Banks Intensify The Squeeze On U.S. Growth Prospects

The Federal Reserve reports that banks are becoming increasingly restrictive in terms of their lending behavior, compounding the recessionary risks coming from rapidly higher borrowing costs. The data suggests a sharp slowdown in lending growth is coming with upside risks to unemployment.

Banks increasingly wary of lending

The Federal Reserve’s Senior Loan Officer Survey shows banks continued to tighten lending standards across the board in the first quarter i.e. being increasingly selective on to whom they lend, how much they lend and at what interest rate. The report stated that “tightening was most widely reported for premiums charged on riskier loans, spreads of loan rates over the cost of funds, and costs of credit lines”, adding that there was also a reduction in “the maximum size of credit lines, loan covenants, and collateralization requirements to firms of all sizes".

A net 46% of banks tightened lending standards to large and medium-sized firms with a net 46.7% of banks tightening standards for small firms while 62.3% increased spreads of loan rates over the banks’ cost of funds. For commercial real estate, it was even more acute with a net 73.8% of banks tightening standards for CRE loans for construction and land development while 66.7% tightened standards on loans for nonfarm nonresidential property.

This is a hugely important story as potential borrowers are already feeling the effects of 500bp of Federal Reserve interest rate hikes, the most rapid and aggressive phase of monetary policy tightening experienced in more than 40 years. With banks tightening lending standards so aggressively this combination of higher borrowing costs and reduced credit availability is typically toxic for economic growth.

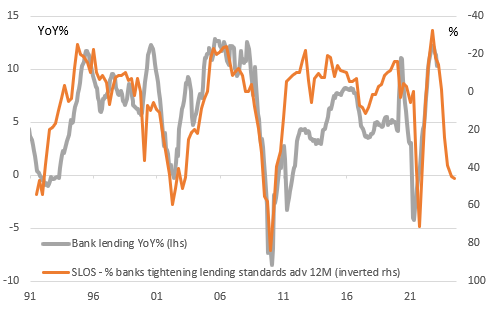

The chart below shows the proportion of banks tightening lending standards to medium and large firms versus overall lending growth in the US. It indicates we should be braced for a very rapid downturn in lending broadly across the US economy.

Tighter lending standards point to a sharp slowdown in lending growth

Source: Macrobond, ING

Demand for credit is falling too with concerns about the jobs outlook

Already we are seeing loan demand dry up. The SLOS survey also showed that the net proportion of banks seeing stronger demand for loans is -55.6% for large and medium sized firms and -53.3% for small firms. These are the lowest readings since the Global Financial Crisis. With the Conference Board measure of US CEO confidence and the National Federation of Independent Business small business optimism survey both at recession levels, these borrowing intention numbers highlight the defensive mindset in America right now that points to less capex and hiring in coming months.

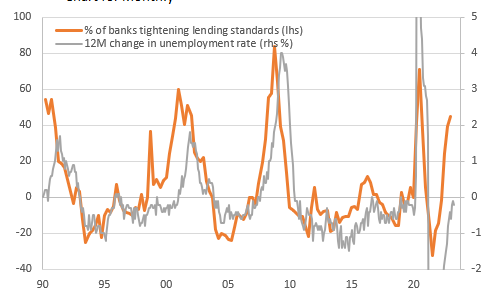

This report therefore suggests recessionary forces are building in the economy and we continue to refer to the chart below that shows when banks tighten lending standards, unemployment always rises. What turns struggling business into failed business is when the bank pulls the plug the company runs out of options. Job losses are the inevitable consequence.

Tighter lending conditions also lead to rising unemployment

Source: Macrobond, ING

Rising recession risk makes rate cuts look likely later in the year

Unfortunately, we are not hopeful of a rapid turnaround in the situation. Regional banks remain in the spotlight with deposit flight and the prospect of greater regulatory oversight set to make them more cautious in their lending behaviour. We do not think the large banks will fully fill the gap. Given small and regional banks account for more than 40% of all commercial bank lending, this is a worrying situation, made even worse with the knowledge that they account for around 70% of all commercial real estate lending, which is under pressure given low office occupancy rates and the significant amount of borrowing that needs to be refinanced over the next 18 months.

The upshot is that a heightened chance of recession means a greater chance that inflation falls more quickly and the Fed can eventually respond by moving monetary policy to a more neutral setting. The market is currently pricing around 20bp of Federal Reserve interest rate cuts by September and 66bp by December. We think September is likely to be too soon but will end up cutting interest rates more aggressively, at least in the early stages. We forecast 50bp rate cuts at both the November and December Federal Open Market Committee meetings with the Fed funds rate getting down to 3% by mid-2024.

More By This Author:

China’s Contracting Imports Pose A Challenge For Future Exports

FX Daily: Testing The Easing Pushback

Poland Central Bank Preview

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more