Bank Caution To Tighten The Squeeze On The U.S. Economy

The Federal Reserve's Senior Loan Officer Opinion Survey shows banks have tightened lending standards further while households and businesses remain wary of taking on additional borrowing. Given how important credit flow is to the US economy it makes it all the more likely that the economy will continue to slow, helping to bring inflation back to target.

Image source: Wikipedia

Banks tighten lending conditions across the board

The Federal Reserve last raised the Fed funds target range in July and with mortgage rates and car loans above 8% and credit card borrowing costs at record highs, officials are now regarding monetary policy as “restrictive”. But it is important to remember that it isn’t just the cost of borrowing that acts as a brake on activity, restricting access to credit is also hugely influential in taking heat out of the economy. Today’s Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) underscores how the tightening of lending conditions will continue to put the brakes on activity and contribute to inflation sustainably returning to target.

Banks tightened lending standards through the third quarter and saw further weakening in demand for loans across the board. The net proportion of banks tightening lending standards to medium and large firms came in at 33.9% in 3Q versus 50.8% in 2Q. Importantly these are incremental changes – we need to remember the 33.9% is over and above the 50.8% of banks tightening in 2Q. Consequently, the wording of the report states, "survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories". Similarly, for lending to households "lending standards tightened across all categories of residential real estate (RRE) loans... In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance".

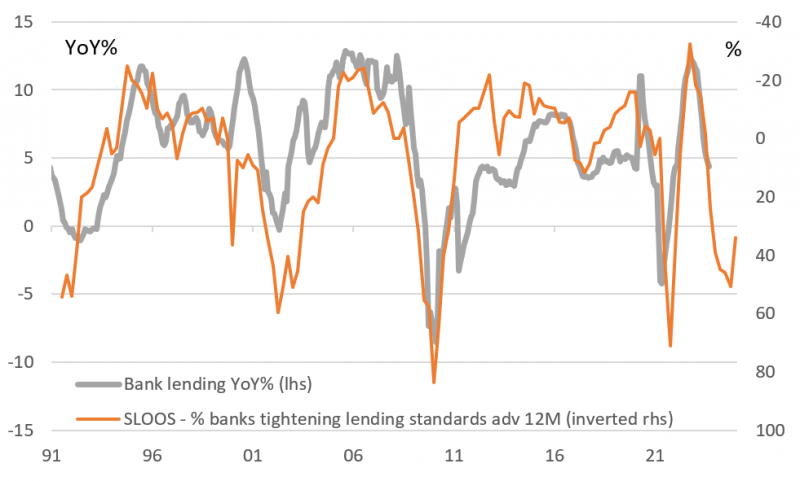

Banks tightening lending standards points to outstanding commercial bank lending turning negative

Macrobond, ING

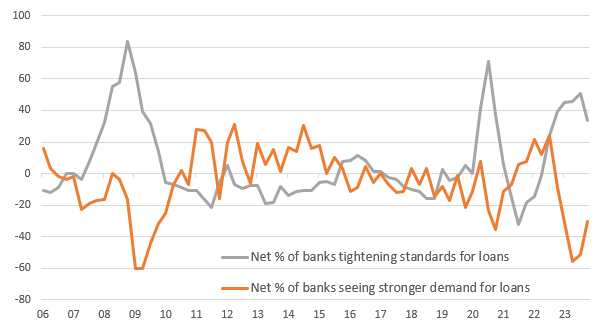

The chart above shows the relationship between the proportion of banks tightening lending standards to corporates and total bank lending in the US economy. I've used lending standards to corporates as a proxy for general lending sentiment and it continues to suggest bank lending in aggregate turning negative over the next couple of quarters. Whenever that has happened there has been a recession. The chart below shows how demand for loans has also weakened further, underscoring the likelihood that lending growth turns negative in the US.

Loan demand also continues to contract

Macrobond, ING

Credit squeeze heightens the chances of a sharper slowdown

The reasoning for banks’ tightening of lending standards included “a less favorable or more uncertain economic outlook; a reduced tolerance for risk; a deterioration in the credit quality of loans; concerns about funding costs; a deterioration of customer collateral values; concerns about the adverse effects of legislative changes, supervisory actions, or changes in accounting standards; concerns about deposit outflows; and a deterioration in or desire to improve their liquidity positions”. With regards to small banks, that were the focus of market worries in March/April following some prominent failures, they placed greater emphasis on “deposit outflows, funding costs, deterioration in or desire to improve their liquidity positions, and concerns about declines in the market value of fixed-income assets as reasons for tightening lending standards”.

This report makes it all the more likely that the Fed will not need to hike interest rates further since tighter lending conditions and reduced loan demand points to a credit credit contraction that will inevitably take heat out of the economy. Markets are currently pricing around 2bp of tightening for the December FOMC meeting and a cumulative 4bp by the January FOMC meeting. This looks fair to us to see, but given the importance of credit flow to the US economy we fear the optimism regarding a potential "soft landing" may be misplaced with the Fed potentially needing to reverse course and start cutting interest rates more aggressively than currently priced. We see upwards of 150bp of rate cuts in 2024 versus the market pricing of around 90bp.

More By This Author:

FX Daily: Another Black November For The Dollar?Banks Outlook 2024: Banks In A World Of Higher For Longer

Saudis Stick To Supply Cut

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more