BDC index (BDCS) (+19.0%) versus the S&P 500 (+10.4). This is arguably due in part to the dividend euphoria the market experienced earlier this year (whereby investors bought up anything that paid a big yield) and the recent strong performance of financials in general since the election. However, as shown in our earlier chart, short interest is high for many BDC indicating that there are investors that may believe BDCs are due for a pullback.

How To Be Safe:

In light of the risks facing the BDC industry, here are some common sense way to be safe...

Pay attention to valuation:

Our table above shows that some BDC valuations may be getting frothy, but this is not true for all of them. And, in fact, there are still some attractively priced BDCs out there. Investors should be cautious to not invest simply on basic quantitative metrics (such as those in our table above), but to also dig into the fundamentals. Here are a couple recent examples of BDC reports that we have written…

Ares Capital: Big Dividend, 3 Big Risks

Saratoga CFO: Healthy Dividend, Lots of Dry Powder

Beware of Conflicts of Interest:

As we’ve written before, even though most publicly traded BDCs have external management teams, this structure still has the potential to create conflicts of interest. We prefer internally managed BDCs. And if not internally managed, then it helps to at least see a high amount of insider ownership to help align management interests with shareholders.

Consider the Small Caps:

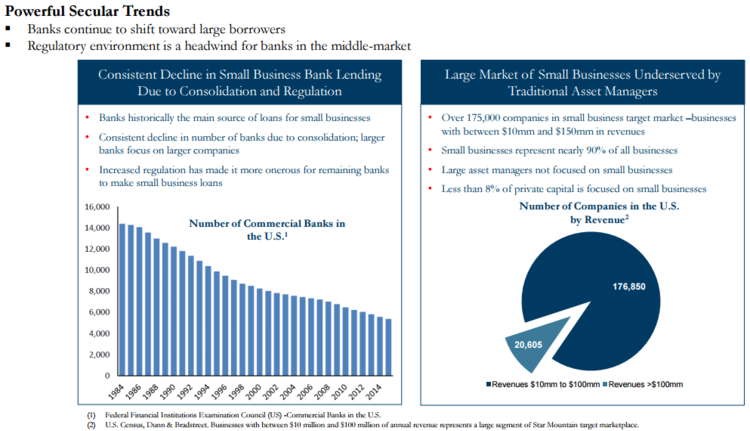

We believe some of the smaller cap BDC may actually turn out to be hidden gems. Small caps are often ignored by big institutional investors because they don’t have enough volume or market cap to meet institutional investor requirements. However, because of this reason, many of the small caps don’t have the same frothy valuations as many of the large caps. For example, the following chart from Saratoga Investment Corp (a small cap BDC) implies that small cap BDCs may actually be less impacted by a banking industry shift to more middle market lending because the banks are not as interested in the smaller side of middle market lending.

Always Stay Diversified:

As investment professionals, it is painful to watch individual investors make the ridiculous mistake of putting all their eggs in one basket. Too often, income-focused investors end up with an undiversified portfolio of big dividend securities like REITs, BDCs and Utilities companies, and when the market rotates out of dividend stocks these undiversified investors get killed. If it is truly high-income and lower-volatility that you are after as an investor then consider diversifying your income-focused portfolio (across market sectors and capitalizations, for example) as we have done in our Blue Harbinger Income Equity portfolio because we believe it’ll reduce your risk and keep your income relatively high.

Disclosure: None.