AUD/USD Weekly Forecast: Debt Ceiling Uncertainty Boosts USD

The AUD/USD weekly forecast is bearish as the debt ceiling crisis in the US could push the dollar higher in the coming week.

Ups And Downs Of AUD/USD

AUD/USD had a bearish week because the dollar rose amid economic uncertainty, and the Aussie fell as Australia’s economy showed signs of weakness. Australia reported a second quarter of lower retail sales volumes, indicating a decline in consumer spending. The drop in sales also points to the effects of rising interest rates in the country.

The dollar rose as investors sought safety after poor economic data in the US pointed to a looming recession. Inflation eased, and the labor market showed weakness as the Fed’s aggressive tightening cools demand. At the same time, there was uncertainty over the US debt ceiling crisis and its impact on the global economy.

Next Week’s Key Events For AUD/USD

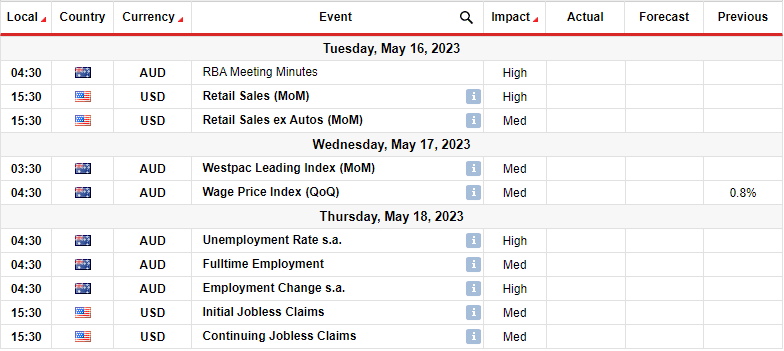

(Click on image to enlarge)

There will be several key releases from Australia and the US next week. Investors will focus on the RBA meeting minutes, Australia’s employment data, and US retail sales.

The RBA minutes will show what led to the surprise rate hike at the last meeting. Investors had largely expected a pause but were surprised when the RBA raised rates by 25bps. The employment data from Australia will show the state of the labor market and could influence the RBA’s next policy move.

Finally, investors will get more data on the US economy that will indicate the country’s consumer spending state.

AUD/USD Weekly Technical Forecast: Bears Ramp Up Selling Pressure Toward Range Support

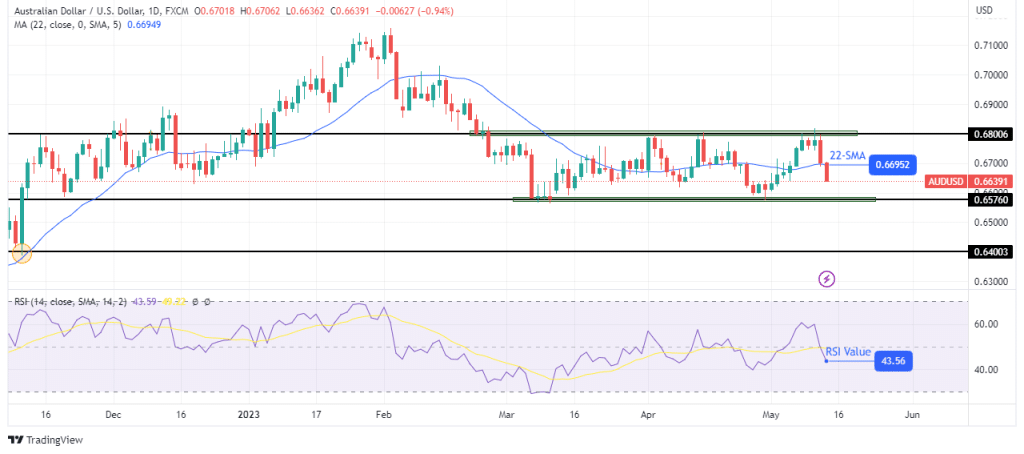

(Click on image to enlarge)

AUD/USD weekly forecast chart

After a strong bearish move, AUD/USD is consolidating in the 4-hour chart. This could be a pause before the downtrend continues. The price is currently ranging with support at 0.6576 and resistance at 0.6800. Within the range area, bears are in control because the price trades under the 22-SMA and RSI below 50.

Bears will likely retest the range support next week. Additionally, if their momentum grows, we might see the price break below the support and fall to the next support at 0.6400. However, if no catalyst exists for such a move, the price will likely remain in the range area.

More By This Author:

AUD/USD Forecast: Aussie Rises On Solid Business ConditionsGBP/USD Weekly Forecast: Bulls Roar As BOE To Follow Fed, ECB

USD/JPY Weekly Forecast: US Job Growth Accelerates In April