AUD/USD Weekly Forecast: Inflation Peak Pushing For Hawkishness

Ups And Downs Of AUD/USD

The pair had a busy week with news releases from Australia and the US. More attention was given to Australia’s inflation which will determine the RBA’s next move. Australian inflation raced to a 32-year high last quarter as the cost of home building and gas surged, a shock result that stoked pressure for a return to more aggressive rate hikes by the country’s central bank.

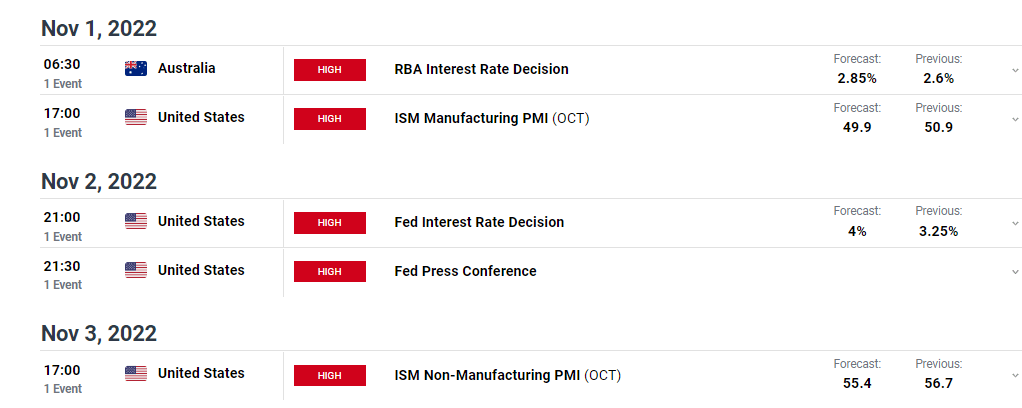

Next Week’s Key Events For AUD/USD

(Click on image to enlarge)

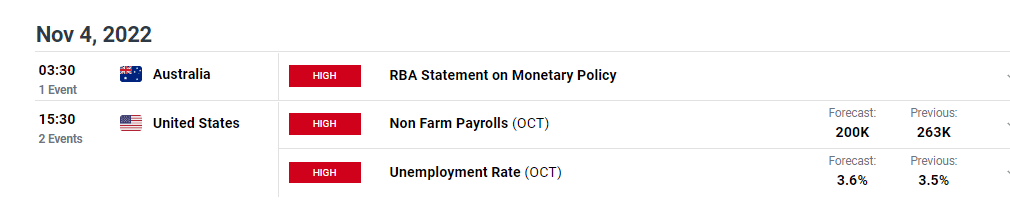

(Click on image to enlarge)

Next week will be packed with weighty economic releases from Australia and the US. Investors will pay more attention to the RBA meeting and the Fed meeting.

The Reserve Bank of Australia is under pressure ahead of its policy meeting on Tuesday.

Investors started to believe peak rates may be approaching due to its decision to cut raises to a quarter-point pace earlier this month.

However, data released on Wednesday showing a startling increase in Australian inflation to a 32-year high implies the RBA has fallen behind and persuades Governor Philip Lowe to make an embarrassing U-turn.

When the Federal Reserve meets on November 1-2, a fourth consecutive big 75bps interest rate increase is largely anticipated. Investors are now concentrating on whether the Fed will limit the pace of future hikes.

AUD/USD Weekly Technical Forecast: Footing Above 30-SMA After A Bullish Divergence

(Click on image to enlarge)

The daily chart shows the price trading above the 22-SMA and the RSI around 50. Bulls have taken control by pushing the price above the 22-SMA, which has been respected as resistance for some time. The price collapsed to the 0.6204 level, where it found strong support. The RSI showed weakness in the bearish trend when it made a bullish divergence.

More By This Author:

EUR/USD Weekly Forecast: Slowing Eurozone Economy Fuels RecessionUSD/CHF Weekly Forecast: Fed Ready to Do More to Curb Inflation

USD/CAD Price Prone To Further Gains Amid Recession, Eying US NFP

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more