Beige Book Confirms Economic Slowdown And Persistent Inflation

The U.S. economy is likely to remain challenged as U.S. businesses expect demand conditions to weaken and inflationary pressures to persist for at least six to twelve months, according to the latest release of the Federal Reserve’s Beige Book Survey.

For context, the Beige Book is a publication on current economic conditions in the 12 Federal Reserve Districts. The purpose of the report is to engage with companies and other organizations to identify emerging trends in the economy that may not be evident in the economic data, as well as to assess current economic developments. The FOMC closely follows the survey as part of its policy decision-making.

Today’s release highlights that the outlook for future growth continues to decline in some districts. Five of them reported slight to modest expansion while five others reported slight to modest softening.

As in the previous survey, construction and residential real estate continue to show signs of deterioration; automobile sales are muted amid limited inventories, yet tourism and hospitality are pointing to an uptick in activity. All of this is in line with some weakening consumer demand.

In terms of inflation, the report notes that price pressures remain high, though there are signs of moderation in nine of the 12 Districts. In any case, substantial price increases are still seen in food, rent, utilities, and hospitality services.

Likewise, businesses continue to cite that supply chain disruption and labor shortages are complicating production. Although the report indicates improvement in employment metrics reflected in the modest increase in almost all Districts, labor market remains tight. In this context, wages continue to grow, though salary expectations appear to be moderating.

In this regard, Fed officials highlighted that is too early to conclude that price pressures have peaked, doubling down on its commitment to curb sky-high inflation even at the expense of economic growth and higher unemployment.

Tomorrow Fed Chairman Jerome Powell is expected to speak, a conference that is likely to attract a lot of attention ahead of the August CPI print next week and the FOMC meeting on September 21.

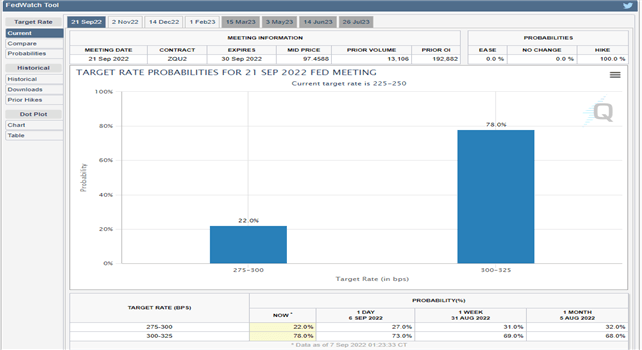

Immediately after the Beige Book’s crossed the wires, investors assigned a 78% probability of a 75-basis point rate hike at the September 21st FOMC meeting, compared to an 80% chance prior to the survey’s release. The current Fed Fund Rate Target Range is 2.25%-2.50%.

RATE HIKE EXPECTATIONS:

More By This Author:

S&P 500, Nasdaq, Dow Rally, Snapping Several Days Of Losses

Bitcoin Breaks Below Another Big Zone Of Support – What Next For BTC?

US Dollar Price Action Setups: USD/CAD, USD/JPY, GBP/USD, EUR/USD

Disclosure: See the full disclosure for DailyFX here.