Biden In Touch With Buffett On Bank Crisis

What do you call it when an 80-year-old seeks the advice of a 92-year-old?

Answer: the worst financial crisis since Lehman.TM

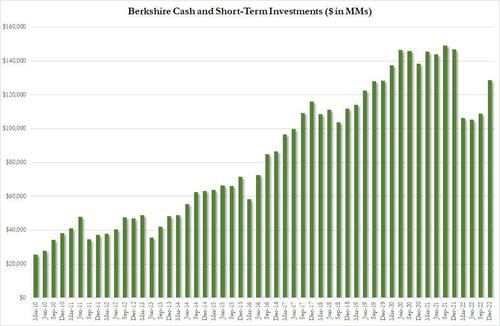

Realizing that Berkshire Hathaway (BRK-B) had a near-record $128 billion in cash at the start of the year, more than most countries...

... Joe Biden, who on Monday lied to the American people that the "our banking system is safe"...

... appears to have changed his mind and is urgently hoping to recreate the zeitgeist surrounding the infamous Oct 16 "Buy American" NYT op-ed by Warren Buffett.

... which ended up being memorable but only after the biggest bailout of US banks and capital markets in history and the start of the never ending QR/ZIRP->bust->QE/ZIRP cycle.

According to Bloomberg, Berkshire’s Warren Buffett has been in touch with senior officials in President Joe Biden’s administration in recent days as the regional banking crisis goes from bad to worse to Savings And Loan 2.0 (if only America had any savings left).

The buzz of private jet activity centering on Omaha was first reported by Fuzzy Panda who noted that "a large number (>20) of Private Jets landed in Omaha yesterday afternoon" with jets flying from HQs of Regional Banks, Ski Resorts & DC, and prompting the question "Did Buffett just fly all the regional bank CEOs into Omaha & offer a deal to SAVE the banks?"

For now the answer is unclear, nor is it clear what role, if any, the billionaire investor may play to contain the crisis after the cascading failures of Silicon Valley Bank, Signature Bank and Silvergate.

Buffett, who will be 100 years old in 2031, has a long history of stepping in to aid banks in crisis, providing funding at daylight robbery terms (10% prefs + warrants), and leveraging his cult investing status to restore confidence in ailing firms. Bank of America won a capital injection from Buffett in 2011 after its stock plunged amid losses tied to subprime mortgages. Buffett also tossed a $5 billion lifeline to Goldman in 2008 to shore up the bank following the Lehman Brothers collapse.

Meanwhile, Biden’s team, wary of political blowback among progressives, has sought to implement bailouts that are spun as magically not being bailouts and which don’t require direct government spending from taxpayers, including the Federal Reserve’s actions (narrator: of course they require taxpayer backing). Alas, so far Biden's plan has been a disaster: on Thursday, big US banks voluntarily deposited $30 billion to stabilize First Republic Bank this week, a move regulators described as “most welcome.” On Friday, the stock collapsed another 50%.

Any investment or intervention from Buffett or other figures would continue that playbook, looking to stem the crisis without direct bailouts.... until of course direct bailouts, rate cuts and QE are inevitable since a cascading wave of defaults among the regional banks would lead to another great depression as small/medium banks account for 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

But before we get there, and since we are now following the playbook of the 2008 crisis, expect the SEC to "halt short selling of financial stocks to protect investors and markets", just like it did 3 days after Lehman collapse sparking the worst banking crisis... until now.

More By This Author:

UBS Seeks Government Backstop As It Rushes To Finalize Credit Suisse Takeover Deal As Soon As Tonight

BMW To Pause Raising Prices On Premium Vehicles After Years Of 40% Increases

UMich Inflation Expectations Drop To 2-Year-Lows, Overall Sentiment Weakens In March

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more