'Big Banks' See $63BN Deposit Outflows Last Week, Loan Volumes Continue To Contract

Despite another rise in banks' usage of The Fed's expensive BTFP bailout facility (to a new record high), and regulators set to force banks to The Fed instead of the FLHB for cheap funds, regional bank shares surged this week as yields tumbled...

(Click on image to enlarge)

Source: Bloomberg

Amid the ongoing upside-down world of Schrodinger's deposits, we wonder what 'adjustments' The Fed has in store for us this week.

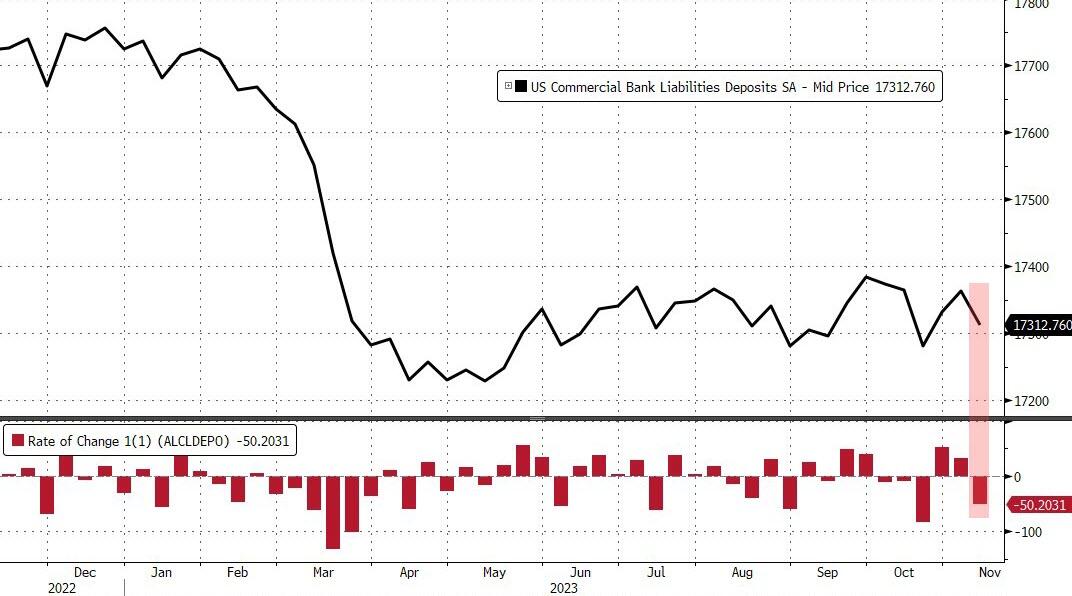

On a seasonally adjusted basis, banks saw a $50BN deposit outflow last week...

(Click on image to enlarge)

Source: Bloomberg

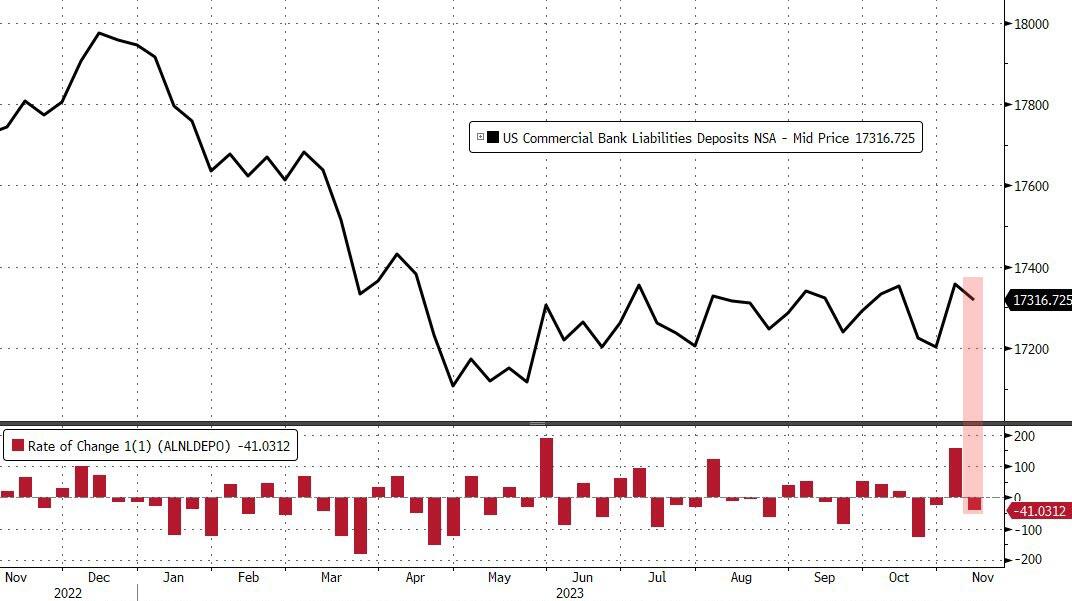

And for a pleasant change, non-seasonally-adjusted bank deposits also saw outflows (of $41BN)...

(Click on image to enlarge)

Source: Bloomberg

Bank deposit outflows and money-market fund inflows continue to diverge dramatically...

(Click on image to enlarge)

Source: Bloomberg

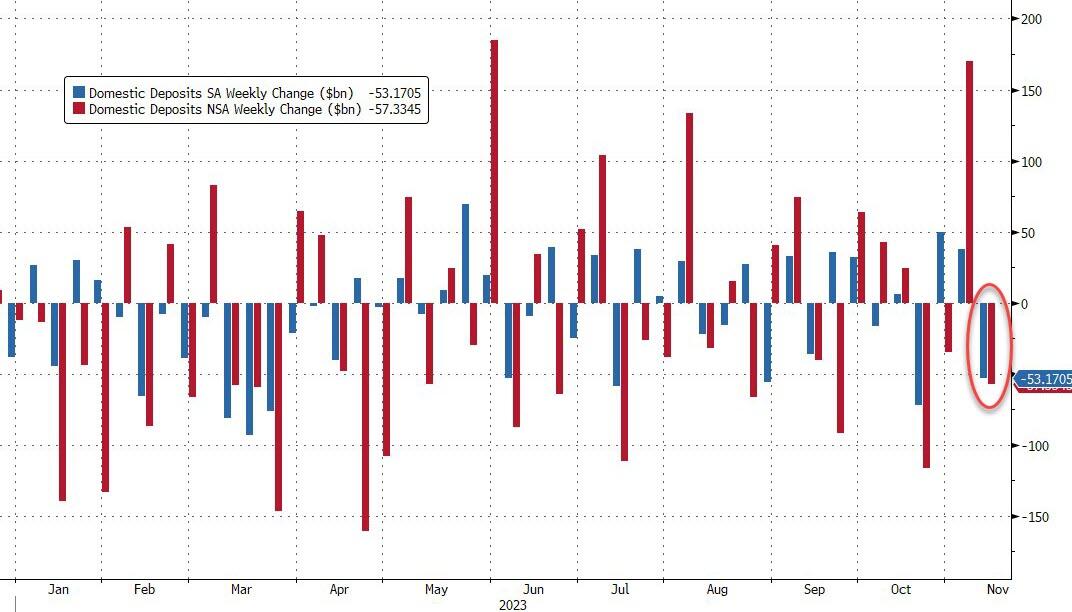

Removing foreign bank deposit flows, the picture for domestic bank deposits was still consistent, with a $57BN outflow NSA (-$62.7BN Large banks, +$5.4BN Small Banks); and a $53BN outflow SA (-$53.8BN outflows for Large Banks but $0.6BN inflows for Small Banks)

(Click on image to enlarge)

Source: Bloomberg

On the other side of the ledger, loan volumes contracted for the second week in a row (large banks -$15.2BN and small banks -$2BN)...

(Click on image to enlarge)

Source: Bloomberg

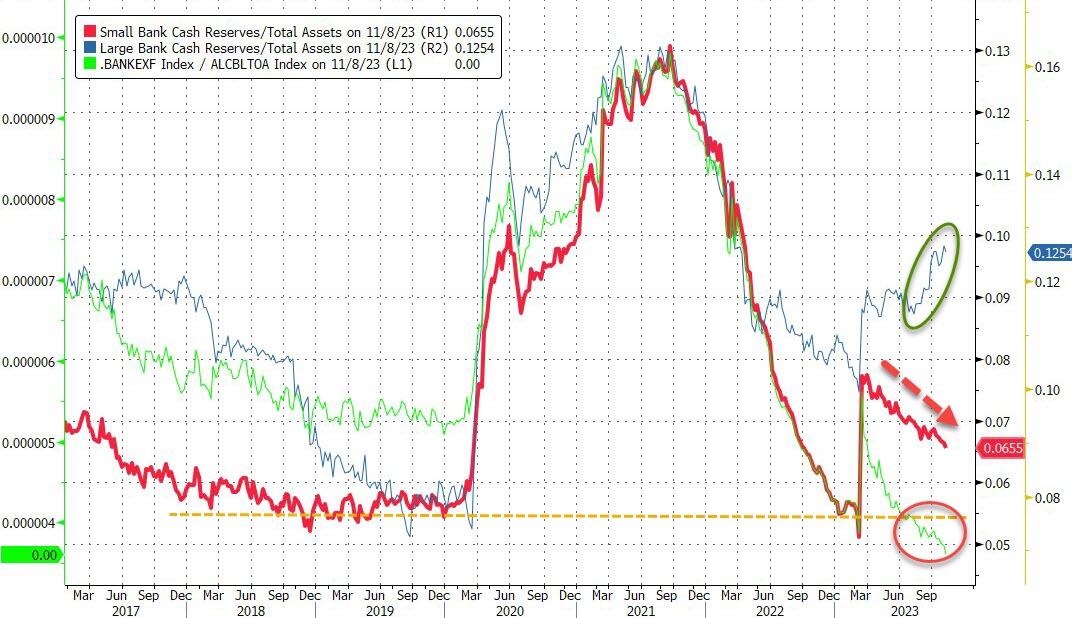

Finally, the key warning sign continues to trend ominously lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now)...

(Click on image to enlarge)

Source: Bloomberg

As the green line shows, without The Fed's help, the crisis is back (and large bank cash needs a home - blue line - like picking up a small bank from the FDIC).

More By This Author:

OPEC+ Considering Additional 1 Million Barrel Oil Production Cut Amid Outrage Over Gaza WarHousing Starts & Permits Unexpectedly Jump In October Despite Homebuilder Sentiment Slump

China Home Prices Plunge The Most In Eight Years

Disclosure: None