Beyond The "Mag 7": 3 Risk-On Market Forces

Image: Bigstock

The major U.S. indices were relatively quiet at first glance, with the Nasdaq and S&P 500 Index gaining roughly a quarter percent for the session. However, investors should never judge a book by its cover. After all, bears have been arguing since the October 2022 low that the general market rally has been built on top of a rickety set of stilts, namely the “Magnificent 7”, which includes mega-cap juggernauts such as Meta Platforms (META - Free Report) and Nvidia (NVDA - Free Report). However, recently, the slim leadership argument has become impossible to defend, and Tuesday’s price action helped to debunk the falsehood further.

During “risk-off” periods in the market, investors seek stability in the form of slow-moving, cheaply valued, and low-beta stocks such as AT&T (T - Free Report). Currently, investors are doing the exact opposite and attempting to grow capital rather than preserve it. Under the surface, the bulls once again flexed their muscle. Three “risk-on” areas of the market are providing clues, including:

· Bitcoin & Crypto: Bitcoin is knocking on the door of all-time highs, gaining momentum from the Bitcoin ETF launch.

· Small Caps: IWM lagged in 2023 but is starting to play catch-up. The index gained 1.42% Tuesday.

· Biotech: Biotech has been one of the worst-performing industries for years. However, in 2024, it’s one of the best performing.

Let’s dive a bit deeper into these three market areas and focus on what is driving them higher:

Bitcoin & Crypto

“Bitcoin is in price discovery phase. Maybe really for the first time since it’s been an asset as now the bulk of U.S. wealth has easy access. Hard to predict where we stop.” ` Mike Novogratz, Ceo, Galaxy Investment Partners

Institutional Adoption is Here

It turns out that the much-hyped launch of Bitcoin ETFs will live up to the hype. By begrudgingly approving Bitcoin ETFs, the U.S. Securities and Exchange Commission (SEC), has opened up the floodgates to institutional adoptions. Fidelity, one of the largest asset managers worldwide, is allocating 1-3% of its All-In-One ETF products to crypto. Meanwhile, the Bitwise Bitcoin ETF (BITB- Free Report) has been approved for use by several wealth management platforms (with some in excess of $100B in AUM!).

The demand is insatiable now, and Bitcoin is encroaching on the $60,000 mark and precious all-time highs early Wednesday.

Image Source: TradingView

Small Caps

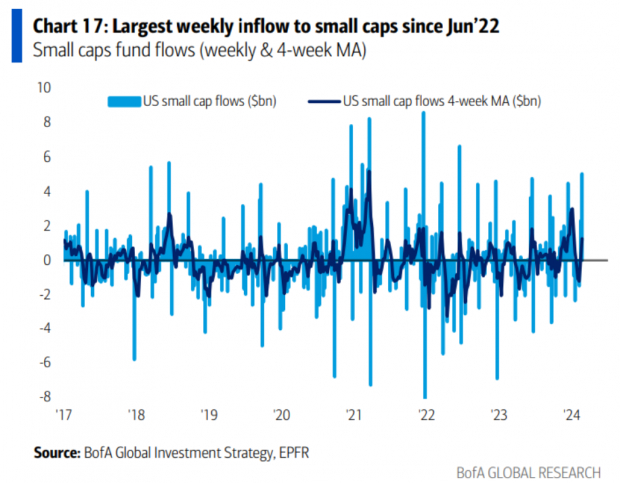

Yes, small caps have lagged for the past few years, and the Russell 2000 Index ETF (IWM - Free Report) is trying to emerge from its worst drawdown in history. However, signs emerge that investors are ready to pass the baton to the small-cap space. Despite massive post-EPS gains in mega-cap stocks like Nvidia, month-to-date, IWM is exhibiting relative strength and is up 5.8%, outperforming both the S&P 500 Index and the Nasdaq. Meanwhile, small caps have just witnessed their largest inflows since June 2022.

Image Source: Bank of America

Biotech

Biotech is the ultimate risk-on barometer. Investing in the public biotech industry can be highly risky due to factors such as the unpredictable and lengthy regulatory approval process for new drugs, the inherent uncertainty of clinical trial outcomes, and the significant research and development costs involved. As a result, biotech companies often face challenges in achieving profitability.

Nevertheless, biotech is making a comeback. For example, Tuesday’s star was Viking Therapeutics (VKTX - Free Report), which bolted 121% for the session after the company announced positive top-line results from its phase 2 weight loss drug.

Image Source: TradingView

While many areas of biotech are firing on all cylinders, the new weight loss drug category alone has a chance to bouy the industry for the next several years.

Bottom Line

The biggest bear argument over the past year has been slim leadership in the market, namely concentrated in mega-cap tech stocks such as the “Mag 7.” However, dig deeper, and you will discover that the market is broadening quickly, led by risk-on areas of the market like crypto, small caps, and biotech.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more