AUD/USD Stumbled On Expectations For A Fed Pivot After Softer US Inflation Data

Image Source: Pexels

- A buoyant US dollar was the main reason for the AUD/USD currency pair's fall.

- US inflation appears set to continue to cool down, while consumer sentiment deteriorated in March.

- TDS analysts expect the RBA will keep rates on hold at the April meeting.

- The AUD/USD pair will likely be subdued in the near-term as it awaits the RBA’s decision.

The Australian dollar retraced after hitting a weekly high of 0.6738, spurred on by the US dollar's recovery as it got bolstered by weekly, monthly, and quarter-end flows. Wall Street appeared set to finish the week with gains, while US inflation data may cement the case for a pause in the Fed’s tightening cycle. The AUD/USD pair was seen trading at 0.6684 on Friday, below its opening price by 0.43%.

AUD/USD Dwindled Below 0.6700 on a Buoyant US Dollar

The Fed's preferred inflation gauge, the core PCE published by the US Department of Commerce, increased 4.6% year-over-year, lower than forecasts and beneath the previous month's reading. Headline inflation was 5%, signaling that the Fed's tightening measures are still curbing inflation.

Susan Collins, President of the Federal Reserve Bank of Boston, expressed approval for the news, but emphasized that the Fed still has work to accomplish.

The University of Michigan's (UoM) Consumer Sentiment on its final March reading was 62, which was worse than expected. At the same time, inflation expectations dropped. For the one-year horizon, American consumers forecast inflation at 3.6%, while for the five-year horizon, inflation estimations dipped to 2.9%.

The New York Fed President John Williams said that an uncertain economic outlook and economic data would drive monetary policy. Williams expects inflation to drop to 3.5% and the Gross Domestic Product (GDP) to contract slightly before rebounding in 2024.

On inflation data, the AUD/USD pair moved upwards to 0.6718 before reversing its course. It then fell sharply below the 0.6700 figure, and printed a daily low of 0.6670. The pair then appeared to stabilize at around 0.6686.

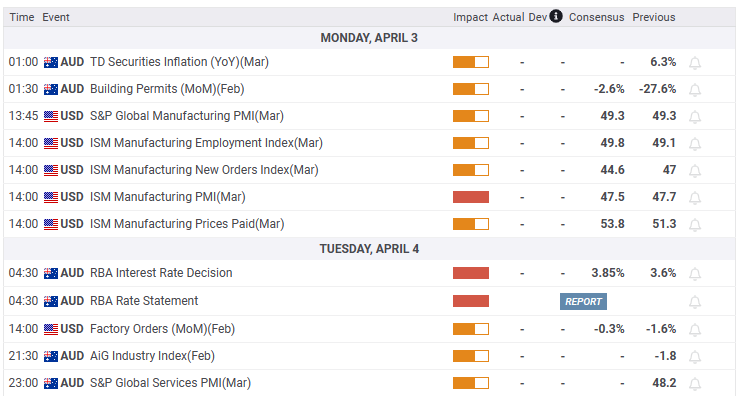

On the Australian front, inflation data may give cues regarding the Reserve Bank of Australia’s (RBA) forward path. The TD Securities Inflation reading for February was 6.3% year-over-year, and any readings below the latter may discourage the RBA from continuing to tighten monetary conditions.

TDS Expects RBA to Pause on Its Tightening Campaign

TD Securities analysts noted that, “The April meeting is a close one, with analysts mixed about the RBA decision and markets pricing in no hike from the RBA. We now expect the Bank to pause at the April meeting given the lower January-February CPI prints and uncertainty over the outlook from the banking turmoil in the near-term.”

AUD/USD Technical Analysis

The AUD/USD currency pair was seen trading sideways, as shown by its daily chart, though this movement was tilted to the downside. For a bearish continuation, sellers would need to reclaim the March 24 swing low at 0.6625, exposing the year-to-date lows at 0.6564.

If that level is cleared, the path towards the Nov. 10 low of 0.6386 could be in the cards. On the flip side, if buyers are able to crack the 0.6700 level, that could keep them hopeful that the AUD/USD pair could test the 0.6800 level in the near-term.

What to Watch?

More By This Author:

USD/JPY Needs More BoJ Action To Justify A Big Move Lower – SocGen

Silver Price Forecast: XAG/USD Hits New Monthly Highs Above $24.00, Driven By Falling US Bond Yields

GBP/USD Holds Above Mid-1.2300s Ahead Of US PCE Price Index, Touching Range High

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more