Australian Dollar Continues The Winning Streak On Surging Commodity Prices

Image Source: Pixabay

- Australian Dollar gains upward momentum due to higher commodity prices.

- Australia’s RBA is expected to increase interest rates by 25 basis points through the end of the year.

- The dovish remarks by Fed officials contribute to pressure on the US Dollar.

The Australian Dollar (AUD) continues to move on an upward trajectory for the fifth successive day. The Aussie pair is gaining upward support, driven by strong underlying commodity prices and the ongoing conflict in the Middle East. Moreover, Westpac Consumer Confidence showed that individual confidence improved in October.

Australia experienced a rebound in inflation in August, primarily attributed to higher oil prices. This development increases the likelihood of another interest rate hike by the Reserve Bank of Australia (RBA).

If the tension in the Middle East persists, it could contribute to further increases in oil prices, thereby potentially elevating inflationary pressures in the Australian economy. This scenario could prompt the RBA to implement a 25 basis points (bps) interest rate hike, bringing it to 4.35% by the end of the year.

After engaging in discussions with US Senators on Tuesday, China's Commerce Minister, Wang Wentao, expressed that "both sides had rational and pragmatic discussions", emphasizing the significance of the US-China economic and trade relationship.

Minister Wang conveyed that China is committed to fair competition based on international rules. He expressed the hope that the US would accurately define security boundaries, urging the avoidance of politicizing and generalizing security issues.

The US Dollar (USD) failed to register significant gains despite the robust US Nonfarm Payroll data released on Friday. This lack of appreciation can be attributed to a decline in US Treasury yields on Monday.

Additionally, the statements from Federal Reserve (Fed) officials overnight led investors to diminish the likelihood of additional rate hikes, causing a further decline in US bond yields. This development is perceived as weakening the strength of the Greenback and providing a tailwind for the Aussie pair.

Daily Digest Market Movers: Australian Dollar extends gains on surging commodity prices

- Australia’s Westpac Consumer Confidence showed that current buying conditions improved in October. The index rose 2.9% from the previous 1.5% decline in September.

- Middle East tension could contribute to further increases in oil prices, thereby potentially elevating inflationary pressures in the Australian economy.

- The heightened geopolitical tensions in the Middle East, are contributing to increased demand for commodities like energy and gold, positively influencing the performance of the AUD/USD pair.

- Australia has committed to ensuring a stable supply of energy resources to Japan in the fifth Japan-Australia Ministerial Economic Dialogue. This agreement reflects a strategic partnership between the two countries, emphasizing the importance of a reliable and consistent flow of energy resources, likely encompassing areas such as coal, and liquified natural gas (LNG).

- Australia’s central bank could go for a rate hike, with expectations pointing toward a peak of 4.35% by the end of the year. This projection aligns with the persistent elevation of inflation above the target.

- The US Nonfarm Payrolls report for September revealed a notable increase of 336,000 jobs, surpassing the market expectation of 170,000. The revised figure for August stood at 227,000.

- US Average Hourly Earnings (MoM) remained steady at 0.2% in September, falling short of the expected 0.3%. On an annual basis, the report indicated a rise of 4.2%, below the anticipated consistent figure of 4.3%.

- The yields on US Treasury bonds declined on Monday, with the 10-year US Treasury bond yield standing at 4.64%.

- Dallas Fed president Lori Logan suggested that there might be less necessity to raise the Fed funds rate, and Fed Vice Chair Philip Jefferson acknowledged the importance of the central bank proceeding cautiously with any additional increases in the policy rate.

- Investors will likely monitor the upcoming International Monetary Fund (IMF) meeting, which is set to deliberate on strategies for stabilizing international exchange rates and fostering development.

- Traders will keenly focus on the US Core Producer Price Index (PPI) on Wednesday and the Consumer Price Index (CPI) on Thursday along with Australia’s Consumer Inflation Expectations, as these events hold a pivotal role in assessing inflationary trends and economic conditions in both nations.

Technical Analysis: Australian Dollar hovers above 0.6400, 23.6% Fibonacci retracement acts as resistance

The Australian Dollar trades higher around 0.6410 against the US Dollar (USD) on Tuesday. The 23.6% Fibonacci retracement at 0.6429 acts to be a significant hurdle. A decisive break above this level could pave the way for the pair to explore higher levels, with the psychological level of 0.6450, lined up with the 21-day Exponential Moving Average (EMA) at 0.6456 as a potential target. On the downside, the key support is seen at 0.6300, followed by the November low at 0.6272. These levels serve as crucial markers for potential shifts in the AUD/USD pair’s trajectory.

AUD/USD: Daily Chart

(Click on image to enlarge)

Australian Dollar price today

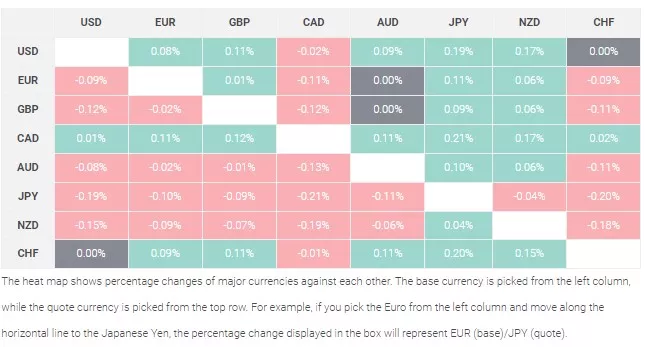

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

More By This Author:

EUR/GBP Price Analysis: Remains Subdued And Oscillates Above 0.8600 Amid Risk-Off ImpulseDXY Fails To Hold Momentum, Declines Near 106.00

GBP/USD Retreats And Snap Three Days Of Gains Amid Escalating Middle East Conflict

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more