August Job Openings & Labor Turnover

The latest JOLTS report (Job Openings and Labor Turnover Summary), with data through August, is now available. From the press release:

The number of job openings decreased to 10.1 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.3 million and 6.0 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.5 million) were little changed. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

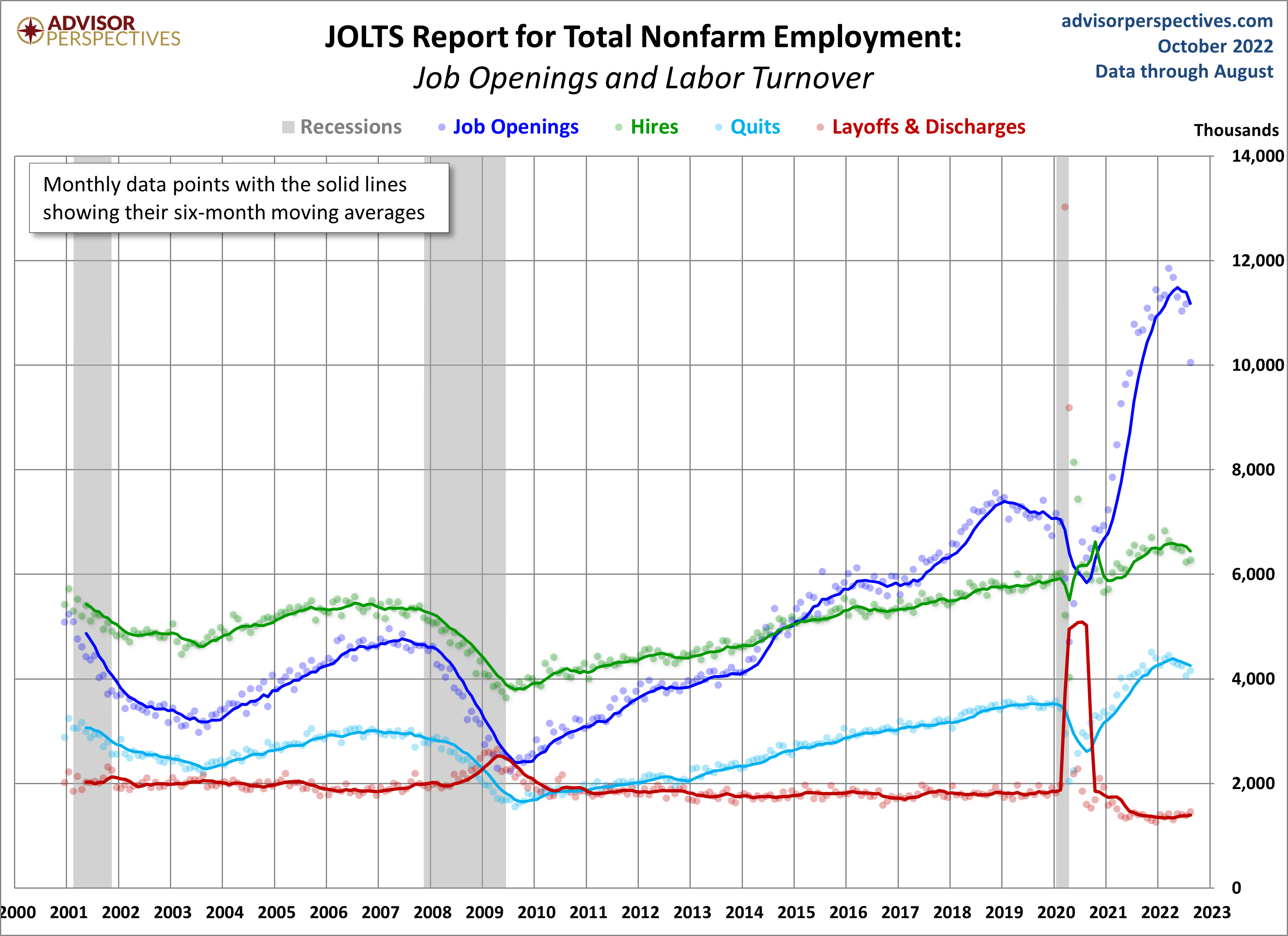

The first chart below shows four of the headline components of the overall series, which the BLS began tracking in December 2000. The time frame is quite limited compared to the main BLS data series in the monthly employment report, many of which go back to 1948, and the enormously popular Nonfarm Employment (PAYEMS) series goes back to 1939. Nevertheless, there are some clear JOLTS correlations with the most recent business cycle trends.

The chart below shows the monthly data points four of the JOLTS series. They are quite volatile, hence the inclusion of six-month moving averages to help identify the trends. The moving average for openings was above the hires levels for over five years, as seen in the chart below. The openings MA dipped below the hires for a brief two months (May and June 2020), only to climb above once more in July 2020.

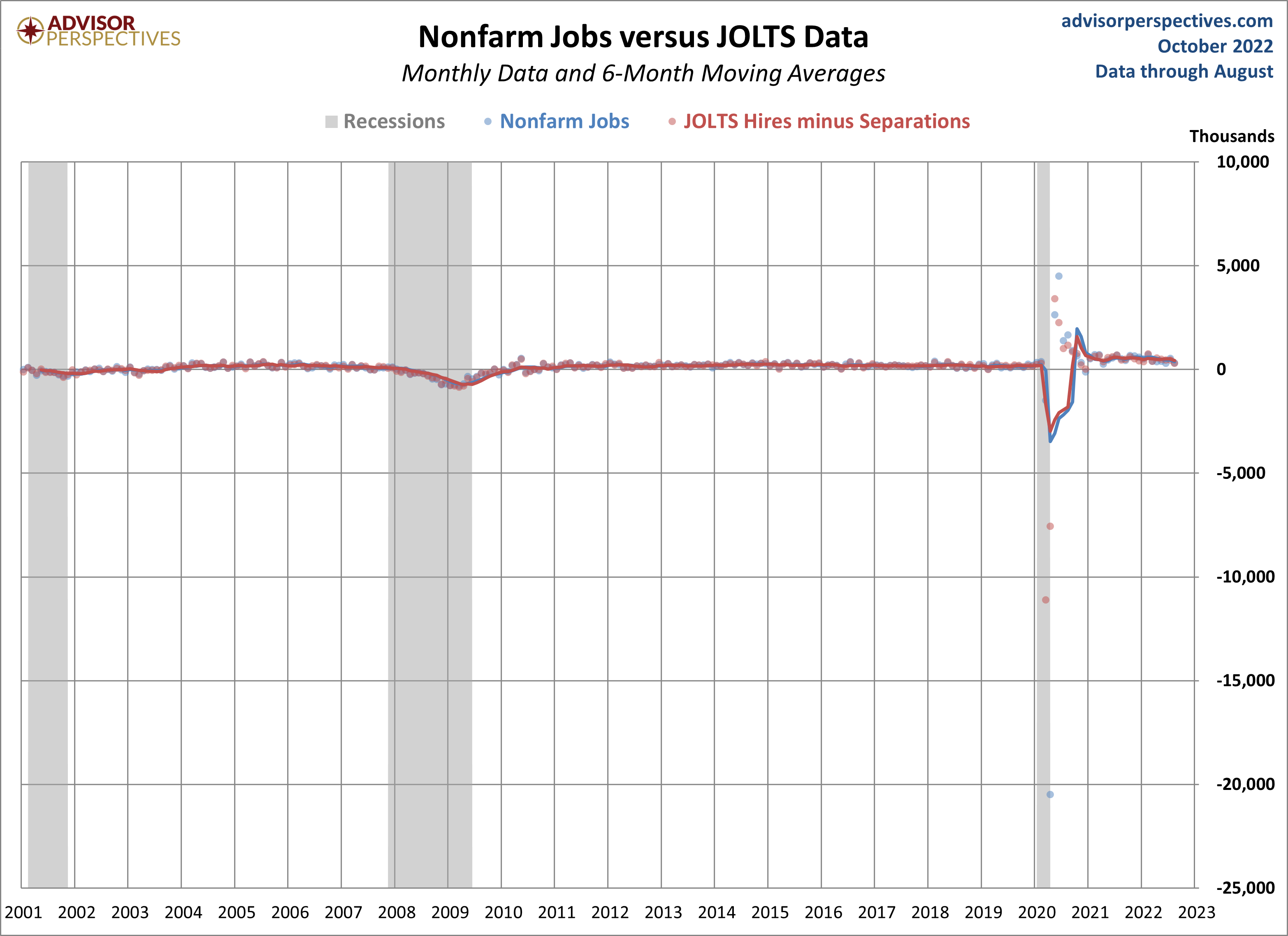

For comparison, here is the monthly BLS Employment Situation Summary charted with JOLTS data:

A Population-Adjusted Perspective on JOLTS

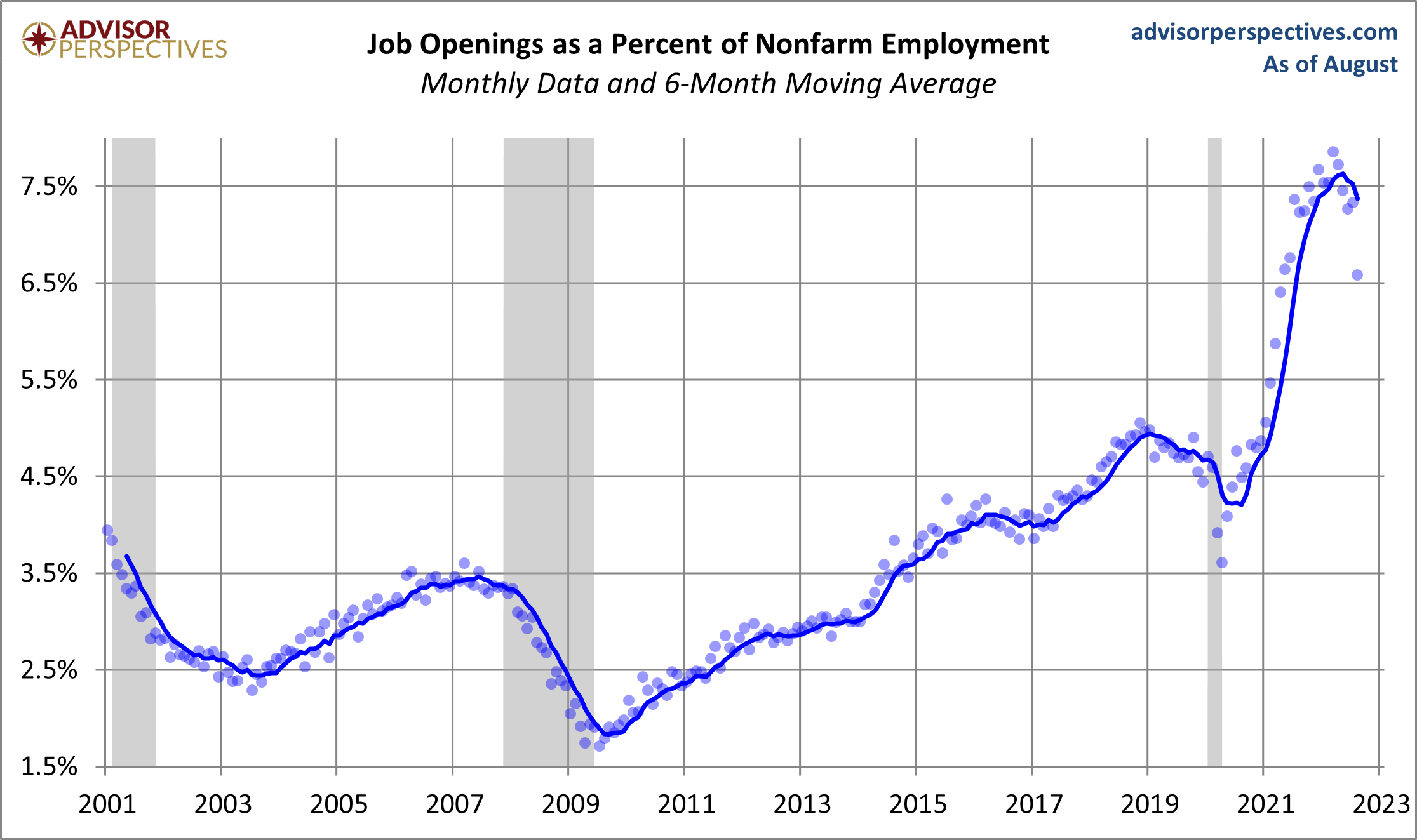

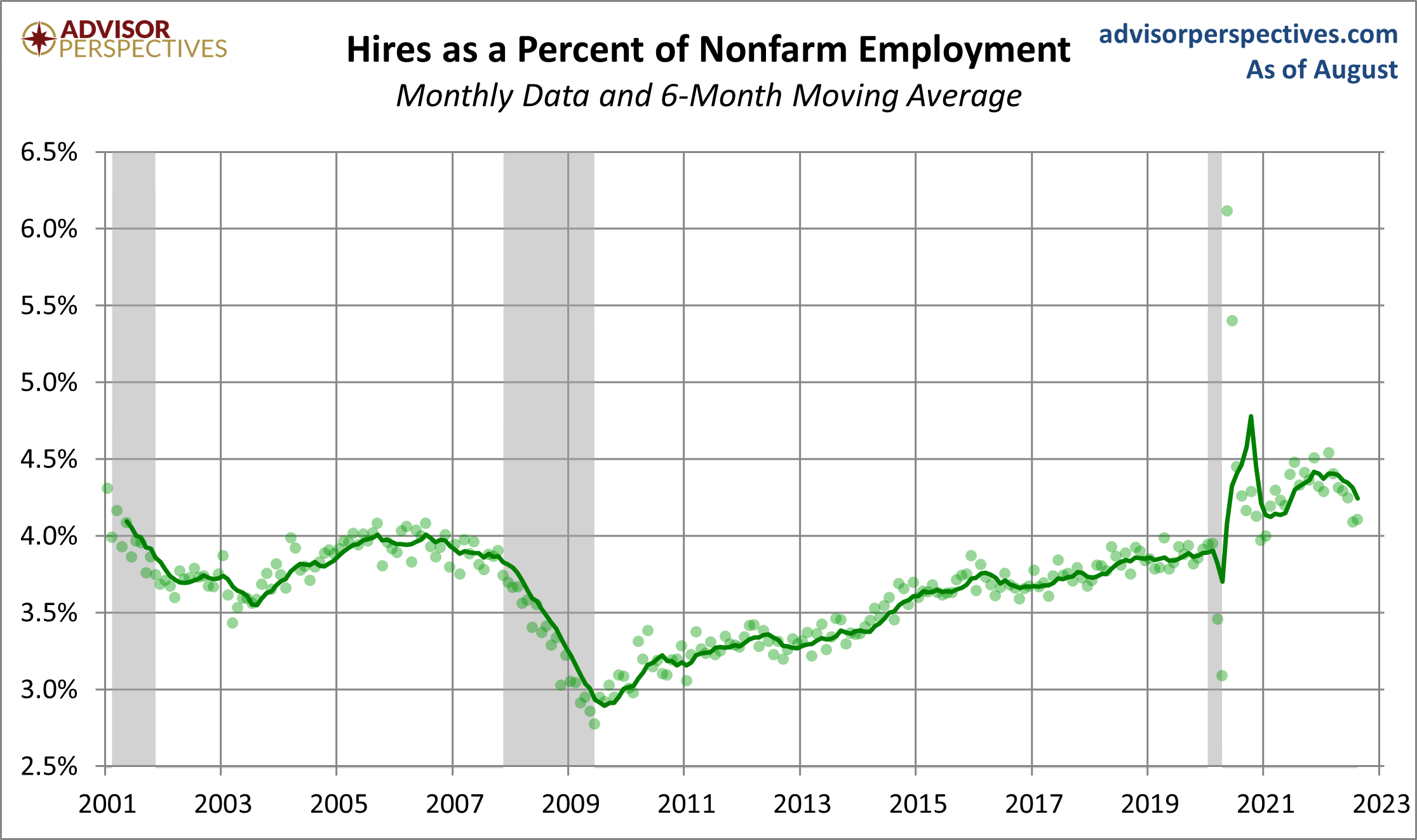

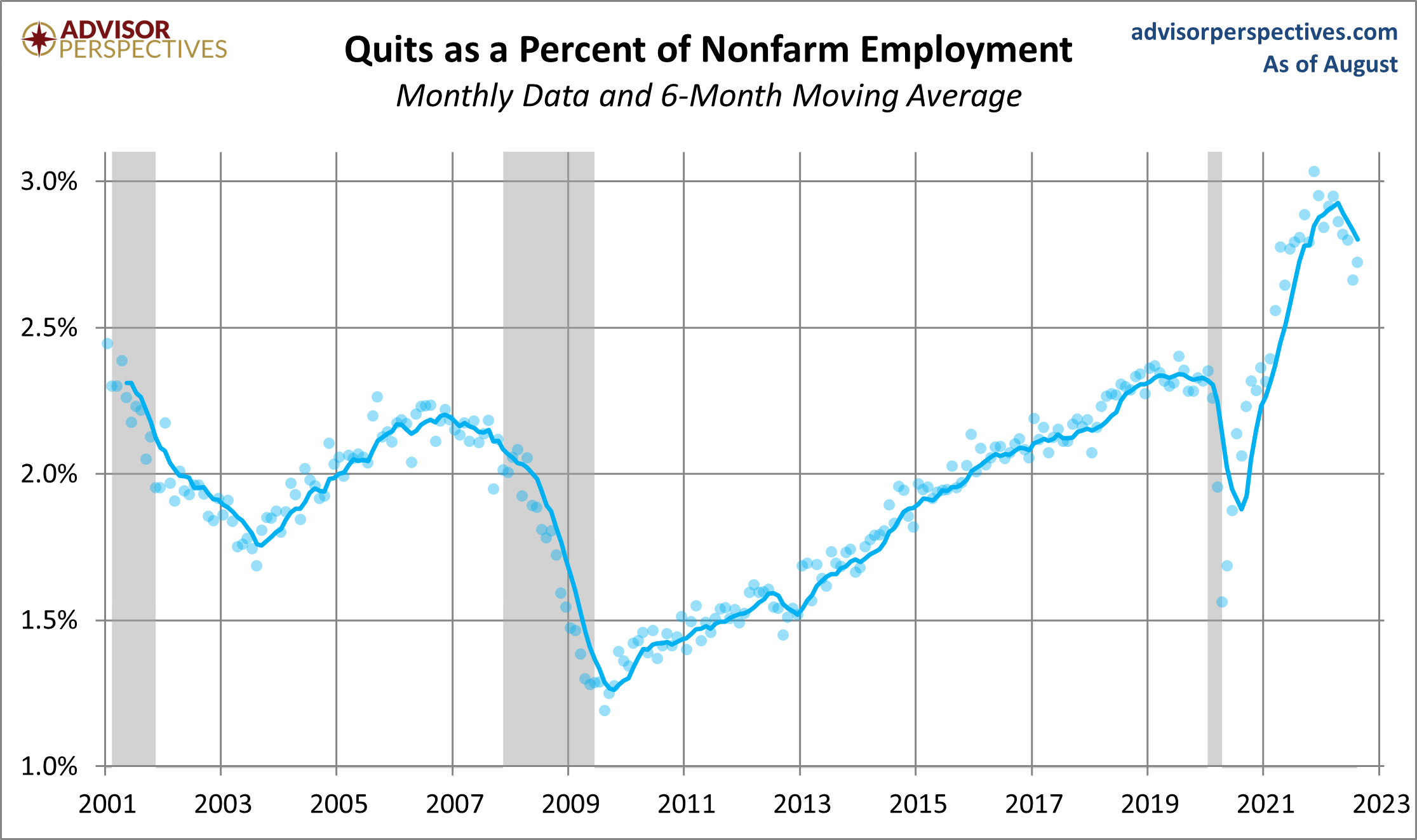

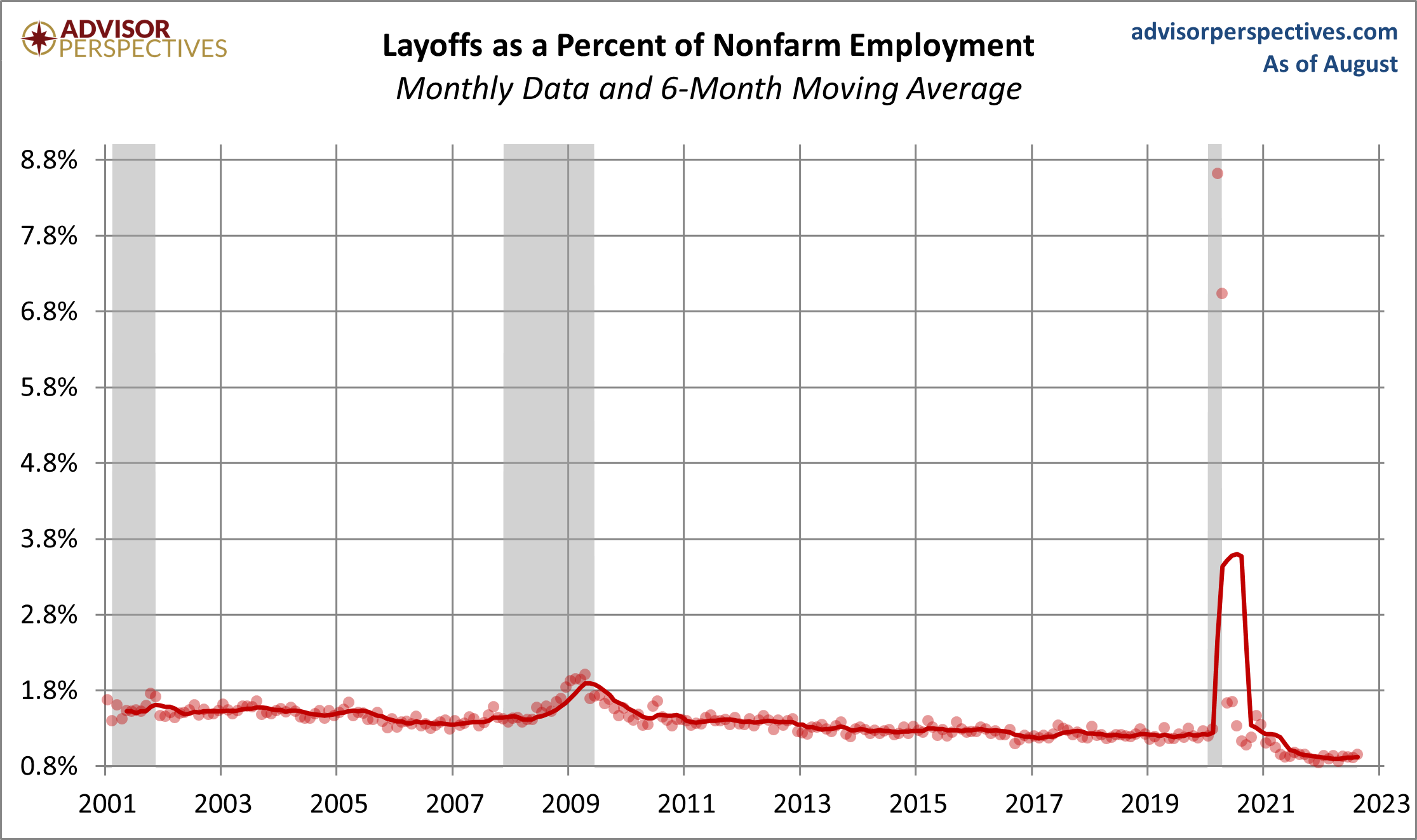

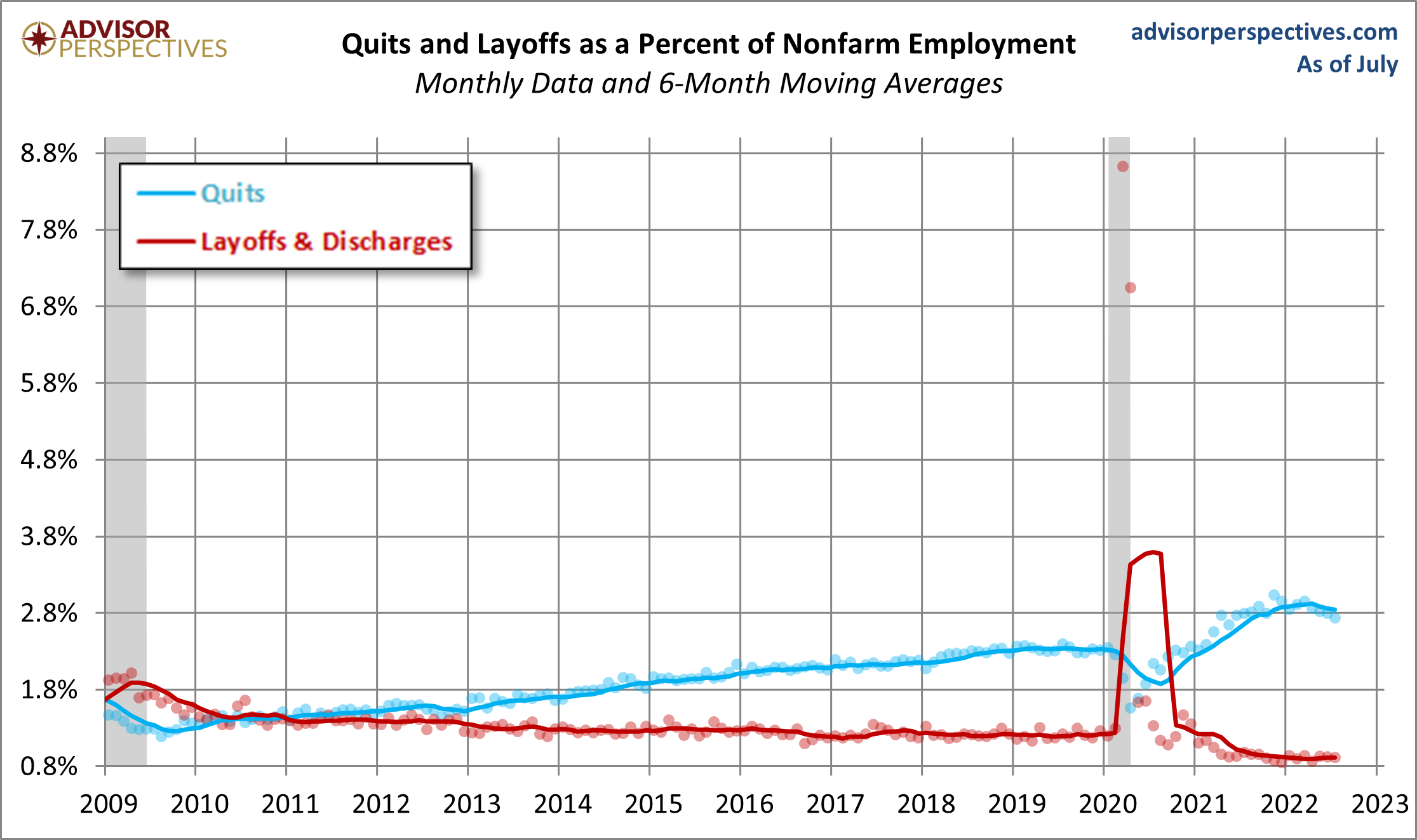

The chart above is based on the actual numbers in the JOLTS report. A better way to view the numbers is as a percent of Nonfarm Employment, which essentially gives us a population-adjusted version of the data. Here is that adjustment for four of the JOLTS series. Note that the vertical axis for each is optimized for the high-low range to facilitate an understanding of the individual trends.

Where Are We Now in the Business Cycle?

Based on the six-month moving averages, we can see that:

- The openings moving average is above the hires levels.

- Hires are below their all-time high.

- Quits are below their all-time high and trending down.

- The Layoffs and Discharges series is below its pre-pandemic levels.

The Trend in Quits

To reiterate a previous point: Increases in Quits suggest employment flexibility. Quits tend to be inversely correlated with Layoffs & Discharges, which are associated with business cycle weakness. Following the last recession, Quits began increasing in 2010, and the rate accelerated in 2013 and continued to rise. Layoffs & Discharges fell post Great-recession and leveled out for many years. Due to the COVID-19 pandemic, layoffs and discharges saw all-time highs.

It would, of course, be excellent if we had historical JOLTS data stretching back through several business cycles. But alas we do not.

The JOLTS reports is interesting to watch, but the volatility of the data, which is also subject to revisions, encourages caution in taking the data for any given month very seriously.

More By This Author:

ISM Manufacturing Index Down In SeptemberReal Disposable Income Per Capita Creeps Up In August

Moving Averages: S&P Down 9.3% In September