AUD/USD Price Analysis: Surprising Inflation Bolsters Aussie

After an unexpectedly robust inflation report, the AUD/USD price analysis took a bullish turn. The Australian dollar strengthened due to expectations of interest rate hikes. It surged to 0.7%, reaching a roughly two-week high of $0.6400 on Wednesday.

Notably, Australia’s consumer price index increased by 1.2% in the third quarter. It surpassed the market expectations of 1.1% and was up from a 0.8% rise in the previous quarter. Consequently, traders began seeing higher chances of a potential interest rate hike by the RBA following four rate pauses next month.

Futures markets are now placing a 66% probability of a quarter-point increase to 4.35%, up from 35% before the data release.

Meanwhile, two major Australian banks, the Commonwealth Bank of Australia and ANZ, shifted their stance on Wednesday. They abandoned their previous view of a rate pause. Both now anticipate a quarter-point hike in November. Such a move would position the RBA as one of the few central banks in the developed world still pursuing a tightening policy.

Meanwhile, markets believe the US Federal Reserve and the European Central Bank have completed their rate hikes.

Elsewhere, business activity in the US improved significantly. S&P Global reported on Tuesday that its flash US Composite Purchasing Managers Index reached its highest level since July. This development might give the US Federal Reserve more flexibility to maintain elevated interest rates.

AUD/USD key events today

Investors are expecting several important reports from the US, including:

- The building permits report.

- The new home sales report.

- A speech from Fed Chair Jerome Powell.

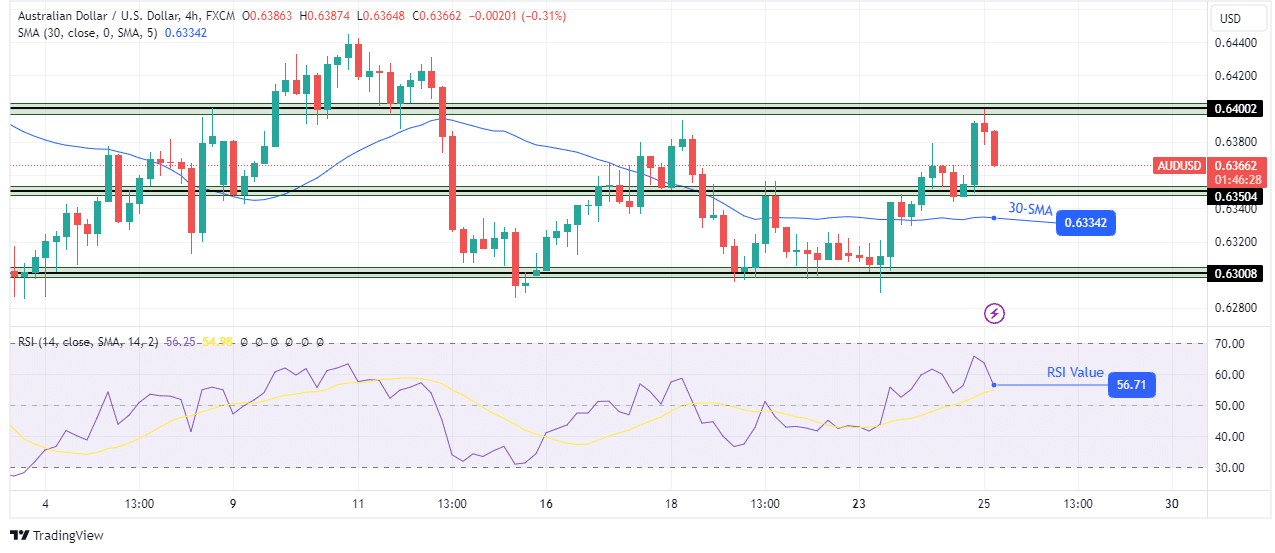

AUD/USD technical price analysis: Bulls’ key to uptrend lies at 0.6400.

(Click on image to enlarge)

AUD/USD 4-hour chart

On the charts, Aussie is bullish as the price shot up from the 0.6350 support level to the 0.6400 resistance. A strong move occurred above the 30-SMA, showing that the bulls are in control. Additionally, there is support from the RSI, which trades in bullish territory.

However, on a larger scale, the price has been stuck in a sideways move, chopping through the SMA. Therefore, this may continue if bears take over at 0.6400 resistance. For the price to start trending up, bulls must break above the 0.6400 resistance.

More By This Author:

EUR/USD Outlook: Extending Rally Fueled By Treasury Yield SlideGold Price Challenging Uptrend Line, Eying US Data

EUR/USD Weekly Forecast: Bets For Fed’s Dec Hike Diminish

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more