AUD/USD Retreated From Year-To-Date Highs As Risk Sentiment Steadied, US Dollar Firmed

Image Source: Pixabay

- The AUD/USD currency pair weakened in recent trading after reaching a fresh year-to-date high of 0.6564 on Thursday.

- US-China trade lifted risk sentiment, but profit taking and a firmer US dollar limited gains.

- The AUD/USD pair was seen heading toward the 0.6500 mark on Friday, as bullish momentum faded above that point.

The Australian dollar was seen pulling back from its weekly highs against the US dollar on Friday, June 27. At the time of writing, the AUD/USD pair was seen trading near the 0.6520 level, after it reached an intraday high of 0.6561.

AUD/USD Pair Retreated as US Dollar Regained Ground and Sentiment Stabilized

The US dollar recovered slightly after falling to three-year lows against its peers. On Friday, the Bureau of Economic Analysis released the latest core Personal Consumption Expenditure (PCE) figures. The core numbers, which reflect the pace at which prices are rising for goods excluding volatile items such as food and energy, increased in May. The annual rate increased by 2.7%, higher than the previously estimated 2.6%, with the monthly figure rising by 0.2 percentage points.

The Federal Reserve’s preferred measure of inflation is closely monitored for potential clues on the trajectory of monetary policy. However, with President Trump placing pressure on the Fed to reduce rates prior to the September meeting, investors were also looking at the Michigan Sentiment Index numbers, which reflected a slight increase in optimism in June.

Despite the release of macroeconomic data, the easing of geopolitical tensions this week has been a major driver of the surge in the AUD/USD pair's price.

With the ceasefire between Israel and Iran boosting demand for risk assets, safe-haven flows had diminished, placing additional pressure on the greenback. News of China and the United States finalizing a trade deal on Friday provided additional support for the AUD/USD pair as well, which seemed eager to retest the key psychological resistance level of 0.6600.

As markets continued to digest the recent developments and prepared to close, an increase in profit-taking sent the currency pair lower.

Technical Rejection at a Key Fibonacci Level Pushed AUD/USD Lower

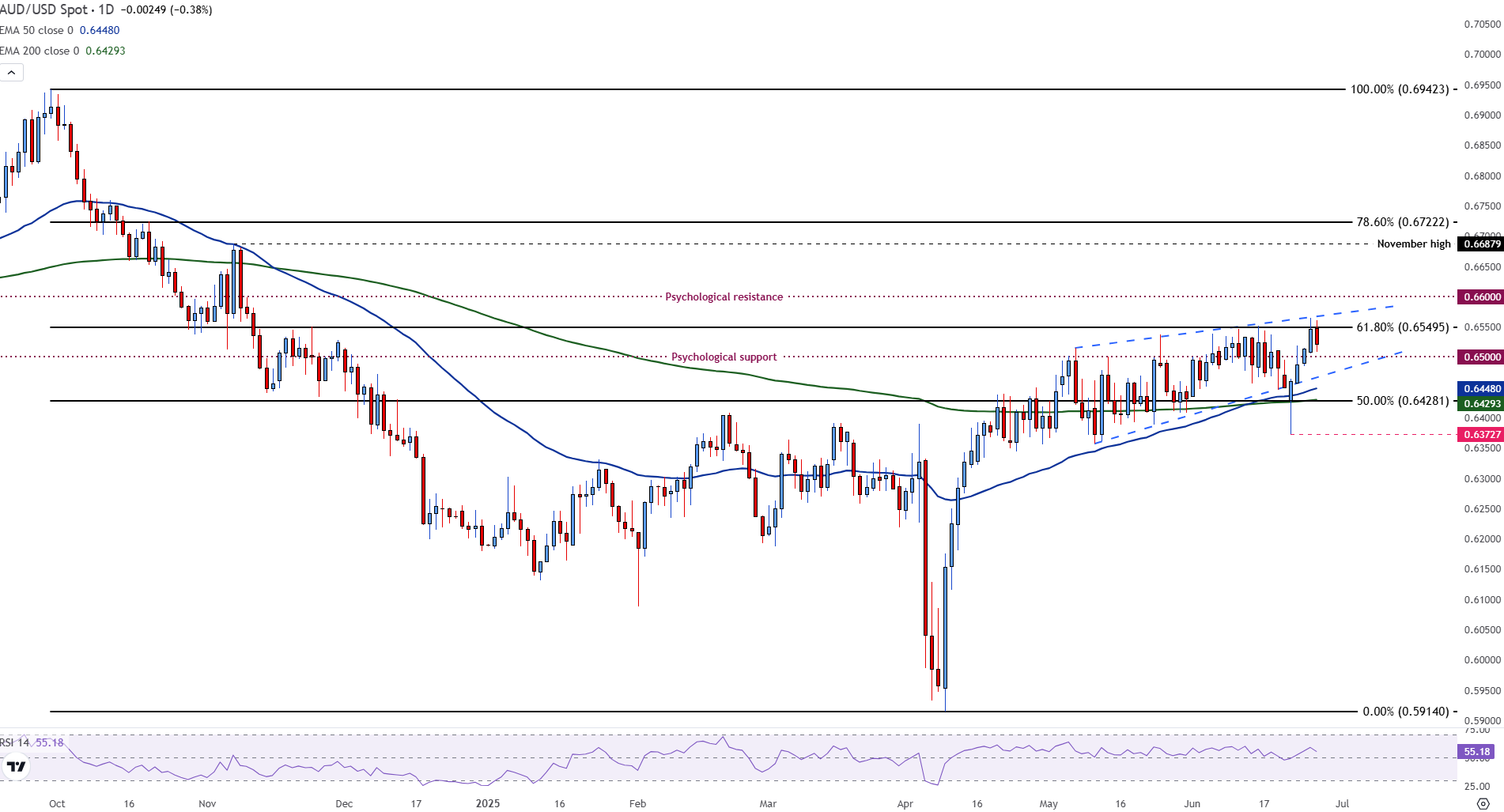

From a technical standpoint, the AUD/USD pair has recently been trading within a rising wedge pattern, which is a structure often associated with a potential bearish reversal.

The pair attempted to break above the 61.8% Fibonacci retracement of the September-April downtrend around the 0.6550 mark, but failed to sustain momentum.

AUD/USD Daily Chart

(Click on image to enlarge)

The rejection at this level triggered a fresh wave of selling, with immediate support seen at the 50-day Exponential Moving Average (EMA) near the 0.6448 level. Below that was the 200-day EMA at 0.6427, which, if broken, would expose Monday’s low of 0.6372.

Meanwhile, the Relative Strength Index (RSI) landed at 55 and pointed downward, indicating the fading of bullish momentum. The near-term outlook for the AUD/USD currency pair has remained cautious. While improved sentiment earlier this week lifted the pair, the inability to clear key resistance levels and resurgent demand for the US dollar could signal the potential for additional downside risks.

More By This Author:

Gold Suffers Another Setback Following A US-China Trade Truce, Ahead Of PCE Inflation ReportGold Benefits From A Weaker US Dollar As Pressure Over Fed Rate Cuts Builds

US Dollar Slides As Israel-Iran Ceasefire Overshadows Hawkish Powell’s Tone

Disclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more