Bank Loan Volumes Tumble Despite Surge In Deposits, Money-Markets Funds Hit New Record High

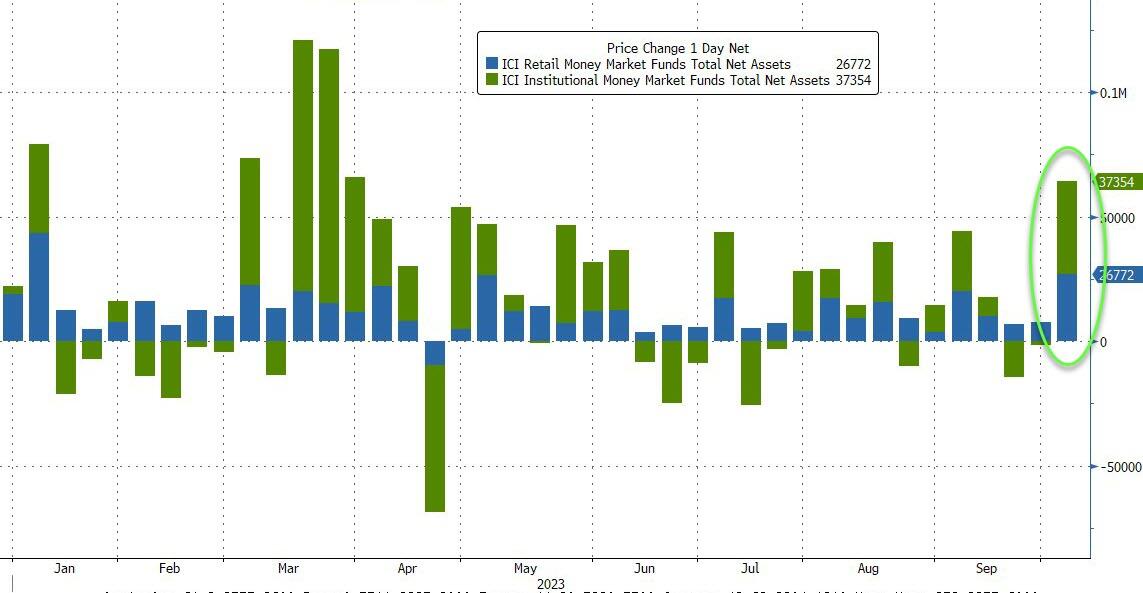

After two weeks of relatively quiet flows, last week saw a massive $64BN inflow into money-market funds - the biggest inflows since the SVB crisis - to a new record high...

(Click on image to enlarge)

Source: Bloomberg

Both retail and institutional funds saw massive inflows last week...

(Click on image to enlarge)

Source: Bloomberg

The Fed's balance sheet continued to contract, down $46BN last week to its lowest since June 2021...

(Click on image to enlarge)

Source: Bloomberg

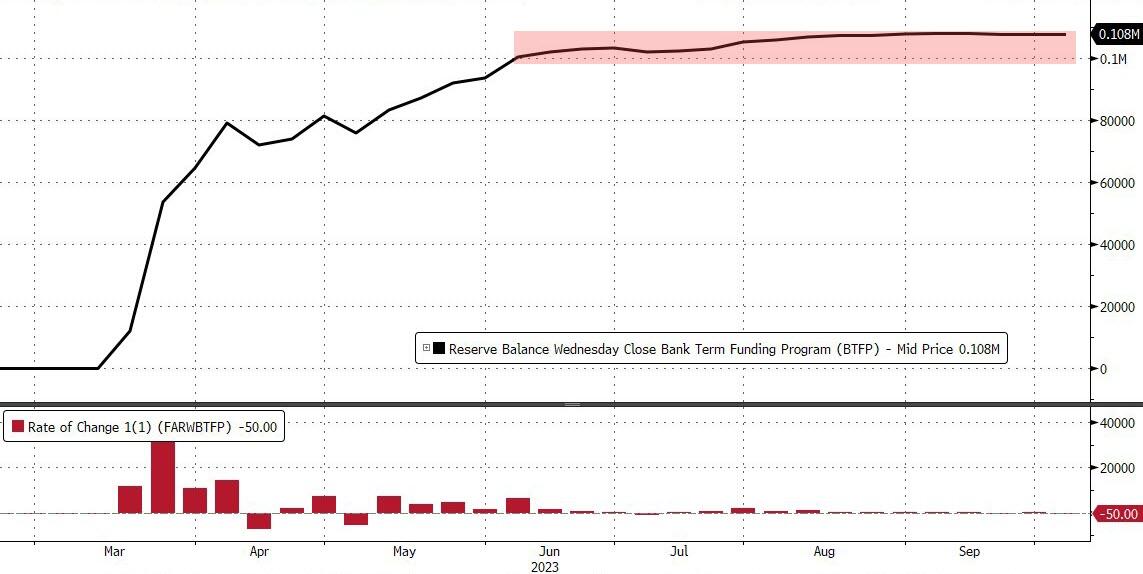

But banks' usage of The Fed's emergency funding facility remains at its record high around $108BN...

(Click on image to enlarge)

Source: Bloomberg

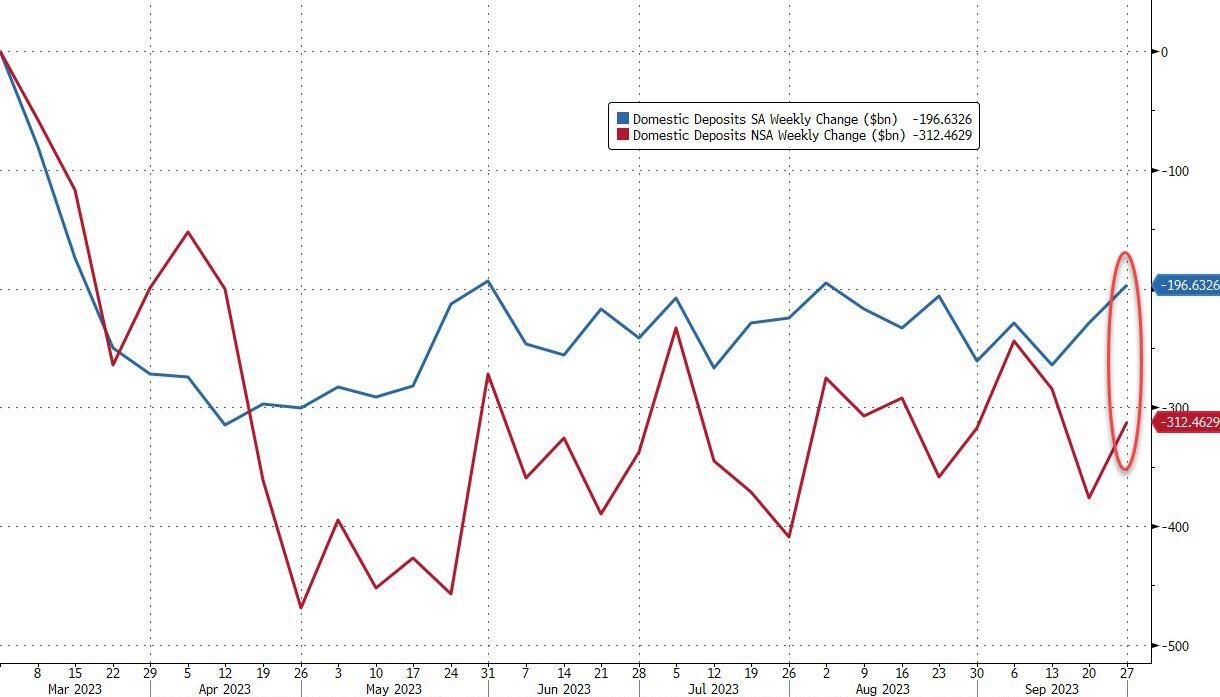

So with banks balance sheets being plugged - and after last week's crazy divergence between SA and NSA deposit flows - we wait with baited breath for what The Fed has in store for us this week...

On a seasonally adjusted basis, total deposits jumped $40BN last week (following the prior week's $48BN SA inflow), back to its highest since the SVB crisis...

(Click on image to enlarge)

Source: Bloomberg

For once, non-seasonally-adjusted deposits went in the same direction, with a $52BN inflow - after last week's $85BN outflow...

(Click on image to enlarge)

Source: Bloomberg

And removing foreign bank flows, domestic banks saw inflows on both an SA and NSA basis...

(Click on image to enlarge)

Source: Bloomberg

The gap between SA and NSA deposit outflows since SVB remain high (around $116BN)...

(Click on image to enlarge)

Source: Bloomberg

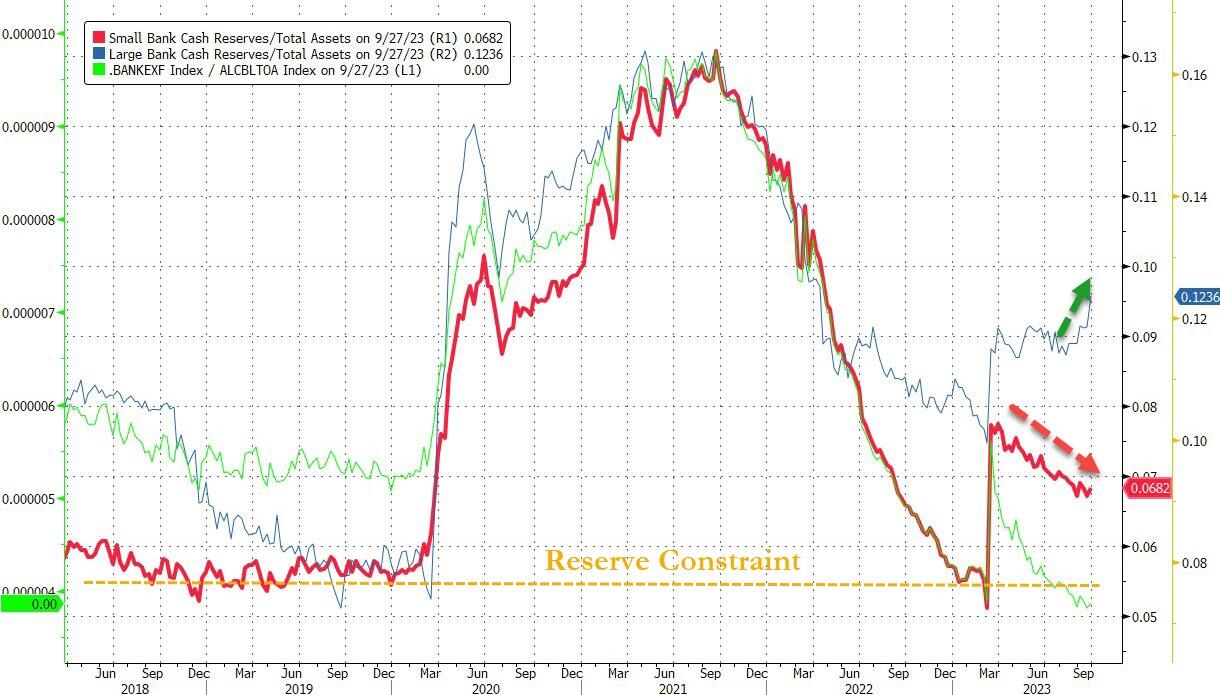

On the other side of the ledger, despite the big deposit inflows, both large and small banks saw loan volumes decline...

(Click on image to enlarge)

Source: Bloomberg

The key warning sign continues to trend lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now)...

(Click on image to enlarge)

After an ugly week (for bonds), following an ugly month and even uglier quarter...

(Click on image to enlarge)

...we sure hope these banks are making plans to fill the $108BN hole in their balance sheets they are filling with expensive Fed loans.

More By This Author:

Inside Today's Jobs Report: 885,000 Full-Time Jobs Lost, 1.127 Million Part-Time Jobs Added, Record Multiple JobholdersJapan Splits Management Of The Impossible Trilemma: MOF For The Currency, BOJ For The Yields

Happy 15th Birthday To The QE Era

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more