Bidenomics: National Debt Increases By Another Half-Trillion In Just 20 Days

Image Source: Pexels

Twenty days.

That’s how long it took the Biden administration to add another half-trillion dollars to the national debt.

Bidenomics certainly requires a lot of borrowing and spending.

On September 15, the debt quietly blew passed $33 trillion. On October 5, it pushed above $33.5 trillion.

By the way, it only took Biden and his willing accomplices in Congress three months to drive the national debt from $32 trillion to $33 trillion.

As of October 5, the debt stood at $33,513,382,512,663.51.

This is an unimaginable amount of money.

To put things into some perspective, the total output of the US economy as measured by GDP was only $25.46 trillion. That means the US economy would have to grow by 33.5% to cover the national debt.

At $33 trillion, the US national debt is more than the total economies of China, Japan, Germany, and the UK combined.

Looking at it another way, as of Oct. 10, every US citizen would have to write a $99,839 check in order to pay off the debt, and every American taxpayer is on the hook for $258,257.

Part of the reason the debt has increased so fast since June is because the Treasury is still rebuilding cash reserves that were depleted during the debt ceiling fight. But the fact remains – the federal government spends too much money.

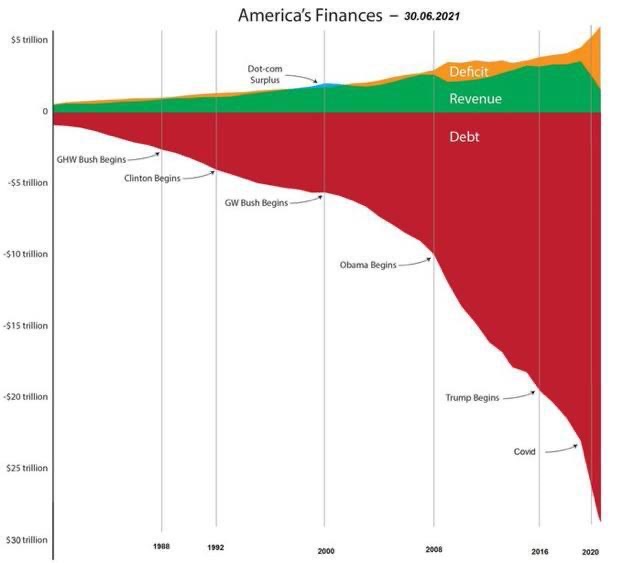

It’s hard to overstate just how bad the US government’s fiscal situation has become. We have a trifecta of surging debt, massive deficits, and declining federal revenue. The chart below provides a visual perspective – and it doesn’t even account for the last few years.

This relentless increase in debt is happening when the economy is supposedly strong. Typically, a strong economy generates more tax revenue, and deficits shrink. But this isn’t really a strong economy. It is a house of cards built on debt. Fiscal stimulus is helping to prop it up.

That means there is no end in sight to this upward-spiraling national debt.

The biggest issue is the federal government spending addiction. In August alone, the Biden administration spent over $527 billion.

And of course, the federal government is always looking for new reasons to spend money. With war raging in the Middle East, there is already a proposal to send aid to Israel and possibly add more aid to Ukraine to that deal.

As Peter Schiff said in a recent podcast, the US can’t afford peace, much less war.

In fact, the US can’t even afford the interest on the debt.

Uncle Sam’s interest expense is already rising at an astronomical rate, and it’s set to explode.

The federal government has paid well over half a trillion dollars ($630 billion) on interest payments alone in fiscal 2023, with one month left to go. Interest on the debt paid in July exceeded the amount spent on national defense that month. Uncle Sam is well on the way to spending more on interest payments than any line item other than Social Security and Medicare.

The average interest rate on the debt is now at the highest level since 2011, coming in at 2.92% as of the end of August. But that’s still relatively low, and the debt is more than double what it was back in the good ol’ days of 2011.

Meanwhile, the average interest rate is poised to climb rapidly. A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

To give you an idea of where we’re heading, T-bills currently yield about 5.5%, the two-year yield is over 5% and the 10-year currently yields around 4.7%.

This has driven interest payments as a percentage of total tax receipts to over 35%. In other words, the government is already paying more than a third of the taxes it collects on interest expense.

If interest rates remain elevated, or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

People tend to yawn at the ever-increasing national debt, but it is a ticking time bomb. Who knows how much time is left, but the timer is ticking relentlessly toward zero.

More By This Author:

Credit Card Spending Spikes Again As Big-Ticket Borrowing Goes Flat

Collateral Squeeze

Not Just Wrong; Wildly Wrong