AUD/USD: Seasonal Weakness Aligns With Tariff Risk

Image Source: Unsplash

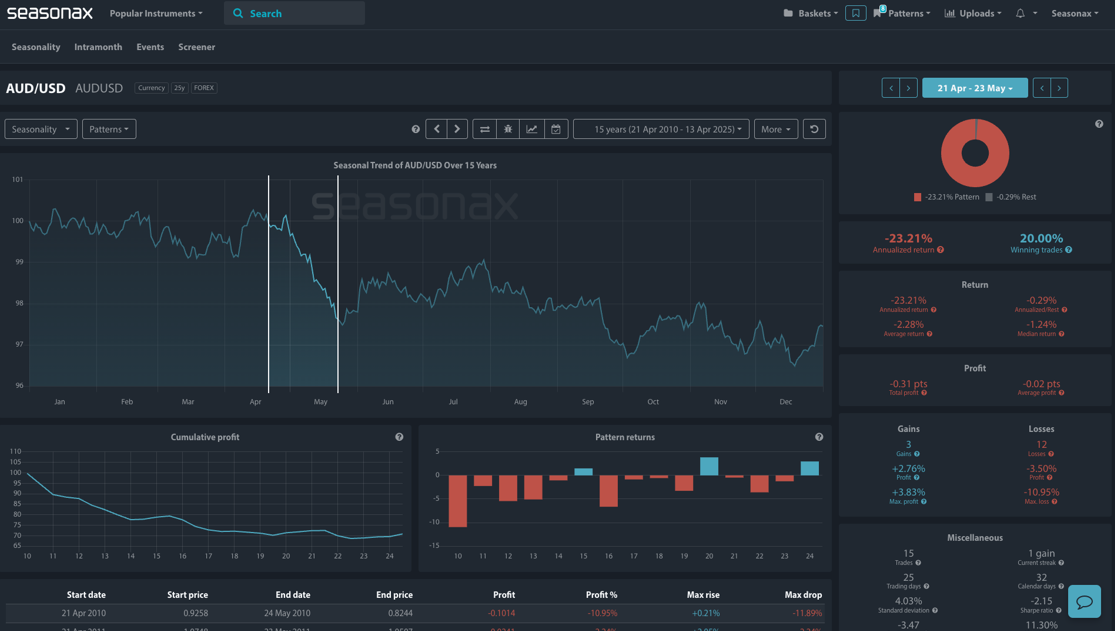

Instrument: AUD/USD

Average Pattern Move: -2.28%

Timeframe: April 21 – May 23

Winning Percentage: 20.00%

You may not realise it, but the Australian dollar often comes under seasonal pressure in late April—and with rising global trade tensions, that weakness could be reinforced. With tariff fears resurfacing, especially under the Trump administration’s renewed push for protectionism, risk-sensitive currencies like the AUD are firmly in the firing line. We want to analyse the data in more detail.

The chart below shows you the typical development of the AUD/USD exchange rate from April 21 to May 23 over the past 15 years. This period has historically been challenging for the Aussie, delivering a -23.21% annualised return with a poor 20% win rate. The average return during this time is -2.28%, with notable downside skew—losses have reached as much as -10.95%.

(Click on image to enlarge)

That seasonal tendency could be further compounded by macro drivers. The Australian dollar is highly sensitive to global trade conditions and commodity demand—particularly from China. With the US pushing forward tariff investigations on copper, aluminium and electric vehicle supply chains, the spectre of another global trade shock is growing. A broadening of tariffs, especially those that touch China’s industrial base or Australia’s export profile, could see risk appetite deteriorate and drive AUD lower.

This makes the current environment particularly vulnerable for the Aussie. If US-China tensions intensify or broader G7 responses follow suit, expect further headwinds for AUD/USD in the weeks ahead.

Trade Risks:

The main risk to this view would be a positive surprise in Chinese stimulus or a de-escalation in tariff rhetoric from the US. Additionally, if US CPI prints weaker and leads to a more dovish repricing of the Fed, USD weakness could offset AUD headwinds.

Technical Perspective

From a technical standpoint there is a major monthly resistance level at 0.6500. This is a clear area for sellers to lean against and will be a major area buyers will need.

(Click on image to enlarge)

More By This Author:

USD/MXN: Seasonal Strength Aligns With Macro Drivers

HSBC Holdings: A Seasonal Window Amid Trade War Turbulence

PepsiCo: Springtime Surge Ahead?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more