Bankruptcy Report: Our Predictions From 2014 And Who’s Going Out In 2015

We made some bold predictions for companies that were going to go bankrupt in 2014, and the results are in. Now, we’re doing it again. Nobody is safe in our analysis as we have some big names in our predictions, make sure your portfolio avoids these stocks at all cost.

Is nobody taking the bankruptcy threats seriously?

Recall the outrage over the GT Advanced Technologies bankruptcy? The Apple (NASDAQ: AAPL) partner’s bankruptcy filing caught everyone off guard in October. The stock price went from $11 a share to 80 cents virtually overnight.

Yet, the market remains near all-time highs, taking the news in stride.

Thinking that the rest of the market is insulated from swift bankruptcies like GT Advanced Technologies could be investors’ biggest mistake in 2015.

I still think investors are “asleep at the wheel” when it comes to managing their own portfolios. It’s been nothing but bliss for several years now, but there are serious issues in international markets. And while the U.S. has largely been insulated, the recent widespread panic, market swings and losses from the Swiss franc shock should serve as a reminder of just how unforgiving the markets are.

While the volatility index has remained somewhat constrained over the last couple years, the VIX spiked to over 23 last week — the highest level in close to three years.

But while market volatility might be bad for your emotional stability, it’s not necessarily bad for your portfolio. Bankruptcies are another story. They represent a near complete loss of value. That’s why we profiled the 5 stocks on the verge of bankruptcy back in August.

By doing so, we hope to help investors avoid the same pain felt by GT Advanced Technologies investors. Here’s a quick update on these five:

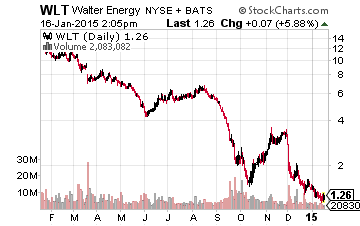

Our first company, Dendreon Corporation, filed for bankruptcy in November. And our other company, Walter Energy (NYSE: WLT), isn’t far behind. Shares of Walter Energy are down 80% since we profiled it, with its debt-to-book value ratio has ballooned from 5x to 7x over the last five months.

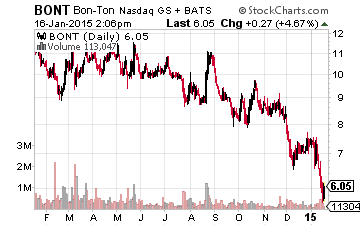

The next company, The Bon-Ton Stores (NASDAQ: BONT), is down nearly 50%, which comes as the company’s debt is now over $1 billion — compared to its $120 million market cap. The retailer has managed to lose nearly $20 million over the last twelve months as it continues to be considered a second tier store in its major markets.

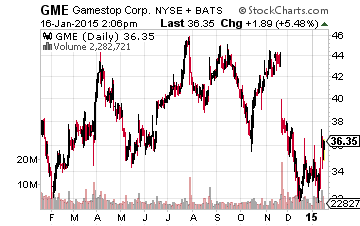

There’s also GameStop Corp. (NYSE: GME), with its shares down 20% since our hit piece. Short sellers continue to pile into the company, with over half of GameStop’s shares now shorted. It’s hard not to think that video games will eventually go the way of VHS and DVDs. Cliché, but GameStop reminds me a lot of Blockbuster.

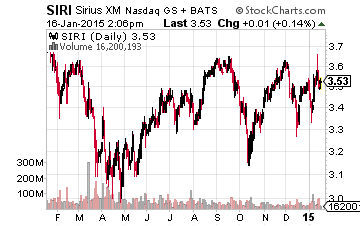

Our final (and largest) company, Sirius XM Holdings (NASDAQ: SIRI), caught many investors by surprise. Shares are flat since we covered it. The perfect storm of peaking auto sales and increasing competition continues to brew. But it’s one of those, bankruptcy happens “gradually, then suddenly” stories. One of those reasons is John Malone.

He’s one of the best investors and capital allocators around. His Liberty Media (LMCA) owns a large portion of the company, having made a big bet on Sirius back in 2009 — saving the company from bankruptcy. Eventually he’ll move on, having made several hundred percentage points on his investment.

Now, for some more fun stuff, we’re adding to our list of bankruptcies to watch for in 2015. This year is still setting up to be a painful year for investors that aren’t forward looking. There are fads everywhere, technology is rendering certain products obsolete and the halving of oil prices will have far reaching effects. Here are the key things to watch out for this year:

There will be more blood in electronics retail

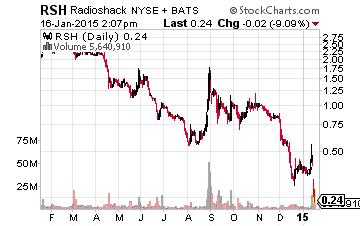

Recall how great Circuit City was, right before it went bankrupt in 2008? Well , it looks like we have our first major Circuit City redux. Wall Street has been calling for RadioShack (NYSE: RSH)’s head for well over six months now and it looks like they might finally be getting it.

The electronics retailer is reportedly planning to file for bankruptcy protection later this month. Shares are trading at just around 25 cents a share — a far cry from the $75 the stock traded at in its heyday back in 1999.

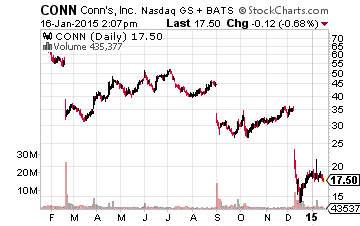

Again, GameStop could face the same fate, but there could be a couple electronics retailers that follow RadioShack even sooner than GameStop. First is Conn’s (NASDAQ: CONN), which is struggling to get a handle on its large credit portfolio that continues to hemorrhage losses. Shares are down 75% over the last year.

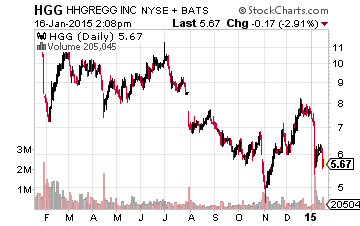

Then there’s hhgregg (NASDAQ: HGG), which lacks the scale, e-commerce presence and purchasing power of Best Buy (NYSE: BBY) to really weather a transition away from buying electronics in stores. The small retailer’s shares have been cut in half over the last year.

All eyes on oil and gas

The big bankruptcy theme will be oil and gas this year. This includes a “blood in the streets” moment for oil in 2015. Granted OPEC’s November announcement that it wasn’t cutting production sent a lot of investors into a frenzy, things could get worse.

The big question is, what will be that moment? It could well be a bankruptcy of a well-known oil and gas name.

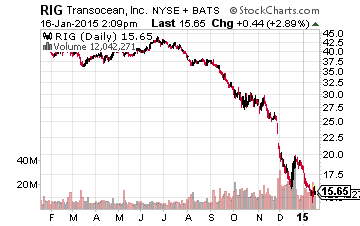

Will it be one of the major offshore drillers? Transocean (NYSE: RIG) is one of the more interesting names in the space, in part, because billionaire activist Carl Icahn is a major holder.

The other part is its large debt load that could be tough to service if oil remains depressed. The company trades at a $5.7 billion market cap, while carrying over $10.3 billion in debt. Its debt-to-EBITDA (earnings before interest taxes depreciation and amortization) is a whopping 12x.

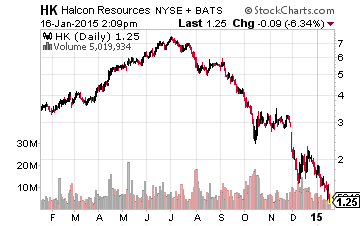

Or an over levered explorer and producer? Halcón Resources Corporation (NYSE: HK) fits that bill nicely. This $570 million market cap oil and gas explorer sports a balance sheet loaded with $3.5 billion in debt. Its debt-to-EBITDA is upwards of 7x.

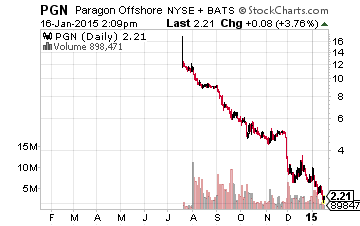

Perhaps one of the newly spun off companies that are loaded with debt? Paragon Offshore (NYSE: PGN) is the offshore driller spinoff from Noble Corp. (NYSE: NE) that started trading at the end of 2014 — shares are down 80% since then. But the real story is that it’s a $180 million market cap company with a $1.7 billion debt load.

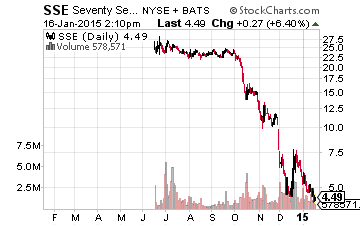

Or there’s the Chesapeake Energy (NYSE: CHK) spinoff,Seventy Seven Energy (NYSE: SSE), which is also down 80% since it started trading. This oilfield services company has a $224 million market cap and yet carries $1.6 billion in debt.

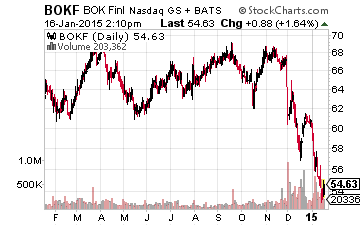

But, there will be second order effects of low oil. With oil have fallen so far, so fast, there will be far reaching fallout beyond just the obvious players. Consider, certain banks, which have lent out a lot of money during the shale boom to explorers looking to capitalize on new drilling techniques like fracking.

If oil and gas companies aren’t profitable on their wells, they can’t service their bank debt. BOK Financial (NASDAQ: BOKF) is one name worth watching. Just under 20% of its loan portfolio is exposed to the energy industry.

Beyond banks, retailers will feel the pressure of higher unemployment (read: less spending) in states that are heavily dependent on oil production. Texas, which produces nearly 40% of the U.S.’s oil, is the biggest state to watch.

And the retailer to watch here? Stage Stores (NYSE: SSI), where nearly 30% of its store base is located in the state of Texas.

BONUS: Yes, another bonus. In our last installment of stocks that could go bankrupt we provided a bonus, a shocking U.S. bankruptcy that would rattle the markets. That company is down over 40% since then and represents the demise of the world’s largest company.

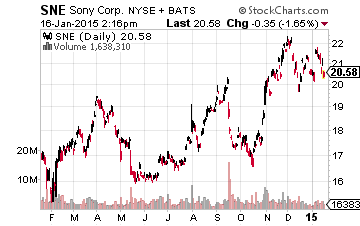

Well, this time we’re taking our bankruptcy predictions international. We’re calling out the $24 billion market cap Japanese company, Sony (NYSE: SNE). But it’s not because of the North Korea hacking. Rather, this company has been notorious at squandering shareholder value and has lost all relevance in the electronics market.

The movie production business is one of its last remaining bright spots, but that can only carry company so far. TVs are a dime a dozen, blu-ray players never really took off, its smartphone foray has largely been a flop, and the rise of mobile games has started having lasting impacts on gaming systems.

Despite generating some $7 billion a year in revenue, it has an unprecedented ability to lose money — having posted $2 billion in losses over the last twelve months. And 30% of its shareholder equity has vanished over the last five years thanks to losses, with its book value being cut from over $32/share to just $18/share over that period.

Don’t be Wall Street’s fall guy: Remember to take the emotion out of investing. It’s hard to envision that one day we might no longer have as many options for buying electronics or that oil prices could fall even lower. Just be sure to paint a clear picture of what you own and whether it can be rendered obsolete, no matter how painful the thought might be.

Disclosure: None

SIRI.....rofl.....its about to explode higher.

Gabelli is hard into $BONT and significantly raised stake throughout last year. An activist push could be around the corner.

$WLT $SNE $HK won't go bankrupt this year no matter how bad it gets. $GDP is much worse off.