Biden's "Gas Tax Holiday" Would Actually Push Pump Prices Higher

While we know that Biden's proposed gas tax holiday is dead on arrival, and thus just another waste of time by the administration whose hot air emissions have singlehandedly raised global temperature by at least one degree, we would be remiss if we didn't point out just how stupid this latest suggestion truly was.

According to a JPMorgan analyst, the Biden's admin's intervention to artificially lower gasoline prices would remove some of the incentive to curb consumption and would in fact push pump prices higher as artificially lower prices would encourage people to drive more.

Instead, long-term price relief can only be achieved when insufficient refining capacity and other supply-side issues are addressed or when demand declines significantly (i.e., Biden pushes the US economy into a recession). Indeed, as we discussed last night, proposed solutions under discussion include cutting fuel taxes, changing blending requirements, and capping fuel exports.

Before we get into the details, a quick anecdote on just how much Biden's tax holiday would "save"

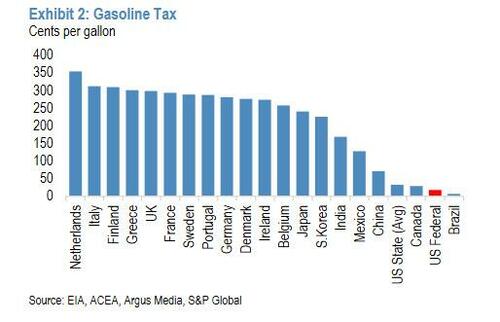

The latest measure under consideration is a temporary halt in the federal gas tax—a key source of funding for federal roads and bridges—that could lower prices at the pump by 18.4 cents per gallon (the 18.4 cents per gallon comes from 18.3 cents in excise tax plus 0.1 cent in a storage fee). The national average price for a gallon was $4.955 per gallon on Tuesday, according to AAA. A gas tax holiday would require congressional action, putting the decision in the hands of an equally divided Senate. How much would the tax holiday benefit an average American driver? If the federal gas tax was suspended for the rest of the summer, someone who drives 12,000 miles a year in a car that averages 22.8 miles per gallon would only save about $20.

So yeah, don't spend it all at once.

With that in mind, here are some more excerpts from the JPM note:

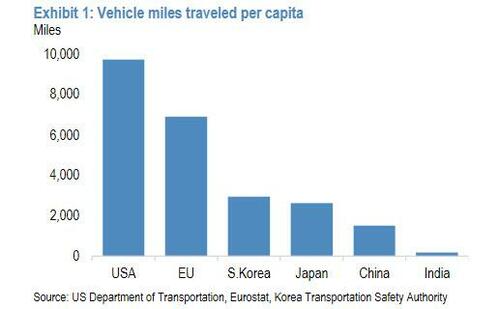

Americans drive a lot. Far more than residents in other countries.

Mass motorization, sprawling suburbs, and an interstate system that crisscrosses most US urban areas have all promoted ubiquitous car ownership. Relatively lower costs of car ownership and use have in turn helped to drive car travel demand in the US higher than in the rest of the world (Exhibit 2).

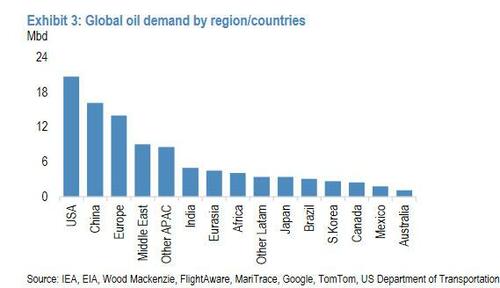

Today a gallon of gasoline is almost twice as expensive in Europe than in the US. That may not come as a shock, but it has implications. US cars and trucks alone use twice as much fuel (12 mbd) than the next largest consumer—China. When compared to the EU, the US alone consumes 1.8 times more diesel and gasoline despite having almost 100 million fewer vehicles on the road. Consequently, the US consumes more petroleum than any other country, accounting for 20.6% of world’s consumption (Exhibit 3).

As millions of Americans prepare for summertime driving, including over next month’s July Fourth holiday, the Biden administration continues to look for ways to ease record fuel prices, including tax holidays and asking refiners to voluntarily cut pump prices. Cutting fuel taxes, changing blending requirements, and capping gasoline exports could each provide some temporary relief to US consumers, yet, until supply-side issues— namely, an acute shortage of refining capacity—are addressed, most measures intended to reduce the price of gasoline will instead likely encourage Americans to drive more, in turn leading to higher gasoline demand and yet higher gasoline prices.

And the sad punchline for the Biden admin: "The reality is that, with demand stimulated and supply-constrained, fuel prices won’t drop until demand does."

Translation: Biden has to decide between lower prices and a recession.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more