Bear Market Rallies Offer Exits From A Burning Building

Following the fastest 37% drop in stock markets ever (February 19 to March 23) short-covering and dip-buying bought a sharp bounce in April. Regret over losses quickly morphed to fear of missing gains as risky assets rallied and speculators piled on. It is important to understand that dramatic rebounds are typical within bear market down channels. Gary Shilling reminds of counter-trend rallies within the infamous 1929 to ’32 bear market in his May 2020 Insight this week, as follows:

The Dow Jones Industrial Average peaked at 381 on September 3, 1929 and then plunged 48% to 199, a little over two months later on November 13.Many believed that the decline had corrected the excesses of the 1920s and rushed back into stocks, which rallied 48% to April 17, 1930.Of course, 48% up didn’t offset the previous 48% down so the Dow then was 294 and the rise had offset just 52% of the earlier loss…by April 1930, the unfolding depression killed all hopes of a real, for-sure bull market as the unemployment rate leaped from almost zero in 1929 to 25% in 1933.The previous recovery in equities proved to be simply a bear market rally and stocks fell another 86% to their final low of 41 on July 8, 1932, a plunge from the September 1929 peak of 89%.

Surely, the crash of 1929 is an outlier? We hope that it is! Still, there’s no denying that we are today in the throes of the deepest economic contraction in at least a century. And we came into it, with the highest debt and financial leverage ever on record. While that leverage magnified asset appreciation in the ‘everything bubble’ of the last decade, it is also certain to magnify losses on the way back down. That’s just how leverage works.

The coronavirus spread has given us a refresher course on exponential math. Bear markets teach about the math of loss. A 50% loss followed by a 50% gain, equals 25% less than where we started. A loss of 70% followed by a 100% rebound, leaves us 40% in the red.

Let’s get more granular. Canadian financial companies make up about 1/3rd of the Canadian broad market index, which the majority of funds and managers are mandated to chase. For this reason, and because Canadians love their debt-lords banks, there is no sector in which Canadian investors are more overweight than financials. This meant that the 37% loss in financial shares from February to March (shown below in my partner Cory Venable’s chart), hit Canadian investors hard, and the 16% rebound to April 29 was a widely felt relief. What happens next is also of grave significance for the masses.

(Click on image to enlarge)

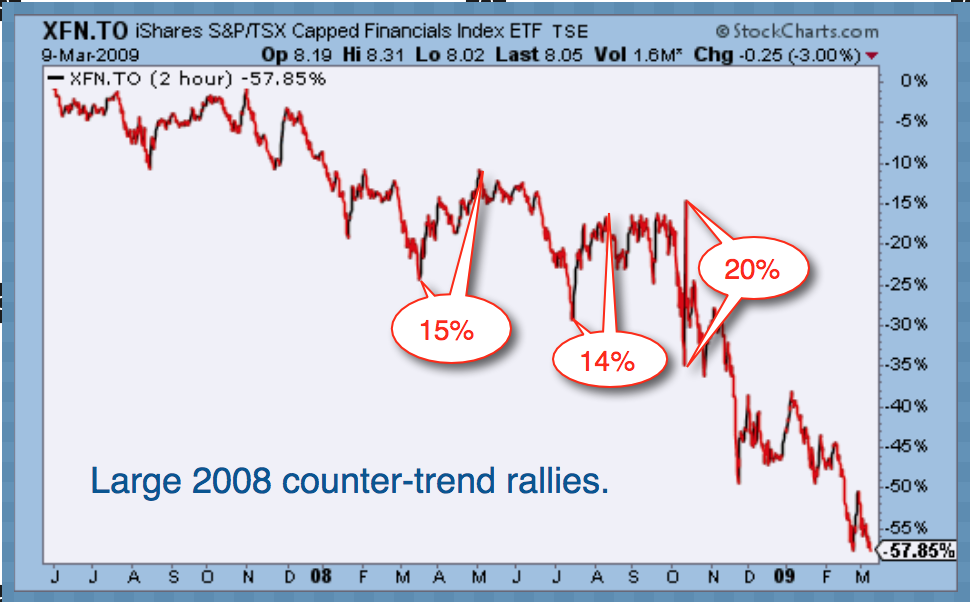

Unfortunately, the impact is likely to be negative. As shown in the chart below, the 15% rally between March and May 2008 was just one of three counter-trend rallies during the overall 57% decline for Canadian financials in the last bear market. Each rally offered another emergency exit from a burning building.

(Click on image to enlarge)

Last cycle, the problems were concentrated in the U.S housing market and subprime loans. This time the coronavirus is impacting every sector worldwide, and Canada is more risk exposed thanks to record-high household and corporate debt along with a real estate bubble and oil crash. Prospering through this calamity will require self-preserving actions.

Disclosure: None.