AUD/USD Price Stuck At Mid-0.73 Amid Firm USD, Risk-Off Tone

In a risk-averse market, the AUD/USD price breaks its Tuesday growth streak. In the morning, the pair opened higher but quickly fell to 0.7333 before rising. This was attributed to Australia’s favorable business climate.

As of writing, the AUD/USD exchange rate is 0.7349, down 0.08 percent from the previous day.

Image Source: Pixabay

The US Dollar Index (DXY), which measures the dollar against its six main competitors, has strengthened around 94.40. The rebound results from investors’ concerns over rising inflation, headwinds from China, and supply chain bottlenecks. The S&P 500 futures are trading at 4332.25, down 0.49% on the day.

In contrast, the Australian dollar has gained some momentum after the NAB Business Confidence Index increased on September 13 from -6 in August to its highest level since May. However, the AUD/USD risk barometer’s returns are limited due to the risk of Evergrande defaulting after missing two more interest payments. To further assess the market sentiment, traders await job vacancy data from US JOLTS.

Moreover, oil prices rose overnight, fueling inflation concerns as crude oil hit its highest level since October 2014. In response to the Covid restrictions imposed upon the highly contagious Delta variant, energy demand increases. On Monday, New South Wales, Australia’s most populous state, lifted restrictions. Recently, vaccination rates in Australia have improved significantly, so work can be resumed.

New Zealand reported a 0.9% increase in e-card spending in September over the previous month. This afternoon, Japan is expected to release its September bank lending and producer price data. Bank of Korea (BOK) intends to maintain its base rate at 0.75 percent. In addition to the UK employment report from July, traders will closely follow the European session.

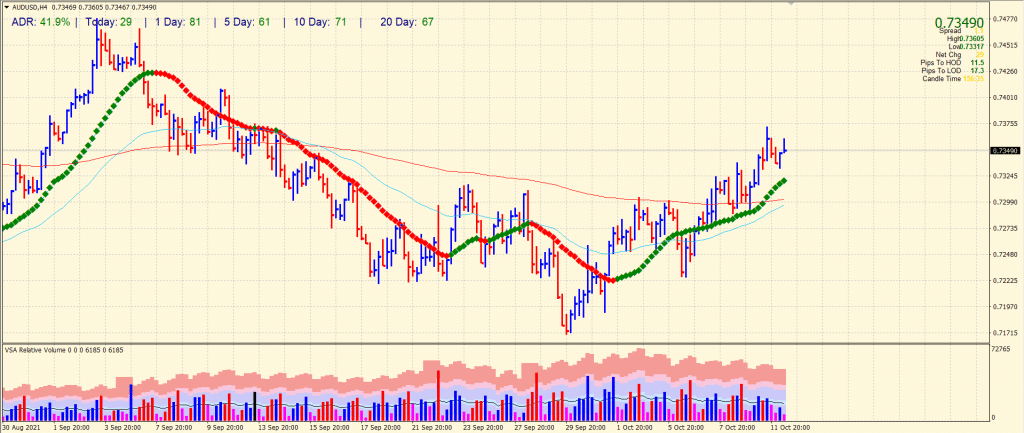

AUD/USD Price Technical Analysis: Key SMAs Pointing Higher

(Click on image to enlarge)

The AUD/USD price is well above the 20-period SMA on the 4-hour chart. The 200-period and 50-period SMAs are also pointing for further gains. The average daily range for the pair is so far 42% which shows mild volatility in the market. The upside remains capped by swing high at 0.7370 area while the downside may find support at 20-period SMA around 0.7325.

Disclosure: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more